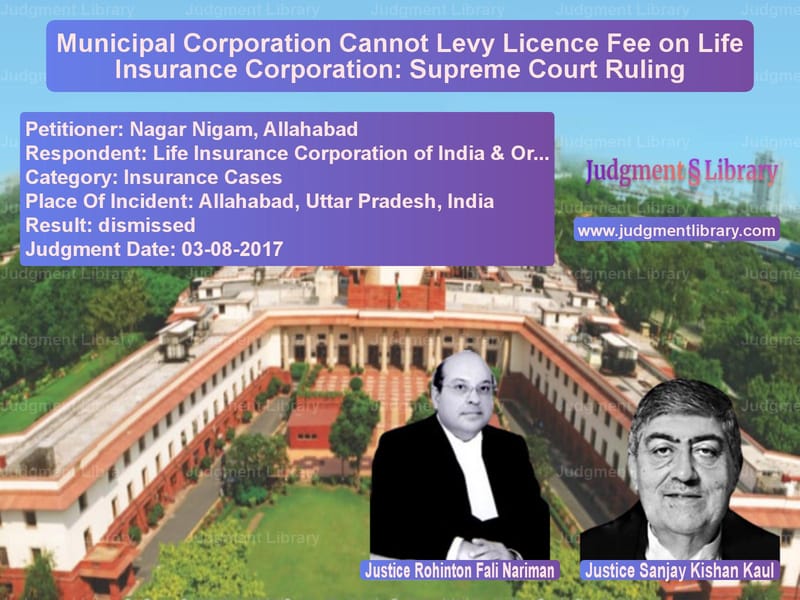

Municipal Corporation Cannot Levy Licence Fee on Life Insurance Corporation: Supreme Court Ruling

The case of Nagar Nigam, Allahabad vs. Life Insurance Corporation of India & Ors. is a landmark judgment by the Supreme Court of India, addressing the legality of a licence fee imposed by the Allahabad Municipal Corporation on Life Insurance Corporation (LIC). The core issue in the case was whether LIC could be classified as an ‘insurance company’ under a municipal notification, thereby making it liable to pay a licence fee.

The Supreme Court ruled in favor of LIC, holding that it was not covered under the definition of an insurance company in the context of the municipal notification. This judgment is significant as it establishes the principles of statutory interpretation and taxation, particularly in cases where ambiguities exist in local government notifications.

Background of the Case

The appellant, Nagar Nigam, Allahabad, issued a notification dated 30.01.1999, which imposed a licence fee on various businesses and commercial establishments operating within the municipal limits. The notification included ‘insurance companies’ under the taxable category.

LIC challenged the imposition of the licence fee on the grounds that it was not a general insurance company but was exclusively engaged in life insurance under the Life Insurance Corporation Act, 1956. The Allahabad High Court ruled in favor of LIC, stating that LIC was distinct from general insurance companies and should not be subject to the fee.

Aggrieved by the High Court’s ruling, Nagar Nigam, Allahabad, filed an appeal before the Supreme Court.

Key Legal Issues

- Whether LIC could be classified as an ‘insurance company’ under the municipal notification imposing a licence fee.

- Whether the municipal corporation had the authority under the Uttar Pradesh Municipal Corporations Act, 1959 to levy such a fee.

- Whether the principles of statutory interpretation support LIC’s exclusion from the notified category.

- Whether taxation rules favor the interpretation that benefits the taxpayer in cases of ambiguity.

Arguments by the Petitioner (Nagar Nigam, Allahabad)

The petitioner, represented by counsel, argued that:

- The municipal notification included insurance companies under the taxable category.

- LIC falls within the definition of an insurance company, as it engages in the business of life insurance.

- The fee was lawfully imposed under Section 438 of the Uttar Pradesh Municipal Corporations Act, 1959.

- The municipal corporation had the power to frame by-laws under Section 541 to include LIC under the fee structure.

Arguments by the Respondent (Life Insurance Corporation of India)

LIC, represented by senior counsel, countered with the following arguments:

- LIC is distinct from general insurance companies and operates under a special statute, the Life Insurance Corporation Act, 1956.

- The notification referred to ‘insurance companies’ in a manner that indicated general insurance companies dealing with risk coverage other than life insurance.

- Taxing statutes must be interpreted strictly, and any ambiguity should be resolved in favor of the taxpayer.

- The notification did not explicitly mention LIC, and its inclusion would require clear legislative intent.

Supreme Court’s Judgment

The Supreme Court, in a judgment delivered by Justice Rohinton Fali Nariman and Justice Sanjay Kishan Kaul, upheld the High Court’s ruling and dismissed the appeal filed by Nagar Nigam, Allahabad.

1. LIC is Not an Insurance Company for the Purpose of the Notification

The Court held that the municipal notification referred to insurance companies dealing in general insurance, not life insurance:

“The list does not include any charitable hospital or government institution, further reinforcing the distinction between insurance companies engaged in general insurance and the Life Insurance Corporation, which operates under a special statute.”

2. Strict Interpretation of Taxing Statutes

The Court applied the principle of strict interpretation in taxation matters:

“In cases where two interpretations of a provision imposing tax/fee are possible, the Court should accept the interpretation which leans in favor of the assessee, i.e., the person who is sought to be burdened.”

3. Lack of Clear Legislative Intent to Include LIC

The Court noted that the notification was ambiguous in its reference to insurance companies and did not explicitly include LIC:

“A taxation statute must be strictly construed. If there is any ambiguity, it must be resolved in favor of the taxpayer.”

4. No Municipal Authority to Impose Licence Fee on LIC

The Court ruled that Section 438 of the Uttar Pradesh Municipal Corporations Act, 1959, did not grant the municipal corporation the authority to impose a licence fee on LIC:

“Section 438 deals with licence fees chargeable for premises used for trade or commercial purposes. LIC, as an institution governed by a special statute, does not fall within this category.”

Key Takeaways from the Judgment

- Municipal notifications must be interpreted strictly: The Supreme Court reaffirmed that ambiguous provisions must be interpreted in favor of the taxpayer.

- LIC operates under a special statute: The Court clarified that LIC is distinct from general insurance companies and cannot be clubbed under a broad definition.

- Local governments cannot impose fees beyond their statutory authority: Nagar Nigam, Allahabad, lacked the authority to levy a fee on LIC under the Municipal Corporations Act.

- Legal clarity in taxation matters is essential: Ambiguities in notifications can lead to legal challenges, and taxation authorities must ensure precision in drafting.

Impact of the Judgment

The ruling has significant implications for taxation policies at the municipal level. It ensures that:

- LIC and similar statutory bodies are protected from arbitrary municipal levies.

- Municipal corporations must carefully draft notifications to avoid ambiguities.

- Legal precedents favor taxpayers when taxation laws are unclear.

Conclusion

The Supreme Court’s judgment in Nagar Nigam, Allahabad vs. Life Insurance Corporation of India & Ors. establishes a crucial principle in taxation law by protecting LIC from an unlawful levy. The ruling reinforces the importance of strict statutory interpretation and upholds the taxpayer’s right against ambiguous municipal fee impositions.

By dismissing the municipal corporation’s appeal, the Supreme Court ensured that LIC is not burdened with an unjust fee, thereby setting a precedent for future cases concerning municipal levies on statutory bodies.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Nagar Nigam, Allahab vs Life Insurance Corpo Supreme Court of India Judgment Dated 03-08-2017.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Commercial Insurance Disputes

See all petitions in Insurance Settlements

See all petitions in Other Insurance Cases

See all petitions in Judgment by Rohinton Fali Nariman

See all petitions in Judgment by Sanjay Kishan Kaul

See all petitions in dismissed

See all petitions in supreme court of India judgments August 2017

See all petitions in 2017 judgments

See all posts in Insurance Cases Category

See all allowed petitions in Insurance Cases Category

See all Dismissed petitions in Insurance Cases Category

See all partially allowed petitions in Insurance Cases Category