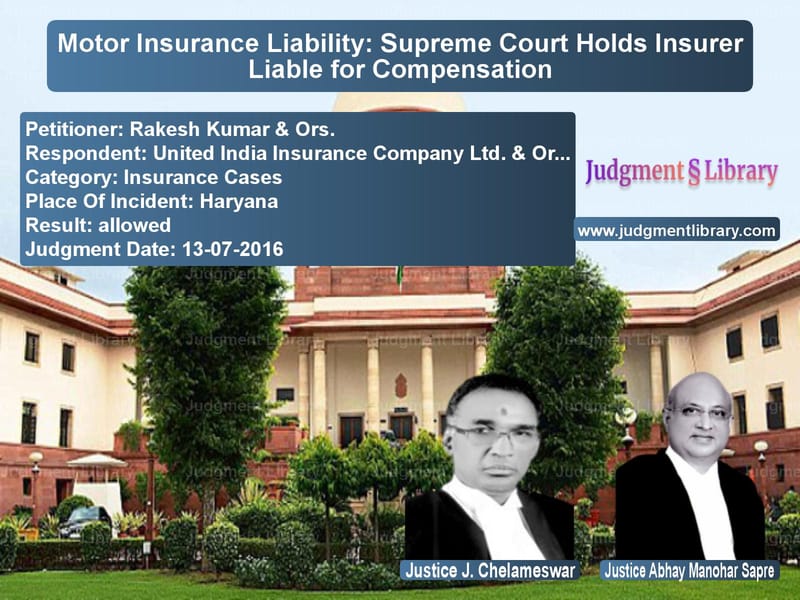

Motor Insurance Liability: Supreme Court Holds Insurer Liable for Compensation

The case of Rakesh Kumar & Ors. vs. United India Insurance Company Ltd. & Ors. revolves around the liability of an insurance company in a motor accident compensation case. The key issue before the Supreme Court was whether the insurer could be exonerated from liability on the ground that the driver of the offending vehicle did not possess a valid license. The Court ruled in favor of the claimants, holding the insurance company liable for compensation.

Background of the Case

The accident occurred on September 16, 2008, when a three-wheeler carrying Sheo Ram, Madan Mohan, and Mohindro Devi collided with a truck (HR-37-C-7937) on Naraingarh-Shahzadpur Road in Haryana. The driver of the truck, Jaipal, was accused of reckless driving. The accident resulted in multiple fatalities and injuries. FIR No. 88/2008 was registered against the truck driver under Sections 279, 337, and 304-A of the Indian Penal Code.

The legal representatives of the deceased filed compensation claims under the Motor Vehicles Act, 1988. The Motor Accident Claims Tribunal (MACT) awarded compensation to the claimants and held the insurer liable. The insurance company appealed the decision, arguing that the driver of the offending truck did not have a valid driving license. The High Court overturned the Tribunal’s order, exonerating the insurer and directing the owner of the vehicle to pay the compensation. The owner challenged the High Court’s decision before the Supreme Court.

Key Legal Issues Considered

- Was the driver of the offending vehicle in possession of a valid driving license?

- Could the insurance company be exonerated from liability due to lack of proper documentation of the driving license?

- Was the High Court justified in reversing the Tribunal’s ruling?

Arguments from Both Sides

Appellant’s Arguments

The appellant (owner of the vehicle) contended:

- “The Tribunal rightly held that the driver had a valid license at the time of the accident.”

- “The insurance company failed to prove that the license was fake or invalid.”

- “The High Court erred in reversing the Tribunal’s finding without proper evidence.”

Respondents’ Arguments

The insurance company countered:

- “The driver failed to produce the original driving license, submitting only a photocopy.”

- “The burden of proving that the driver had a valid license rested on the vehicle owner.”

- “The High Court correctly ruled that the insurer could not be held liable in the absence of a verified license.”

Supreme Court’s Judgment

The Supreme Court set aside the High Court’s order and ruled:

- “The Tribunal correctly found that the driver possessed a valid license.”

- “The insurance company failed to provide evidence that the license was fake or invalid.”

- “The insurer is liable to pay the compensation as per the Tribunal’s award.”

Analysis of the Judgment

The Supreme Court observed:

- The driver submitted a photocopy of the license, and the insurer did not object at the Tribunal stage.

- The insurance company did not produce any evidence to prove that the license was fake.

- The vehicle was insured at the time of the accident, making the insurer liable under the policy terms.

The Court emphasized that an insurer cannot escape liability merely because an original driving license was not produced, especially when there is no proof that the license was forged or expired.

Implications of the Judgment

This ruling has significant implications:

- It reaffirms that an insurer bears the burden of proving that a driver’s license is fake or invalid before denying liability.

- It prevents insurance companies from unjustly denying claims based on technical objections.

- It upholds the rights of accident victims and ensures timely compensation.

- It reinforces the principle that insurance coverage should not be denied unless a clear violation of policy terms is established.

Conclusion

The Supreme Court’s decision in this case upholds the rights of accident victims while ensuring that insurance companies do not arbitrarily evade their liability. The ruling provides clarity on the role of insurance companies in compensation claims and strengthens the principle that procedural objections cannot override substantive justice.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Rakesh Kumar & Ors. vs United India Insuran Supreme Court of India Judgment Dated 13-07-2016-1741873217937.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Motor Insurance Settlements

See all petitions in Compensation Disputes

See all petitions in Negligence Claims

See all petitions in Judgment by J. Chelameswar

See all petitions in Judgment by Abhay Manohar Sapre

See all petitions in allowed

See all petitions in supreme court of India judgments July 2016

See all petitions in 2016 judgments

See all posts in Insurance Cases Category

See all allowed petitions in Insurance Cases Category

See all Dismissed petitions in Insurance Cases Category

See all partially allowed petitions in Insurance Cases Category