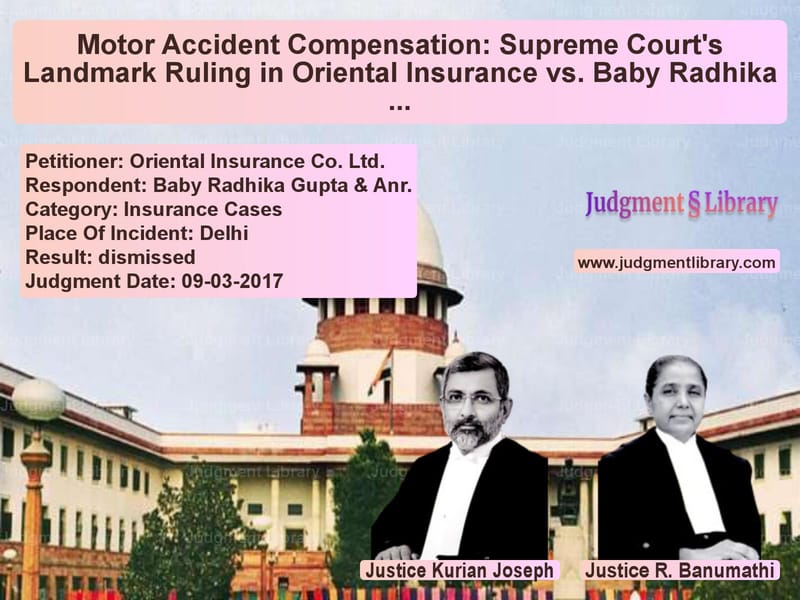

Motor Accident Compensation: Supreme Court’s Landmark Ruling in Oriental Insurance vs. Baby Radhika Gupta

The Supreme Court of India, in a significant judgment, addressed the issue of compensation in motor accident claims in the case of Oriental Insurance Co. Ltd. vs. Baby Radhika Gupta & Anr.. This case revolved around the legal dispute concerning the rightful compensation awarded to victims of motor accidents and the rights of insurance companies to recover excess payments. The decision emphasized the role of Article 142 of the Indian Constitution in ensuring complete justice.

Background of the Case

The case originated when Baby Radhika Gupta and another respondent filed a claim for compensation before the Motor Accident Claims Tribunal (MACT), Delhi. The Tribunal awarded Rs. 44,50,000 along with 9% interest from the date of filing until its realization. However, Oriental Insurance Co. Ltd., the appellant, challenged this award before the Delhi High Court, which significantly reduced the compensation to Rs. 5,82,132.

During the proceedings:

- The claimants were allowed to withdraw 80% of the awarded amount.

- The insurance company retained 20% of the amount along with accrued interest.

The claimants then moved the Supreme Court, which modified the compensation to Rs. 15,70,892. Subsequently, the insurance company sought recovery of the excess amount withdrawn by the respondents.

Legal Issues

- Whether the insurance company had the legal right to recover excess compensation paid to the claimants.

- The role of Article 142 of the Constitution in cases involving social justice.

- The significance of fair compensation in motor accident claims.

Petitioner’s Arguments (Oriental Insurance Co. Ltd.)

The insurance company argued:

- The High Court had explicitly allowed them to recover the excess amount withdrawn by the claimants.

- The respondents had already withdrawn more than the amount they were entitled to after the Supreme Court’s modification of compensation.

- Since the respondents had received an amount in excess of their entitled sum, they were legally bound to return the surplus, including the interest component.

Respondents’ Arguments (Baby Radhika Gupta & Anr.)

The respondents countered:

- The deceased was a young employee, only 32 years old, and the compensation initially awarded by MACT was fair and just.

- The compensation awarded by the Supreme Court did not adequately account for loss of income, consortium, or the minor child’s future care.

- The financial burden caused by the accident necessitated a humanitarian approach in deciding whether the excess payment should be recovered.

Supreme Court’s Observations

The Supreme Court examined the legal provisions governing compensation in motor accident claims and recovery of excess amounts. The Court acknowledged the right of the insurance company to recover the excess sum but noted the peculiar circumstances of the case.

Key observations included:

- The deceased was a 32-year-old employee with dependents, and fair compensation was essential.

- The claimants had not been granted 50% enhancement in salary calculations.

- No separate amount was granted to the minor child for loss of love, care, and protection.

- Only Rs. 25,000 was granted as consortium, which was insufficient given the circumstances.

“No amount was given to the minor towards loss of love, care, and protection. Only Rs. 25,000 was granted for consortium, which we deem inadequate. Thus, we find it appropriate to dismiss the insurance company’s appeal under Article 142 of the Constitution.”

The Court emphasized that while the insurance company had a legal right to seek recovery, the principle of complete justice under Article 142 allowed for discretion in such cases.

Supreme Court’s Ruling

- The appeal by Oriental Insurance Co. Ltd. was dismissed.

- The claimants were allowed to retain the withdrawn amount without repaying the excess.

- The legal question regarding recovery of excess compensation was left open for future cases.

Impact of the Judgment

This ruling highlights the Supreme Court’s approach in balancing legal provisions with social justice. The decision reaffirmed that accident victims should not be burdened with repayment demands when their compensation has already been reduced significantly. The Court’s invocation of Article 142 ensured that complete justice was served, particularly considering the financial distress faced by accident victims.

Key Takeaways

- Insurance companies have the legal right to recover excess payments, but courts may intervene under extraordinary circumstances.

- Compensation must be fair, accounting for dependents, loss of earnings, and emotional suffering.

- Article 142 of the Indian Constitution provides the Supreme Court with discretionary power to deliver complete justice.

Conclusion

The judgment in Oriental Insurance Co. Ltd. vs. Baby Radhika Gupta & Anr. sets an important precedent in motor accident compensation cases. It upholds the principles of fairness, ensuring that accident victims receive just compensation without being subjected to undue financial hardship. The ruling also clarifies that insurance companies must approach courts with due diligence when seeking recovery of excess payments.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Oriental Insurance C vs Baby Radhika Gupta & Supreme Court of India Judgment Dated 09-03-2017.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Motor Insurance Settlements

See all petitions in Compensation Disputes

See all petitions in Insurance Settlements

See all petitions in Judgment by Kurian Joseph

See all petitions in Judgment by R. Banumathi

See all petitions in dismissed

See all petitions in supreme court of India judgments March 2017

See all petitions in 2017 judgments

See all posts in Insurance Cases Category

See all allowed petitions in Insurance Cases Category

See all Dismissed petitions in Insurance Cases Category

See all partially allowed petitions in Insurance Cases Category