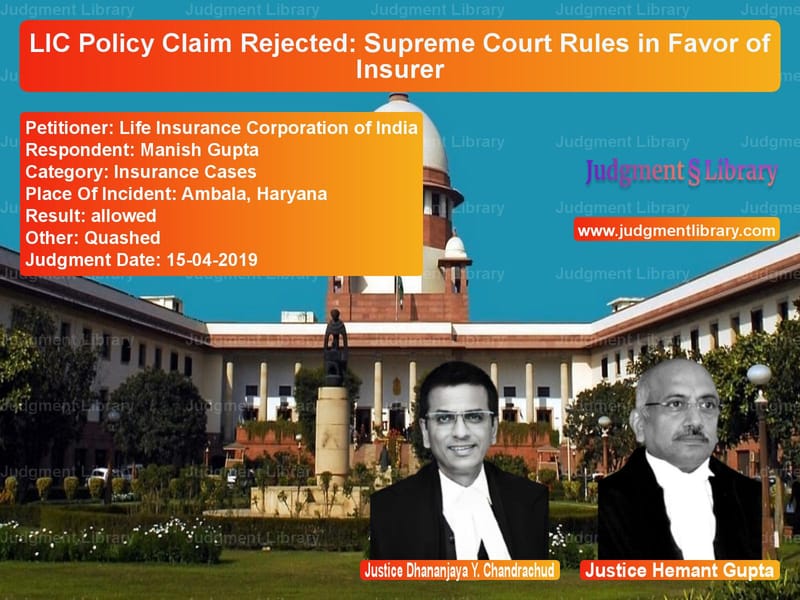

LIC Policy Claim Rejected: Supreme Court Rules in Favor of Insurer

The case of Life Insurance Corporation of India vs. Manish Gupta revolves around a mediclaim policy dispute where the insurer rejected a claim based on non-disclosure of a pre-existing health condition. The Supreme Court reviewed whether the insurer was justified in repudiating the claim and ruled in favor of the insurance company, emphasizing the principle of utmost good faith in insurance contracts.

Background of the Case

The respondent, Manish Gupta, obtained a Mediclaim policy from Life Insurance Corporation of India (LIC) under the Health Plus policy scheme. The policy was issued on 25 June 2008 for a sum insured of Rs 1,60,000. The insurance proposal form required the proposer to disclose any history of cardiovascular diseases, including heart attacks, chest pain, or strokes. The respondent declared that he had no such medical history.

On 7 August 2009, the insurer received a hospital claim form stating that the respondent had undergone a Mitral Valve Replacement (MVR) surgery at Fortis Hospital, Mohali. The insurer rejected the claim on 29 October 2009, citing non-disclosure of a pre-existing illness, specifically rheumatic heart disease, which was recorded in the hospital’s medical notes as a known condition since childhood.

Arguments by the Petitioner

The Life Insurance Corporation of India (LIC) made the following arguments:

- The policy was issued under the “Non-Medical General” (NMG) category, meaning no pre-policy medical examination was conducted. The insurer relied solely on the information provided by the proposer.

- The respondent failed to disclose his history of rheumatic heart disease at the time of taking the policy.

- The claim was rightfully repudiated under the policy’s pre-existing conditions exclusion clause.

- The insurer was not obligated to pay a claim based on fraudulent or inaccurate information.

Arguments by the Respondent

Manish Gupta, appearing in person, countered with the following arguments:

- He had only informed the doctor about having fever and joint pain since childhood, not rheumatic heart disease.

- The doctor’s notes recording a history of rheumatic heart disease were not based on any formal medical diagnosis.

- Since no medical examination was required for the policy, the insurer had no basis to reject the claim.

- The consumer forums had ruled in his favor, stating that the insurer failed to prove that he knowingly concealed material facts.

Consumer Court Decisions

The respondent initially approached the District Consumer Disputes Redressal Forum, Ambala, which ruled in his favor, ordering:

- LIC to pay Rs. 2,21,990 with 9% interest per annum from 29 October 2009.

- Compensation of Rs. 10,000 for mental harassment.

- Litigation costs of Rs. 10,000.

- Additional interest of 12% per annum if payment was delayed.

The decision was upheld by the State Consumer Disputes Redressal Commission (SCDRC) and later by the National Consumer Disputes Redressal Commission (NCDRC). The NCDRC noted that the insurer failed to prove that the respondent knowingly withheld information.

Supreme Court’s Observations

The Supreme Court analyzed the medical records and insurance contract, stating:

“The discharge summary from Fortis Hospital clearly mentions a known case of rheumatic heart disease since childhood. The proposer had an obligation to disclose this condition in the policy proposal form.”

The Court further emphasized the duty of good faith in insurance contracts:

“A contract of insurance requires utmost good faith. The proposer cannot determine what is relevant for disclosure; it is their duty to reveal all known medical conditions.”

Final Judgment

The Supreme Court ruled in favor of LIC, setting aside the lower court decisions. The Court held:

- The insured’s failure to disclose a pre-existing condition justified the claim’s rejection.

- Consumer forum decisions were based on an incorrect assessment of the insurer’s obligations.

- The repudiation of the claim was valid and enforceable under the insurance contract.

As a result, the petition was allowed, and the respondent’s consumer complaint was dismissed.

Significance of the Judgment

This case reinforces the principle of utmost good faith in insurance contracts. The judgment clarifies that policyholders must disclose all known medical conditions, even if they do not consider them significant. It sets a precedent for insurers to reject claims where material facts were misrepresented or withheld.

Petitioner Name: Life Insurance Corporation of India.Respondent Name: Manish Gupta.Judgment By: Justice Dhananjaya Y. Chandrachud, Justice Hemant Gupta.Place Of Incident: Ambala, Haryana.Judgment Date: 15-04-2019.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Life Insurance Corpo vs Manish Gupta Supreme Court of India Judgment Dated 15-04-2019.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Health Insurance Disputes

See all petitions in Life Insurance Claims

See all petitions in Insurance Settlements

See all petitions in Judgment by Dhananjaya Y Chandrachud

See all petitions in Judgment by Hemant Gupta

See all petitions in allowed

See all petitions in Quashed

See all petitions in supreme court of India judgments April 2019

See all petitions in 2019 judgments

See all posts in Insurance Cases Category

See all allowed petitions in Insurance Cases Category

See all Dismissed petitions in Insurance Cases Category

See all partially allowed petitions in Insurance Cases Category