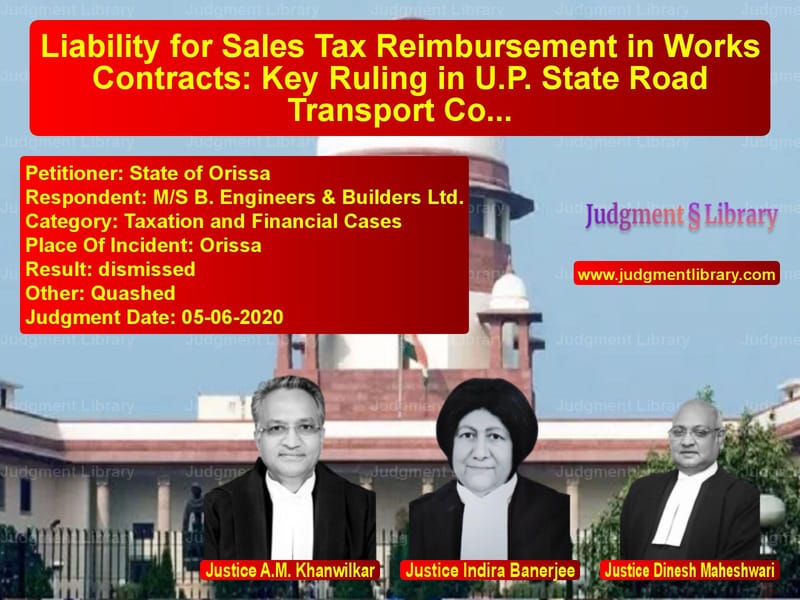

Liability for Sales Tax Reimbursement in Works Contracts: Key Ruling in U.P. State Road Transport Corporation vs. Rajendri Devi

The case of State of Orissa vs. M/S B. Engineers & Builders Ltd. & Ors. addresses a significant issue related to the reimbursement of sales tax in works contracts, particularly under the framework of the Orissa Sales Tax Act, 1947, and the constitutional amendment related to works contracts. The case revolves around the payment and reimbursement of sales tax on completed works under government contracts.

The respondent, M/S B. Engineers & Builders Ltd., had been involved in various works contracts with the State Government of Orissa. The company claimed reimbursement for the sales tax paid on materials used in the execution of these contracts. However, the State government, through circulars and clauses in the contracts, resisted this reimbursement, leading to the filing of a writ petition by the contractor. The High Court ruled in favor of the contractor, ordering the reimbursement of sales tax. The State of Orissa appealed this decision before the Supreme Court.

Background of the Case

The respondent company, M/S B. Engineers & Builders Ltd., had been awarded various works contracts by the Government of Orissa. These contracts included provisions for the reimbursement of sales tax, particularly under Clause 45.2 of the General Conditions of Contract (GCC). The company executed the contracts, but sales tax was levied on the materials used in the works. The government initially allowed reimbursement of the sales tax paid during certain periods, but later, a circular was issued which opposed further reimbursements. The company sought relief from the High Court, which ruled in its favor. The government, however, challenged this ruling in the Supreme Court.

The core issue before the Court was whether the contractor was entitled to reimbursement of sales tax under the terms of the contract, despite the government’s circulars that opposed such reimbursements. The case also delved into the constitutional aspects of sales tax levies on works contracts post the 46th Amendment to the Constitution.

Legal Provisions and Key Issues

The case primarily involved the interpretation of the following legal provisions:

- Clause 45.2 of the General Conditions of Contract (GCC): This clause stipulates that reimbursement of sales tax paid by the contractor for completed items of work shall be made, provided proof of payment is submitted.

- Section 5(2)(AA) of the Orissa Sales Tax Act, 1947: This section defines the taxable turnover for works contracts and addresses how sales tax is levied on goods used in such contracts.

- Article 366(29-A) of the Constitution of India: Following the 46th amendment, this article allows states to levy sales tax on the transfer of property in goods involved in the execution of works contracts.

- Previous case law (Gannon Dunkerley and Builders’ Association): These rulings addressed the nature of sales tax in works contracts and the impact of the 46th amendment.

The Supreme Court had to address the following key issues:

- Whether the reimbursement of sales tax, as per the terms of the contract, was justified despite the subsequent circulars issued by the government.

- Whether the provisions of Clause 45.2 of GCC applied to the sales tax paid on the materials used in the execution of the works contracts.

- The interpretation of the term “completed item of work” in the context of reimbursement of sales tax.

Arguments of the Petitioner

The petitioner, State of Orissa, presented the following arguments:

- Sales tax on works contracts is levied on the value of materials used, and the contractor should have included this tax in the bid price, as per Clause 13.3 of the Instructions to Bidders (ITB) and Clause 45.1 of GCC.

- The reimbursement is only applicable to taxes levied on completed items of work, and since the completed item of work is immovable property, no sales tax should apply to it.

- The circular issued in 2001 clarified that sales tax would not be reimbursed for materials used in the execution of works contracts, as it was included in the quoted rates.

- The reimbursement clause only applies to taxes paid on goods used in the execution of a works contract and not on the completed work itself.

Arguments of the Respondent

The respondent, M/S B. Engineers & Builders Ltd., presented the following arguments:

- The claim for reimbursement is based on Clause 45.2 of the GCC, which specifically provides for reimbursement of sales tax paid on materials used in the works contract.

- The circular issued by the State government in 2001 was contrary to the contractual terms and the statutory provisions governing the taxation of works contracts.

- According to the previous case law (Gannon Dunkerley), sales tax on works contracts is levied on the turnover, not on the completed item of work.

- The reimbursement of sales tax on completed items of work is a statutory right, and the government cannot deny this reimbursement based on arbitrary circulars.

Judgment of the Supreme Court

The Supreme Court analyzed the relevant legal provisions and previous judgments before delivering its verdict. The key findings of the Court were:

- The Court held that the reimbursement of sales tax under Clause 45.2 of GCC applies to the sales tax paid on materials used in works contracts, and not to the completed item of work.

- The 46th Amendment to the Constitution, which allows the levy of sales tax on works contracts, was discussed in the context of its impact on reimbursement claims.

- The High Court’s decision to allow the reimbursement was upheld, as the circular issued by the State government was inconsistent with the provisions of the contract and the legal framework.

- The Court emphasized that the terms of the contract, specifically Clause 45.2, should be upheld, and the government must reimburse the contractor for the sales tax paid on materials used in the works contract.

Accordingly, the Supreme Court dismissed the appeal and upheld the High Court’s judgment, ordering the reimbursement of the sales tax as per the terms of the contract.

Impact of the Judgment

This ruling has significant implications for works contracts and the reimbursement of sales tax in India:

- It reinforces the contractual obligation of the employer (in this case, the State) to reimburse the contractor for sales tax paid on materials used in the execution of works contracts.

- It clarifies the interpretation of the term “completed item of work” and confirms that reimbursement is applicable to the tax paid on materials, not on the completed work itself.

- The ruling ensures that the terms of the contract are honored, and arbitrary circulars by the government cannot override the agreed terms.

- It provides a precedent for future cases involving reimbursement claims under works contracts, ensuring fairness and consistency in the application of such claims.

Conclusion

The judgment in State of Orissa vs. M/S B. Engineers & Builders Ltd. is a significant ruling in the area of works contracts and taxation. The Supreme Court has affirmed the rights of contractors to claim reimbursement of sales tax paid on materials used in the execution of works contracts, despite contrary circulars issued by the State government. This case reinforces the importance of adhering to the terms of the contract and statutory provisions governing such claims.

By clarifying the scope of reimbursement for sales tax under works contracts, this judgment will serve as a guiding precedent for similar cases involving works contracts, taxation, and the interpretation of contractual terms in public sector agreements.

Petitioner Name: State of Orissa.Respondent Name: M/S B. Engineers & Builders Ltd..Judgment By: Justice A.M. Khanwilkar, Justice Indira Banerjee, Justice Dinesh Maheshwari.Place Of Incident: Orissa.Judgment Date: 05-06-2020.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: State of Orissa vs MS B. Engineers & B Supreme Court of India Judgment Dated 05-06-2020.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Income Tax Disputes

See all petitions in GST Law

See all petitions in Tax Evasion Cases

See all petitions in Banking Regulations

See all petitions in Judgment by A M Khanwilkar

See all petitions in Judgment by Indira Banerjee

See all petitions in Judgment by Dinesh Maheshwari

See all petitions in dismissed

See all petitions in Quashed

See all petitions in supreme court of India judgments June 2020

See all petitions in 2020 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category