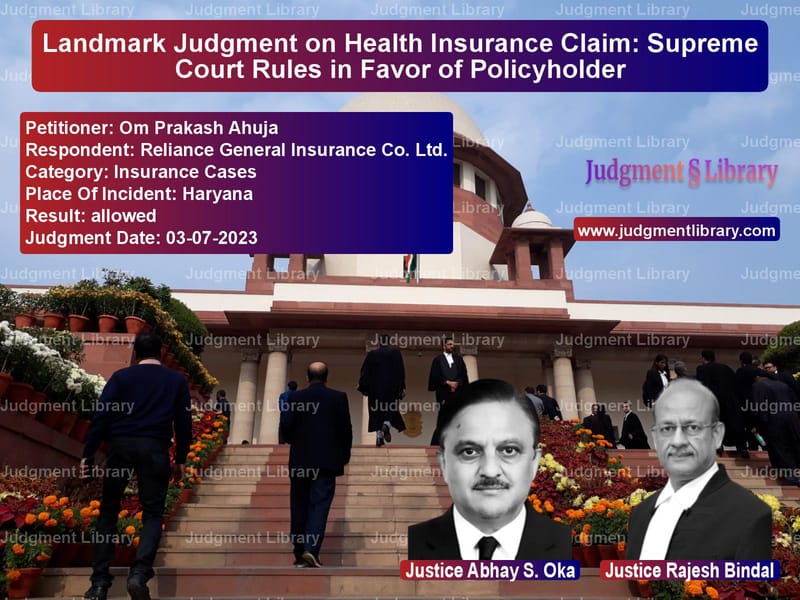

Landmark Judgment on Health Insurance Claim: Supreme Court Rules in Favor of Policyholder

The case of Om Prakash Ahuja v. Reliance General Insurance Co. Ltd. is a significant ruling that sheds light on health insurance claims and the rights of policyholders. This case revolved around the denial of an insurance claim for medical expenses incurred for the treatment of the appellant’s wife and the subsequent refusal of policy renewal by the insurance company. The Supreme Court ultimately ruled in favor of the policyholder, setting an important precedent in consumer protection law.

Background of the Case

Om Prakash Ahuja had purchased a health insurance policy from Reliance General Insurance Co. Ltd., covering his family. The policy, initially valid from July 7, 2007, to July 6, 2008, was renewed for another year until July 6, 2009. His wife was diagnosed with ovarian cancer and underwent treatment in multiple hospitals between January 19, 2008, and August 23, 2008. The appellant lodged claims of ₹91,496 for treatment from January 19, 2008, to March 11, 2008, and ₹4,14,464 for the period from March 13, 2008, to September 19, 2008.

However, the insurance company repudiated both claims, citing that the appellant’s wife had pre-existing rheumatic heart disease, which was not disclosed while purchasing the policy. The appellant filed a complaint with the District Consumer Disputes Redressal Forum, which ruled in his favor, directing the insurance company to reimburse the medical expenses along with interest at 8% per annum.

Legal Proceedings and Appeals

District Forum’s Ruling

The District Forum ruled that:

- The insurance company must reimburse the medical expenses incurred by the appellant.

- The refusal to renew the insurance policy was arbitrary and unjustified.

- The insurance policy must be renewed upon payment of the premium.

State Commission’s Decision

The insurance company challenged the District Forum’s ruling before the State Consumer Disputes Redressal Commission. The State Commission upheld the decision of the District Forum, dismissing the insurance company’s appeal.

National Commission’s Intervention

Upon further challenge by the insurance company, the National Consumer Disputes Redressal Commission partially upheld the State Commission’s decision. It directed reimbursement of the medical expenses but set aside the directive for the renewal of the insurance policy.

Supreme Court’s Observations and Judgment

The Supreme Court examined whether the insurance company was justified in denying policy renewal and rejecting medical claims on the grounds of non-disclosure of pre-existing conditions. It considered several legal principles, including the IRDA guidelines and consumer rights.

Key Arguments

Petitioner’s Arguments

- The health insurance policy was valid during the treatment period, and the expenses incurred were covered under the policy.

- The insurance company was aware of the wife’s treatment when it renewed the policy for the first time.

- The alleged non-disclosure of rheumatic heart disease was immaterial as the wife was treated for ovarian cancer, which was unrelated.

- The insurance company had unjustly refused to renew the policy, depriving the appellant of medical coverage.

- Since the insurance company charged higher premiums during subsequent renewals, it had already accounted for additional risks.

Respondent’s Arguments

- The policy was renewed beyond July 6, 2009, only due to a directive from the consumer forums and not voluntarily.

- The renewal of the policy was subject to a final decision by the National Commission.

- The IRDA guidelines permitted rejection of renewal on grounds of fraud, misrepresentation, or moral hazard.

- The appellant had concealed pre-existing rheumatic heart disease while purchasing the initial policy.

Supreme Court’s Rationale

The Supreme Court relied on past precedents and consumer protection principles. It made the following observations:

- The insurance company was well aware of the wife’s treatment during the first renewal period, yet it renewed the policy without objections.

- There was no direct relation between rheumatic heart disease and ovarian cancer, making the alleged non-disclosure irrelevant.

- The insurance company could not reject policy renewal arbitrarily after collecting increased premiums for additional risk coverage.

- The IRDA guidelines did not permit the rejection of policy renewal merely because a claim had been filed in a previous term.

Final Judgment

The Supreme Court set aside the National Commission’s ruling and reinstated the orders of the District Forum and State Commission. The key directives were:

- The insurance company must reimburse the full medical expenses incurred by the appellant.

- The appellant was entitled to policy renewal as originally directed by the lower consumer forums.

- The insurance company’s arbitrary rejection of renewal was invalid.

Implications of the Judgment

This ruling reinforces the principle that insurance companies cannot reject claims or deny renewal arbitrarily. It protects policyholders from unjust denial of benefits based on technical grounds. The decision sets an important precedent, ensuring that insurers honor their obligations and adhere to fair business practices.

Conclusion

The Supreme Court’s judgment in Om Prakash Ahuja v. Reliance General Insurance Co. Ltd. is a landmark decision upholding consumer rights in health insurance claims. It sends a clear message that insurers must act in good faith and cannot reject claims or deny policy renewal without legitimate reasons. This case serves as a crucial reference for future disputes involving insurance claims and policy renewals, reinforcing consumer protection laws in India.

Petitioner Name: Om Prakash Ahuja.Respondent Name: Reliance General Insurance Co. Ltd..Judgment By: Justice Abhay S. Oka, Justice Rajesh Bindal.Place Of Incident: Haryana.Judgment Date: 03-07-2023.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: om-prakash-ahuja-vs-reliance-general-ins-supreme-court-of-india-judgment-dated-03-07-2023.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Health Insurance Disputes

See all petitions in Insurance Settlements

See all petitions in Judgment by Abhay S. Oka

See all petitions in Judgment by Rajesh Bindal

See all petitions in allowed

See all petitions in supreme court of India judgments July 2023

See all petitions in 2023 judgments

See all posts in Insurance Cases Category

See all allowed petitions in Insurance Cases Category

See all Dismissed petitions in Insurance Cases Category

See all partially allowed petitions in Insurance Cases Category