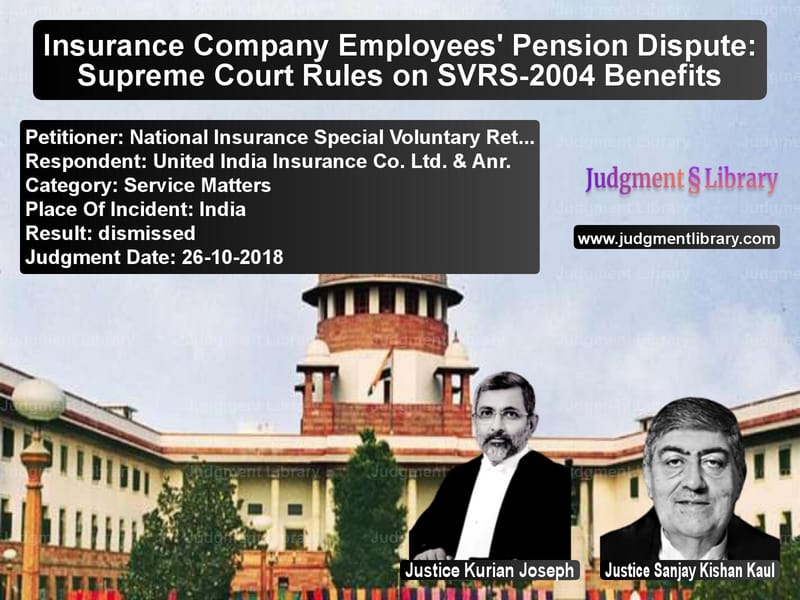

Insurance Company Employees’ Pension Dispute: Supreme Court Rules on SVRS-2004 Benefits

The Supreme Court of India recently adjudicated a long-standing dispute regarding pension benefits under the Special Voluntary Retirement Scheme, 2004 (SVRS-2004) for employees of nationalized insurance companies. The case, titled National Insurance Special Voluntary Retired/Retired Employees Association & Anr. vs. United India Insurance Co. Ltd. & Anr., revolved around whether employees who opted for voluntary retirement under SVRS-2004 were entitled to the additional five years of notional service benefit granted under the earlier General Insurance (Employees’) Pension Scheme, 1995.

Background of the Case

The appellants, former employees of various nationalized insurance companies, initially joined service between 1972 and 1980. In 2004, they opted for voluntary retirement under the SVRS-2004, a scheme designed to reduce workforce size in state-owned insurance firms.

The central issue in this case was whether retirees under SVRS-2004 were eligible for additional notional benefits as per the 1995 Pension Scheme, which allowed voluntary retirees to have their qualifying service increased by five years. The insurance companies denied this benefit, leading to litigation.

Key Legal Provisions

The 1995 Pension Scheme

The General Insurance (Employees’) Pension Scheme, 1995, provided that an employee voluntarily retiring after 20 years of service would receive:

- An additional five years of service added to their total tenure.

- The total service period could not exceed 33 years.

- The additional years should not extend beyond the employee’s retirement age.

The SVRS-2004 Scheme

The SVRS-2004 was introduced specifically to reduce excess manpower in insurance companies. It provided financial benefits such as:

- Ex-gratia payment of either 60 days’ salary for each completed year of service or salary for the remaining months before retirement (whichever was lower).

- Provident Fund, Gratuity, and Pension (as per the 1995 Pension Scheme).

- Leave encashment.

However, a crucial clause in the SVRS-2004 explicitly excluded the additional five years of notional service for calculating pension.

Petitioners’ Arguments

The retired employees contended that:

- The 1995 Pension Scheme’s additional five years of service should be extended to them.

- The exclusion of this benefit under SVRS-2004 was unjustified and unfair.

- A prior Supreme Court ruling in Manojbhai N. Shah & Ors. v. Union of India suggested that such benefits were admissible to SVRS-2004 retirees.

Respondents’ Arguments (Insurance Companies)

The insurance firms countered that:

- SVRS-2004 was a distinct scheme designed with different financial benefits.

- The scheme explicitly stated that the additional five years’ service benefit would not be applicable.

- Employees who opted for SVRS-2004 agreed to its terms, and they could not selectively claim benefits from different schemes.

- The Supreme Court’s ruling in Manojbhai N. Shah was being misinterpreted, and no such benefit was ever granted.

Supreme Court’s Observations and Ruling

The Supreme Court ruled in favor of the insurance companies, holding that:

- “The intent of the SVRS-2004 Scheme was made explicitly clear by Clause 6(1)(c), which categorically excludes the additional five years of service for pension calculation.”

- “If employees avail of the benefit of such a scheme with their eyes open, they cannot selectively look at different schemes to seek additional benefits.”

- “The terms of a voluntary retirement scheme are binding, and employees cannot claim rights beyond what is explicitly granted.”

- “The prior case of Manojbhai N. Shah only addressed retrospective pay revision and did not grant additional service benefits to SVRS-2004 retirees.”

Impact of the Judgment

This ruling has significant implications for employees who opted for voluntary retirement under schemes like SVRS-2004:

- Finality of Retirement Schemes: Employees cannot claim benefits outside the express terms of a voluntary retirement scheme.

- Legal Clarity on Pension Benefits: The judgment confirms that voluntary retirees under SVRS-2004 cannot claim additional service years from the 1995 Pension Scheme.

- Precedent for Future Cases: This ruling will guide similar disputes in other public sector entities offering voluntary retirement schemes.

Conclusion

The Supreme Court’s decision in National Insurance Special Voluntary Retired/Retired Employees Association & Anr. vs. United India Insurance Co. Ltd. & Anr. firmly establishes that employees who opted for SVRS-2004 cannot claim the additional five years’ notional service benefit under the 1995 Pension Scheme. The ruling upholds the principle that voluntary retirement schemes must be adhered to strictly, ensuring clarity and certainty in employee benefits and legal entitlements.

Petitioner Name: National Insurance Special Voluntary Retired/Retired Employees Association & Anr..Respondent Name: United India Insurance Co. Ltd. & Anr..Judgment By: Justice Kurian Joseph, Justice Sanjay Kishan Kaul.Place Of Incident: India.Judgment Date: 26-10-2018.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: National Insurance S vs United India Insuran Supreme Court of India Judgment Dated 26-10-2018.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Pension and Gratuity

See all petitions in Termination Cases

See all petitions in Public Sector Employees

See all petitions in Judgment by Kurian Joseph

See all petitions in Judgment by Sanjay Kishan Kaul

See all petitions in dismissed

See all petitions in supreme court of India judgments October 2018

See all petitions in 2018 judgments

See all posts in Service Matters Category

See all allowed petitions in Service Matters Category

See all Dismissed petitions in Service Matters Category

See all partially allowed petitions in Service Matters Category