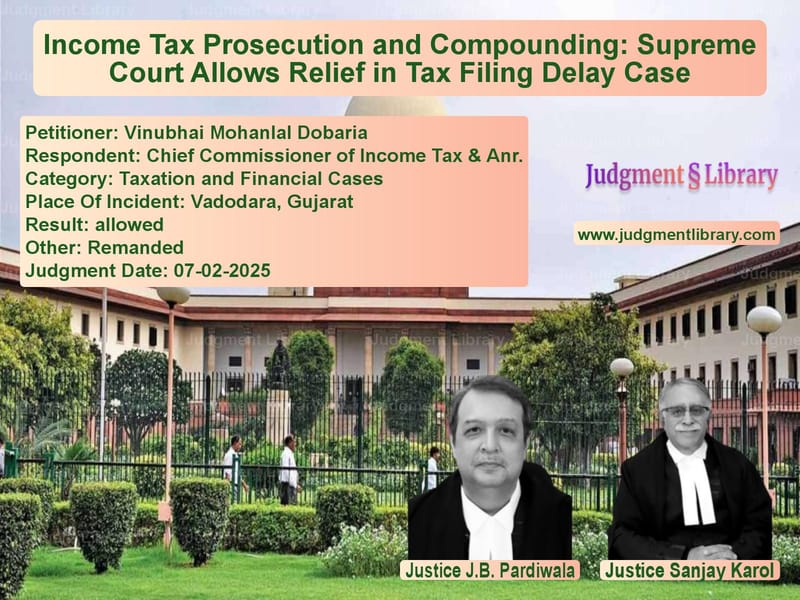

Income Tax Prosecution and Compounding: Supreme Court Allows Relief in Tax Filing Delay Case

The Supreme Court of India recently delivered an important judgment in the case of Vinubhai Mohanlal Dobaria vs. Chief Commissioner of Income Tax & Anr., ruling that an offence under Section 276CC of the Income Tax Act for failure to file returns on time can be compounded if it qualifies as a first offence. The decision reaffirms the principle that prosecution for delayed filing of income tax returns must be assessed on a case-by-case basis while adhering to the Guidelines for Compounding of Offences under Direct Tax Laws.

Background of the Case

The appellant, Vinubhai Mohanlal Dobaria, was charged with failing to file his income tax returns on time for the assessment years (AY) 2011-12 and 2013-14. He had filed his tax returns with delays of over a year in both instances:

Read also: https://judgmentlibrary.com/supreme-court-overrules-excise-duty-demand-against-bharat-petroleum/

- For AY 2011-12, the return was filed on 04.03.2013, while the due date was 30.09.2011.

- For AY 2013-14, the return was filed on 29.11.2014, while the due date was 31.10.2013.

Upon review, the Income Tax Department issued a show cause notice under Section 276CC, initiating proceedings for failure to file timely returns. The appellant applied for compounding under the 2014 Guidelines for Compounding of Offences. However, his request was rejected by the Chief Commissioner of Income Tax, Vadodara, on the grounds that this was not his first offence.

High Court’s Decision

The appellant challenged the rejection before the Gujarat High Court. The High Court ruled against him, holding that since he had previously delayed tax filings, the compounding application was invalid. The appellant then approached the Supreme Court.

Petitioner’s Arguments

The appellant’s counsel, Mr. Tushar Hemani, made the following key arguments:

- The appellant’s offence should be considered a first offence as per the 2014 guidelines since the default for AY 2013-14 occurred before the issuance of the first show cause notice for AY 2011-12.

- The calculation of an offence under Section 276CC should be based on the day after the due date for filing rather than the actual delayed filing date.

- Section 276CC does not specify that compounding is an automatic right, but the department’s rejection was inconsistent with the principle of fairness.

- The High Court misinterpreted Clause 8(ii) of the 2014 guidelines, leading to an erroneous rejection of the compounding application.

Respondent’s Arguments

The respondents, led by counsel Mrs. Monica Benjamin, countered the petition with the following points:

- The appellant had already been served a show cause notice for AY 2011-12 before he committed the default for AY 2013-14.

- The compounding guidelines aim to prevent repeated offences, and granting relief to habitual offenders would defeat the purpose of deterrence.

- The guidelines state that only the first offence is generally compoundable; since the appellant had committed similar defaults in multiple years, his offence should not be compounded.

- The appellant was trying to circumvent the law by applying compounding selectively.

Supreme Court’s Judgment

The Supreme Court bench comprising Justices J.B. Pardiwala and Sanjay Karol ruled in favor of the appellant, making key observations:

- “An offence under Section 276CC occurs the day after the due date for filing tax returns, not on the date when the return is actually filed late.”

- “Since the default for AY 2013-14 occurred before the issuance of a show cause notice for AY 2011-12, it qualifies as a first offence under the 2014 guidelines.”

- “Compounding of offences should be applied fairly. Arbitrary rejection of a compounding application without considering relevant timelines and facts is not permissible.”

- “The 2014 guidelines are directory and not mandatory, meaning that rejection of compounding should be based on substantive reasons, not just procedural formality.”

Final Judgment and Directions

The Supreme Court overturned the Gujarat High Court’s ruling and directed the following:

- The rejection of the compounding application is set aside.

- The appellant may reapply for compounding within two weeks.

- The Chief Commissioner of Income Tax, Vadodara, must process the compounding application within four weeks.

- Pending criminal proceedings under Section 276CC shall remain stayed until the compounding application is decided.

- If compounding is granted, the prosecution shall be abated; otherwise, the trial shall proceed.

Conclusion

This judgment clarifies that:

- An offence under Section 276CC is determined the day after the tax return due date, not on the actual filing date.

- Guidelines for compounding should be applied fairly, with proper consideration of timelines.

- Taxpayers seeking compounding should not be automatically rejected if their offence falls within the scope of the first offence.

- Revenue authorities must exercise discretion in rejecting compounding applications instead of following rigid interpretations.

The ruling strengthens taxpayer rights while ensuring compliance with tax laws and fair enforcement mechanisms.

Petitioner Name: Vinubhai Mohanlal Dobaria.Respondent Name: Chief Commissioner of Income Tax & Anr..Judgment By: Justice J.B. Pardiwala, Justice Sanjay Karol.Place Of Incident: Vadodara, Gujarat.Judgment Date: 07-02-2025.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: vinubhai-mohanlal-do-vs-chief-commissioner-o-supreme-court-of-india-judgment-dated-07-02-2025.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Income Tax Disputes

See all petitions in Tax Evasion Cases

See all petitions in Tax Refund Disputes

See all petitions in Judgment by J.B. Pardiwala

See all petitions in Judgment by Sanjay Karol

See all petitions in allowed

See all petitions in Remanded

See all petitions in supreme court of India judgments February 2025

See all petitions in 2025 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category