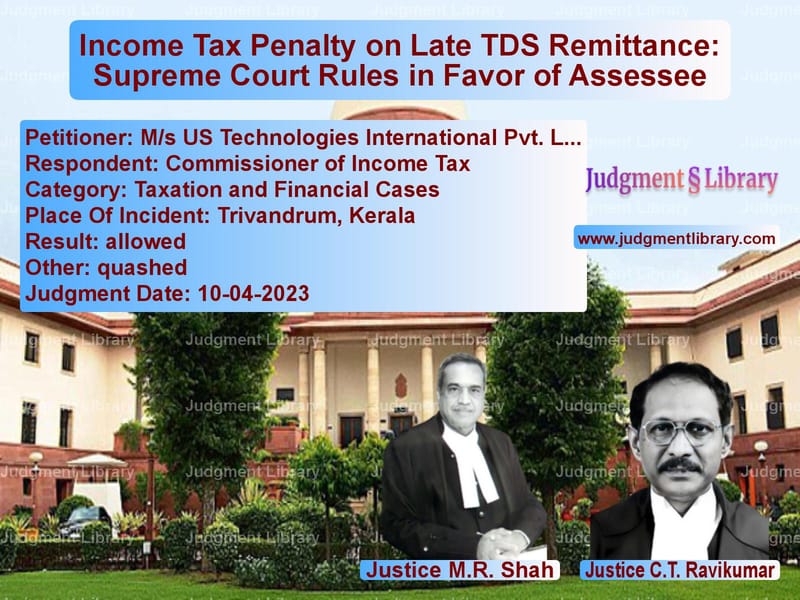

Income Tax Penalty on Late TDS Remittance: Supreme Court Rules in Favor of Assessee

The Supreme Court of India recently delivered a crucial judgment in the case of M/s US Technologies International Pvt. Ltd. vs. Commissioner of Income Tax, clarifying the applicability of penalties under Section 271C of the Income Tax Act, 1961. The case revolved around whether an assessee should be penalized for late remittance of Tax Deducted at Source (TDS) despite having deducted the tax within the prescribed timeline.

Background of the Case

The appellant, M/s US Technologies International Pvt. Ltd., a software development company based in Technopark, Trivandrum, deducted TDS on employee salaries, contract payments, and other obligations amounting to Rs. 1.10 crore for the assessment year 2003-04. However, a portion of the deducted TDS amounting to Rs. 71.47 lakh was remitted late, leading to penalties imposed by the tax authorities.

The Additional Commissioner of Income Tax (ACIT) levied a penalty under Section 271C, equating it to the full TDS amount deducted. The penalty was upheld by the High Court of Kerala, which ruled that late remittance of TDS was tantamount to a failure to deduct tax, making the assessee liable for penalty.

Arguments of the Petitioner

The counsel for the petitioner, Senior Advocate Arijit Prasad, argued that:

- The company had deducted TDS but had only remitted it late, and thus, it did not fall under the purview of Section 271C, which penalizes failure to deduct TDS.

- The Income Tax Act provides for penal interest under Section 201(1A) for delayed remittance, which the assessee had already paid.

- Penalty under Section 271C is meant only for non-deduction of TDS, not for late remittance.

- Penal provisions must be interpreted strictly and not extended to cases not explicitly covered by the law.

Arguments of the Respondents

The Additional Solicitor General (ASG) Balbir Singh, appearing for the Revenue, countered that:

- Section 271C covers both failure to deduct and failure to remit TDS.

- Delayed remittance of TDS deprives the government of timely revenue, which justifies penal action.

- The intent behind introducing Section 271C was to enforce strict compliance with TDS provisions.

Supreme Court’s Observations

The Supreme Court, after analyzing the statutory provisions and previous judgments, made the following key observations:

- “As per Section 271C(1)(a), a penalty is applicable if a person fails to deduct TDS. In the present case, there was no failure to deduct TDS, but only a delay in remittance.”

- “The words ‘fails to deduct’ in Section 271C must be read literally. The provision does not cover cases where TDS is deducted but remitted late.”

- “Wherever Parliament intended to penalize late payment, it has provided separate provisions, such as interest under Section 201(1A) and prosecution under Section 276B.”

- “The CBDT Circular No. 551 dated 23.01.1998 also clarifies that Section 271C is meant for failure to deduct TDS, whereas Section 276B covers failure to remit deducted tax.”

Final Judgment

Based on the above observations, the Supreme Court ruled in favor of the assessee, holding that:

- “No penalty shall be levied under Section 271C for mere late remittance of TDS after deduction.”

- “The High Court’s ruling is set aside, and the penalty imposed is quashed.”

- “The liability for delayed remittance is adequately covered under Section 201(1A), and further penalization under Section 271C is unwarranted.”

Implications of the Judgment

This ruling has significant implications for businesses and taxpayers:

- Clarification on TDS Compliance: The decision establishes that while timely remittance of TDS is essential, its delay does not automatically attract penal action under Section 271C.

- Prevention of Double Penalty: The ruling ensures that assessees are not subjected to both penal interest under Section 201(1A) and penalty under Section 271C for the same default.

- Strict Interpretation of Penal Laws: The judgment reinforces the principle that penal provisions must be strictly interpreted, preventing revenue authorities from imposing penalties beyond the legislative intent.

Conclusion

The Supreme Court’s verdict in M/s US Technologies International Pvt. Ltd. vs. Commissioner of Income Tax is a landmark decision that protects taxpayers from excessive penalties for mere procedural lapses. By ensuring that penalties are imposed only in cases explicitly covered under the law, the judgment upholds the fundamental principles of fairness and due process in tax administration.

Petitioner Name: M/s US Technologies International Pvt. Ltd..Respondent Name: Commissioner of Income Tax.Judgment By: Justice M.R. Shah, Justice C.T. Ravikumar.Place Of Incident: Trivandrum, Kerala.Judgment Date: 10-04-2023.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: ms-us-technologies-vs-commissioner-of-inco-supreme-court-of-india-judgment-dated-10-04-2023.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Income Tax Disputes

See all petitions in Tax Refund Disputes

See all petitions in Banking Regulations

See all petitions in Judgment by Mukeshkumar Rasikbhai Shah

See all petitions in Judgment by C.T. Ravikumar

See all petitions in allowed

See all petitions in Quashed

See all petitions in supreme court of India judgments April 2023

See all petitions in 2023 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category