Income Tax Dispute: Supreme Court Sends Back Rajasthan High Court’s Ruling for Reassessment

The case of Principal Commissioner of Income Tax (Central) vs. M/s. Motisons Entertainment India Pvt. Ltd. & Ors. revolves around the dispute over tax assessments made by the Income Tax Department. The case was brought to the Supreme Court after the Rajasthan High Court disposed of the matter with a brief order, leading the tax authorities to challenge the decision.

The Supreme Court reviewed whether the High Court adequately addressed the issues raised and ultimately decided to remit the case back for fresh consideration.

Background of the Case

The case originated when the Assessing Officer (AO) added Rs. 7,78,00,000 to the taxable income of the assessee for the Assessment Year 2012-13. The assessee, M/s. Motisons Entertainment India Pvt. Ltd., challenged this assessment before the Commissioner of Income Tax (Appeals) [CIT(A)]. The CIT(A) ruled that an amount of Rs. 6,36,50,000 was properly explained, but the remaining Rs. 1,41,50,000 was not adequately justified and, therefore, should be retained as taxable income.

Both the assessee and the Revenue department filed appeals before the Income Tax Appellate Tribunal (ITAT), which upheld the CIT(A)’s ruling regarding the Rs. 6,36,50,000 but ruled in favor of the assessee for the remaining Rs. 1,41,50,000, thereby granting complete relief to the assessee.

The Revenue department then approached the Rajasthan High Court by filing Income Tax Appeal No. 137 of 2018. However, the High Court disposed of the case in a single-paragraph judgment, stating:

“Counsel for the appellant has taken us to the order of AO, CIT(A) and tribunal and thereafter contended that both CIT(A) as well as Tribunal have erred in deleting the addition of Rs. 1.95 crore which was made u/s 56(1). However, the tribunal while considering the matter has discussed the law as well as factual matrix of the case. In our considered opinion, this is more an appreciation of facts rather than a question of law.”

The Revenue department challenged this decision before the Supreme Court, arguing that the High Court failed to provide proper reasoning in disposing of the case.

Arguments of the Petitioner (Income Tax Department)

The tax authorities argued:

- The High Court failed to consider the legal issues involved and merely stated that the matter involved the appreciation of facts.

- There were substantive questions of law regarding the unexplained income under Section 56(1) of the Income Tax Act, which needed proper examination.

- The ITAT erred in granting full relief to the assessee without adequately addressing the Revenue’s objections.

- The High Court should have provided a detailed judgment explaining why it agreed with the ITAT’s decision.

Arguments of the Respondent (M/s. Motisons Entertainment India Pvt. Ltd.)

The assessee countered:

- The ITAT had properly examined the financial records and provided a reasoned decision in favor of the assessee.

- The High Court’s observation that the matter involved an appreciation of facts was correct, and there was no substantial question of law.

- The Revenue’s challenge was based on re-arguing factual matters rather than presenting genuine legal issues.

Supreme Court’s Observations

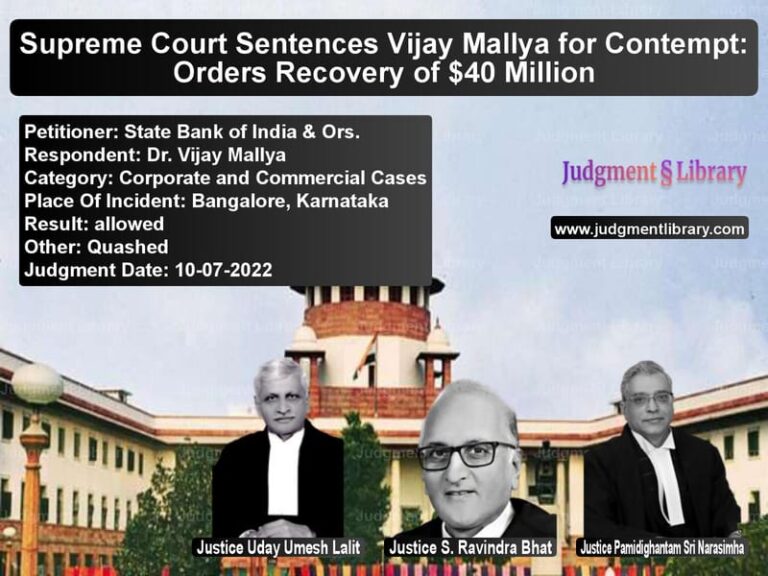

The Supreme Court, comprising Justices Uday Umesh Lalit and S. Ravindra Bhat, reviewed the case and found that the High Court had erred in dismissing the appeal without properly discussing the issues.

The Court noted:

- The High Court’s order was too brief and did not engage with the key legal issues raised in the appeal.

- Even if the case involved a factual appreciation, the High Court should have examined whether the ITAT’s decision was legally sound.

- There was no proper discussion on the applicability of Section 56(1) of the Income Tax Act and whether the ITAT’s ruling was consistent with established tax law principles.

- The judgment lacked reasoning and failed to provide clarity on why the High Court agreed with the ITAT’s findings.

The Court emphasized that appellate courts must provide well-reasoned judgments, particularly in cases involving significant tax assessments.

Supreme Court’s Verdict

On March 7, 2022, the Supreme Court ruled:

- The High Court’s judgment was set aside for being inadequately reasoned.

- The case was remanded back to the Rajasthan High Court for fresh consideration.

- The High Court was directed to reconsider the matter and deliver a judgment addressing all legal issues.

- The case was listed for rehearing before the High Court on April 18, 2022.

The Court concluded:

“The High Court was not right and justified in disposing of the appeal with one-paragraph order without discussing the issues which arose for consideration.”

Conclusion

This ruling underscores the Supreme Court’s expectation that High Courts must provide detailed reasoning when deciding tax matters. The judgment establishes key principles:

- Judicial responsibility: Appellate courts must engage with legal questions and provide reasoned decisions.

- Reassessment of unexplained income: Cases involving substantial tax additions require careful judicial scrutiny.

- Role of ITAT and High Court: While ITAT is the final fact-finding authority, its decisions must be examined for legal correctness by the High Court.

- Precedent for future tax cases: This case reinforces the need for detailed judicial reasoning in taxation appeals.

The Supreme Court’s directive ensures that the Rajasthan High Court will now conduct a thorough reassessment of the case, providing clarity on the disputed tax assessments.

Petitioner Name: Principal Commissioner of Income Tax (Central).Respondent Name: M/s. Motisons Entertainment India Pvt. Ltd. & Ors..Judgment By: Justice Uday Umesh Lalit, Justice S. Ravindra Bhat.Place Of Incident: Jaipur, Rajasthan.Judgment Date: 07-03-2022.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: principal-commission-vs-ms.-motisons-entert-supreme-court-of-india-judgment-dated-07-03-2022.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Income Tax Disputes

See all petitions in Tax Refund Disputes

See all petitions in Banking Regulations

See all petitions in Judgment by Uday Umesh Lalit

See all petitions in Judgment by S Ravindra Bhat

See all petitions in allowed

See all petitions in Remanded

See all petitions in supreme court of India judgments March 2022

See all petitions in 2022 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category