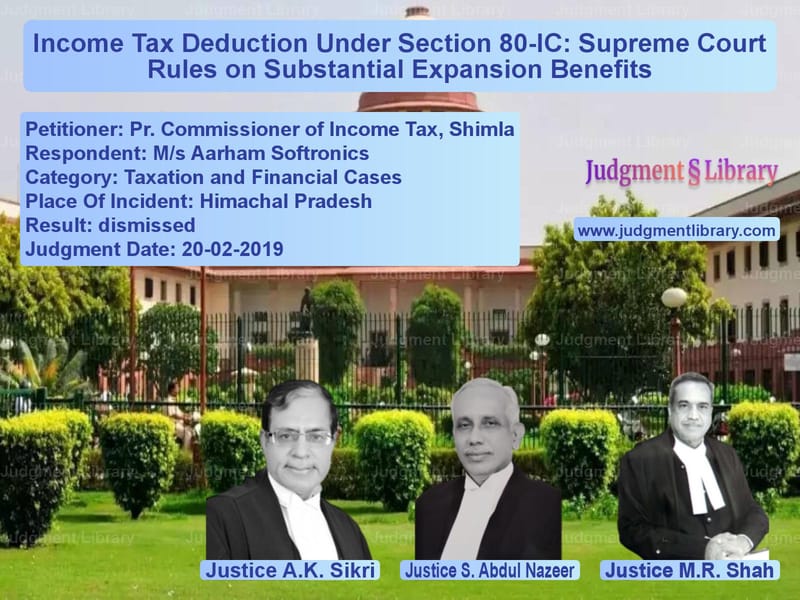

Income Tax Deduction Under Section 80-IC: Supreme Court Rules on Substantial Expansion Benefits

The case of Pr. Commissioner of Income Tax, Shimla vs. M/s Aarham Softronics revolves around the interpretation of Section 80-IC of the Income Tax Act, 1961, particularly the eligibility of an industrial unit for a second round of 100% deduction upon substantial expansion. The Supreme Court, in this landmark judgment, clarified whether an enterprise that has already availed 100% tax exemption for five years can again claim the same benefit after substantial expansion.

Background of the Case

The respondent, M/s Aarham Softronics, is an industrial unit situated in Himachal Pradesh, a state covered under Section 80-IC of the Income Tax Act. The company initially set up its manufacturing facility and claimed a 100% deduction on profits for five years as per the provision. After this period, the company undertook substantial expansion and claimed another five years of 100% deduction.

The Income Tax Department, however, objected to this claim, arguing that once the first five-year period ends, the deduction rate should reduce to 25% (or 30% for companies) for the remaining years, as per Section 80-IC(3). The matter reached the Himachal Pradesh High Court, which ruled in favor of the assessee, allowing the second 100% exemption period.

The Income Tax Department challenged the decision before the Supreme Court.

Key Legal Issue

The fundamental question before the Supreme Court was:

“Whether an assessee who sets up a new industry of a kind mentioned in sub-section (2) of Section 80-IC of the Act and starts availing exemption of 100% tax under sub-section (3) of Section 80-IC (which is admissible for five years) can start claiming the exemption at the same rate of 100% beyond the period of five years on the ground that the assessee has now carried out substantial expansion in its manufacturing unit?”

Petitioner’s Arguments

The Income Tax Department contended:

- The provision in Section 80-IC allows for a maximum period of 10 years of deduction but limits the first five years to 100% deduction and the subsequent five years to 25%.

- Allowing a second 100% deduction period after substantial expansion would be against the legislative intent of the provision.

- The benefit of 100% deduction was meant only for new units and not for existing units undergoing expansion.

- Permitting such an interpretation would allow businesses to repeatedly claim 100% exemption indefinitely by undertaking successive expansions.

Respondent’s Arguments

M/s Aarham Softronics argued:

- The Income Tax Act defines an “initial assessment year” in such a way that substantial expansion can trigger a new period of 100% exemption.

- The purpose of Section 80-IC was to promote industrial development in special category states like Himachal Pradesh, and limiting the benefit would go against the intent of the law.

- Substantial expansion requires a significant investment in plant and machinery, and the law allows for a fresh exemption when such an expansion takes place.

- The High Court correctly ruled that substantial expansion amounts to a new beginning for the purposes of tax exemption.

Supreme Court’s Observations

The Supreme Court analyzed the relevant provisions of Section 80-IC, particularly:

- Sub-section (2), which outlines eligibility criteria for industries in special category states.

- Sub-section (3), which provides for 100% tax exemption for five years, followed by 25% deduction.

- Sub-section (6), which sets a maximum limit of 10 years for the exemption.

- Sub-section (8), which defines ‘substantial expansion’ as an increase in investment in plant and machinery by at least 50%.

The Court made the following key observations:

“The definition of ‘initial assessment year’ in clause (v) of sub-section (8) allows for a new assessment year to be triggered when an industrial unit carries out substantial expansion.”

It further held:

“When an existing unit completes substantial expansion, it is entitled to claim a fresh 100% deduction for another five years, subject to the overall limit of 10 years.”

Final Judgment

The Supreme Court ruled:

- The High Court correctly interpreted the law in favor of the assessee.

- The benefit of 100% deduction can be claimed again after substantial expansion, but the total period of deduction cannot exceed 10 years.

- There is no restriction in Section 80-IC that prohibits a unit from claiming 100% exemption again after expansion.

- The Income Tax Department’s appeal was dismissed.

Conclusion

This landmark judgment clarifies the scope of tax exemptions under Section 80-IC, particularly regarding substantial expansion. The ruling benefits industries operating in special category states by providing them with continued tax relief upon reinvestment. By affirming the High Court’s interpretation, the Supreme Court has reinforced the incentive structure designed to promote industrial growth in developing regions.

Petitioner Name: Pr. Commissioner of Income Tax, Shimla.Respondent Name: M/s Aarham Softronics.Judgment By: Justice A.K. Sikri, Justice S. Abdul Nazeer, Justice M.R. Shah.Place Of Incident: Himachal Pradesh.Judgment Date: 20-02-2019.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Pr. Commissioner of vs Ms Aarham Softronic Supreme Court of India Judgment Dated 20-02-2019.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Income Tax Disputes

See all petitions in Tax Refund Disputes

See all petitions in Judgment by A.K. Sikri

See all petitions in Judgment by S. Abdul Nazeer

See all petitions in Judgment by Mukeshkumar Rasikbhai Shah

See all petitions in dismissed

See all petitions in supreme court of India judgments February 2019

See all petitions in 2019 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category