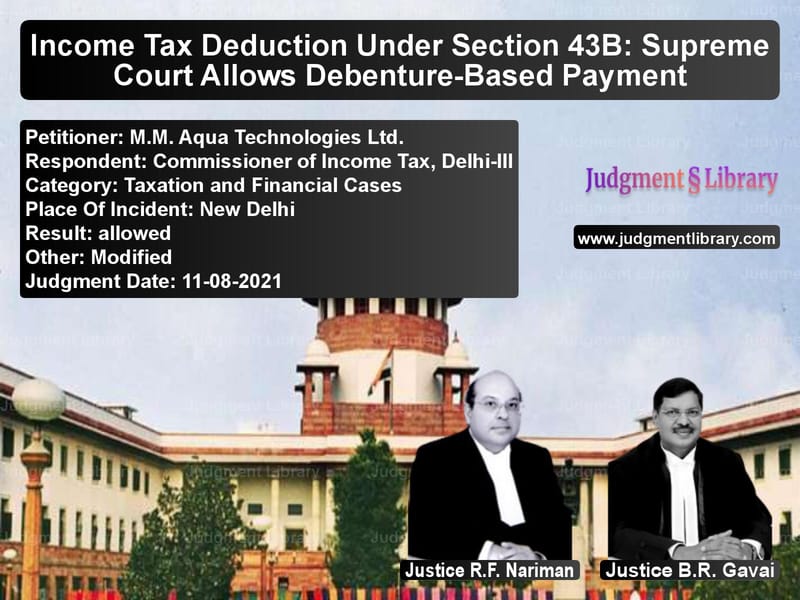

Income Tax Deduction Under Section 43B: Supreme Court Allows Debenture-Based Payment

The case of M.M. Aqua Technologies Ltd. vs. Commissioner of Income Tax, Delhi-III revolved around a key issue in taxation law: whether the issuance of debentures in lieu of outstanding interest qualified as an actual payment under Section 43B of the Income Tax Act, 1961. The Supreme Court was called upon to decide if such a transaction satisfied the conditions of Section 43B and if Explanation 3C, inserted retrospectively in 2006, applied to the present case.

Case Background

M.M. Aqua Technologies Ltd., the appellant, filed its income tax return for the assessment year 1996-1997, declaring a loss of Rs.1,03,18,572. The company claimed a deduction of Rs.2,84,71,384 under Section 43B of the Income Tax Act on account of interest paid to financial institutions. However, the payment was not made in cash but through the issuance of debentures.

The Assessing Officer (AO) rejected the claim, stating that Section 43B required actual payment and that converting interest into debentures did not satisfy this condition. The Commissioner of Income Tax (Appeals) [CIT(A)] overruled this decision, allowing the deduction, and the Income Tax Appellate Tribunal (ITAT) upheld the CIT(A)’s findings.

However, the Delhi High Court reversed the ITAT’s order, ruling that Explanation 3C, which was inserted in 2006 with retrospective effect from 1st April 1989, barred such deductions. The appellant challenged this ruling before the Supreme Court.

Arguments by the Appellant (M.M. Aqua Technologies Ltd.)

- The appellant contended that the issuance of debentures was a valid discharge of liability and qualified as an actual payment.

- “A debenture is a valuable security and a negotiable instrument. By issuing debentures, the company effectively settled its interest dues,” argued the appellant.

- The financial institutions had accepted the debentures as full satisfaction of the outstanding interest, meaning no further liability existed.

- Explanation 3C, inserted in 2006, should not be applied retrospectively to transactions completed before its introduction.

- The AO misinterpreted Section 43B, which does not specify any particular mode of payment.

Arguments by the Respondent (Commissioner of Income Tax, Delhi-III)

- The revenue department argued that Section 43B required actual payment, which meant that the interest should have been paid in cash or via banking transactions.

- “Conversion of outstanding interest into debentures is merely a deferment of liability, not an actual payment,” asserted the respondent.

- Explanation 3C was introduced to prevent misuse of Section 43B and applied retrospectively to all pending cases.

- Allowing such deductions would defeat the purpose of Section 43B, which was enacted to ensure timely tax payments.

Supreme Court’s Observations

The Supreme Court examined three critical aspects:

1. Does the issuance of debentures qualify as actual payment under Section 43B?

- The Court noted that debentures were accepted as full settlement by financial institutions.

- “Interest was effectively discharged through debentures, which were valuable and transferable instruments,” the Court stated.

2. Is Explanation 3C retrospective?

- The Court clarified that Explanation 3C was inserted to curb tax evasion by preventing interest from being converted into a fresh loan.

- “The provision does not apply to cases where debentures were issued as a mode of payment and not as a loan restructuring measure,” ruled the Court.

3. Did the High Court err in applying Explanation 3C?

- The Court found that the High Court had overlooked key factual findings by the ITAT and CIT(A).

- “Section 43B does not prescribe any specific mode of payment, and the tribunal’s factual findings cannot be ignored,” the judgment emphasized.

Supreme Court’s Judgment

The Supreme Court ruled:

- “The judgment of the Delhi High Court dated 18th May 2015 is set aside.”

- “The order of the Income Tax Appellate Tribunal allowing the deduction under Section 43B is restored.”

- “The issuance of debentures in discharge of interest liability constitutes actual payment for the purposes of Section 43B.”

Conclusion

This judgment provides clarity on the applicability of Section 43B in cases involving debenture payments. The Supreme Court reaffirmed that as long as financial institutions accept debentures as full settlement, such transactions qualify as actual payments. The ruling also prevents the retrospective application of Explanation 3C in situations where there was no intention to defer or manipulate tax liabilities.

Petitioner Name: M.M. Aqua Technologies Ltd..Respondent Name: Commissioner of Income Tax, Delhi-III.Judgment By: Justice R.F. Nariman, Justice B.R. Gavai.Place Of Incident: New Delhi.Judgment Date: 11-08-2021.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: m.m.-aqua-technologi-vs-commissioner-of-inco-supreme-court-of-india-judgment-dated-11-08-2021.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Income Tax Disputes

See all petitions in Tax Refund Disputes

See all petitions in Banking Regulations

See all petitions in Judgment by Rohinton Fali Nariman

See all petitions in Judgment by B R Gavai

See all petitions in allowed

See all petitions in Modified

See all petitions in supreme court of India judgments August 2021

See all petitions in 2021 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category