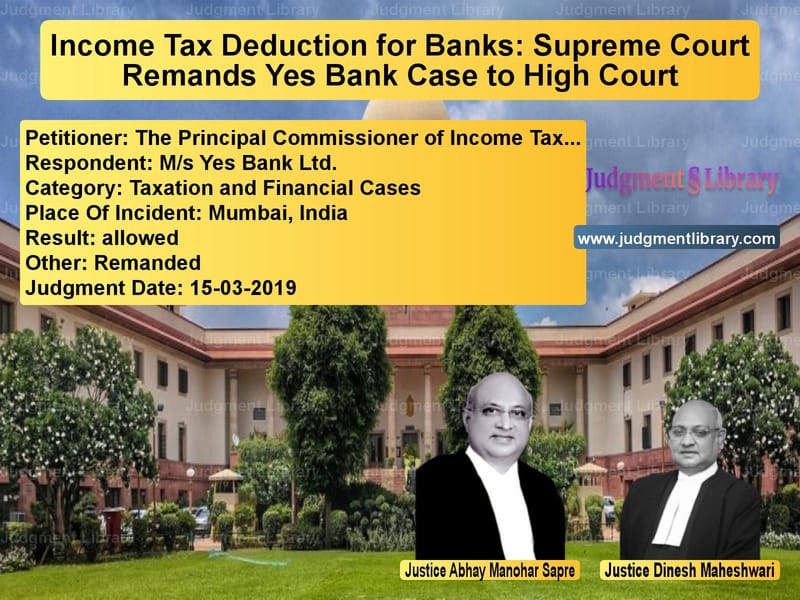

Income Tax Deduction for Banks: Supreme Court Remands Yes Bank Case to High Court

The Supreme Court of India recently delivered an important judgment in the case of The Principal Commissioner of Income Tax-8 vs. Yes Bank Ltd.. The case revolved around whether a banking institution qualifies as an ‘industrial undertaking’ for the purpose of claiming a deduction under Section 35D of the Income Tax Act, 1961.

The ruling is significant for financial institutions and tax authorities as it clarifies the procedural requirements under Section 260A of the Act and reinforces the need for judicial review of tax disputes based on substantial questions of law.

Background of the Case

The case emerged from an assessment of Yes Bank Ltd. for the Assessment Year 2007-08. The central issue was:

- Whether Yes Bank Ltd. could claim a deduction under Section 35D of the Income Tax Act.

- Whether a banking institution could be classified as an ‘industrial undertaking’ under the provisions of the Act.

The Assessing Officer initially denied the deduction. This decision was challenged before the Commissioner of Income Tax (CIT) under Section 263 of the Act, which ruled against the bank. The Income Tax Appellate Tribunal (ITAT) later overturned the CIT’s order, allowing the deduction. The Revenue Department (Income Tax) then appealed to the Bombay High Court under Section 260A of the Income Tax Act.

Petitioner’s Arguments

The Principal Commissioner of Income Tax-8, representing the Revenue Department, made the following arguments:

- The deduction under Section 35D of the Income Tax Act is available only to ‘industrial undertakings.’

- A banking institution does not fall within the ambit of an industrial undertaking and, therefore, is not eligible for deduction under Section 35D.

- The ITAT erred in allowing the deduction without properly considering the statutory definition of an industrial undertaking.

- The High Court, without framing a substantial question of law as required under Section 260A, dismissed the Revenue Department’s appeal.

Respondent’s Arguments

Yes Bank Ltd., the respondent, countered with the following points:

- Banking institutions provide essential financial services that contribute to economic development, justifying their classification as industrial undertakings.

- Section 35D does not explicitly exclude banking companies, and the benefit should be available to all entities engaged in commercial activities.

- The ITAT’s decision was based on a detailed examination of facts, and the High Court correctly dismissed the Revenue’s appeal.

- The High Court had the authority to dismiss the appeal without framing a substantial question of law.

Supreme Court’s Observations

The Supreme Court, after reviewing the case, observed:

“The High Court did not frame any substantial question of law under Section 260A of the Act, yet it proceeded to dismiss the appeal on merits.”

The Court further noted:

“Framing a substantial question of law is a mandatory requirement under Section 260A. Without determining whether a question of law arises, the High Court should not have dismissed the appeal outright.”

On the question of whether Yes Bank qualifies as an industrial undertaking, the Court stated:

“This issue requires a thorough examination based on statutory interpretation, judicial precedents, and factual considerations, which was not undertaken by the High Court.”

Final Judgment

The Supreme Court ruled as follows:

- The appeal by the Revenue Department was allowed.

- The judgment of the Bombay High Court was set aside.

- The case was remanded to the High Court for reconsideration.

- The High Court was directed to frame appropriate substantial questions of law before deciding the appeal.

The Court clarified that it had not made any findings on the merits of the case but had remanded it solely to ensure proper judicial procedure.

Implications of the Verdict

This ruling has several key implications:

- Strict Adherence to Section 260A: High Courts must frame substantial questions of law before deciding income tax appeals.

- Taxation of Financial Institutions: The case may set a precedent for determining whether banking institutions can avail of certain tax benefits meant for industrial undertakings.

- Judicial Oversight: The ruling reinforces the Supreme Court’s role in ensuring proper procedural adherence in tax disputes.

- Potential Industry-Wide Impact: The decision may influence similar cases involving deductions for banks and other financial institutions.

By remanding the case for reconsideration, the Supreme Court has ensured that tax appeals are decided through a well-reasoned judicial process, maintaining fairness and consistency in tax law interpretation.

Petitioner Name: The Principal Commissioner of Income Tax-8.Respondent Name: M/s Yes Bank Ltd..Judgment By: Justice Abhay Manohar Sapre, Justice Dinesh Maheshwari.Place Of Incident: Mumbai, India.Judgment Date: 15-03-2019.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: The Principal Commis vs Ms Yes Bank Ltd. Supreme Court of India Judgment Dated 15-03-2019.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Income Tax Disputes

See all petitions in Tax Refund Disputes

See all petitions in Banking Regulations

See all petitions in Judgment by Abhay Manohar Sapre

See all petitions in Judgment by Dinesh Maheshwari

See all petitions in allowed

See all petitions in Remanded

See all petitions in supreme court of India judgments March 2019

See all petitions in 2019 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category