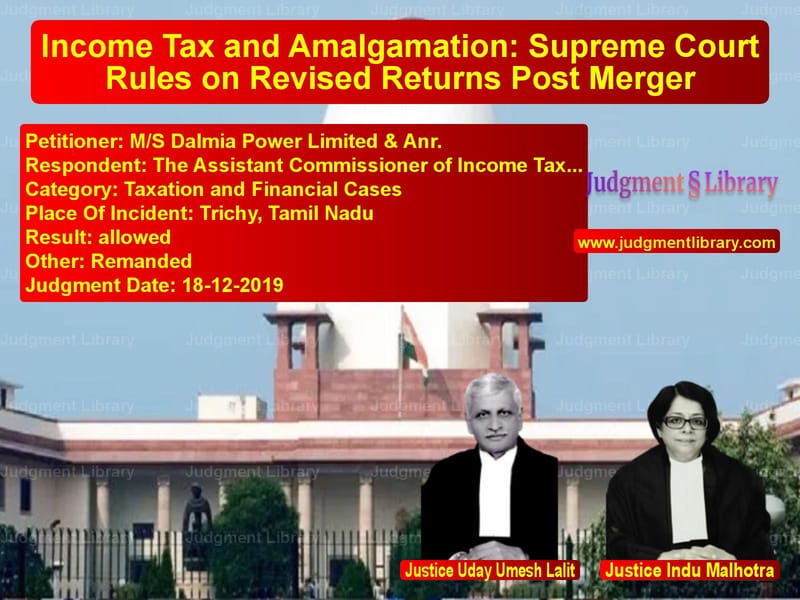

Income Tax and Amalgamation: Supreme Court Rules on Revised Returns Post Merger

The case of M/S Dalmia Power Limited & Anr. v. The Assistant Commissioner of Income Tax Circle 1, Trichy is a landmark ruling regarding the applicability of income tax laws in cases of corporate restructuring and mergers. The Supreme Court, in its judgment dated December 18, 2019, ruled in favor of the assessee companies, allowing them to file revised income tax returns post-amalgamation, despite the expiry of the due date prescribed under Section 139(5) of the Income Tax Act, 1961.

Background of the Case

The appellants, M/S Dalmia Power Limited and M/S Dalmia Cement (Bharat) Limited, are public limited companies engaged in the business of power generation and cement manufacturing. As part of a corporate restructuring process, they entered into four interconnected Schemes of Arrangement and Amalgamation with nine other companies, which were approved by the National Company Law Tribunal (NCLT) with an appointed date of January 1, 2015.

Following the NCLT’s approval, the appellants filed revised income tax returns on November 27, 2018, to reflect the financial impact of the merger. However, the Income Tax Department refused to accept the revised returns, citing the expiration of the statutory deadline on March 31, 2018.

Petitioner’s Arguments

The appellants argued that:

- The revised returns were filed pursuant to the NCLT-approved schemes, which have statutory force and cannot be disregarded.

- Section 139(5) of the Income Tax Act, which prescribes a deadline for filing revised returns, is not applicable in cases where the delay was due to the time taken for the approval of an amalgamation scheme.

- Under Section 170(1) of the Income Tax Act, the successor entity (i.e., the amalgamated company) must be assessed in respect of the income of the predecessor companies.

- Since the amalgamation resulted in the transfer of assets, liabilities, and tax liabilities, the companies were legally bound to revise their returns to reflect the new financial position.

Respondent’s Arguments

The Income Tax Department contended that:

- The revised returns were filed after the statutory deadline of March 31, 2018, and thus were invalid under Section 139(5).

- If the appellants faced difficulties in meeting the deadline, they should have applied for condonation of delay under Section 119(2)(b) of the Income Tax Act.

- The Department was not obligated to accept revised returns filed manually instead of through electronic means, as required by Rule 12(3) of the Income Tax Rules.

- Allowing such belated returns could create administrative difficulties and set a precedent for future cases.

Supreme Court’s Analysis

The Supreme Court scrutinized the relevant legal provisions and found that:

- The NCLT-approved schemes were binding on all authorities, including the Income Tax Department.

- Under Section 230(5) of the Companies Act, 2013, statutory authorities, including tax authorities, are required to raise objections within 30 days of being notified of a proposed merger scheme. The Department did not object during the approval process.

- The delay in filing the revised returns was due to the time required to obtain NCLT approval and was beyond the control of the companies.

- Since the amalgamating companies ceased to exist post-merger, the successor companies had a legal obligation to update their tax filings.

- Rules of procedure should not defeat substantive justice. The Department’s insistence on procedural deadlines should not prevent a correct assessment of tax liability.

The Court emphasized:

“The Department is required to assess the income of the appellants after taking into account the revised returns filed post-amalgamation, as sanctioned by the NCLT.”

Key Legal Precedents Cited

The Supreme Court referred to several important rulings:

- Marshall Sons & Co. (India) Ltd. v. ITO – Holding that the appointed date in a merger scheme is the effective date for tax purposes.

- Pr. Commissioner of Income Tax, New Delhi v. Maruti Suzuki India Limited – Establishing that a merged entity loses its independent existence for tax purposes.

- J.K. (Bombay) (P) Ltd. v. New Kaiser-I-Hind Spg. and Wvg. Co. Ltd. – Affirming that NCLT-approved schemes have binding statutory force.

Final Judgment

The Supreme Court ruled:

“The Department is directed to receive the revised Returns of Income for A.Y. 2016-2017 filed by the Appellants and complete the assessment after taking into account the Schemes of Arrangement and Amalgamation as sanctioned by the NCLT.”

The Court also set aside the judgment of the Division Bench of the Madras High Court, which had earlier upheld the Department’s rejection of the revised returns.

Impact of the Judgment

This ruling has significant implications for corporate tax law and merger transactions:

- It clarifies that tax authorities must recognize and implement NCLT-approved schemes, even if they require procedural flexibility.

- It ensures that companies undergoing amalgamation are not unfairly penalized for delays caused by regulatory approvals.

- It reinforces that the successor entity in a merger inherits the tax obligations of the amalgamating entities.

- It establishes a precedent for allowing revised returns beyond statutory deadlines in genuine cases of corporate restructuring.

Conclusion

The Supreme Court’s decision in M/S Dalmia Power Limited & Anr. v. The Assistant Commissioner of Income Tax is a landmark ruling that upholds the principles of tax fairness and procedural justice in corporate restructuring cases. By directing the Income Tax Department to accept revised returns filed post-merger, the judgment ensures that tax assessments reflect the economic realities of amalgamation transactions.

Petitioner Name: M/S Dalmia Power Limited & Anr..Respondent Name: The Assistant Commissioner of Income Tax Circle 1, Trichy.Judgment By: Justice Uday Umesh Lalit, Justice Indu Malhotra.Place Of Incident: Trichy, Tamil Nadu.Judgment Date: 18-12-2019.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: MS Dalmia Power Lim vs The Assistant Commis Supreme Court of India Judgment Dated 18-12-2019.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Income Tax Disputes

See all petitions in Tax Refund Disputes

See all petitions in Corporate Compliance

See all petitions in Judgment by Uday Umesh Lalit

See all petitions in Judgment by Indu Malhotra

See all petitions in allowed

See all petitions in Remanded

See all petitions in supreme court of India judgments December 2019

See all petitions in 2019 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category