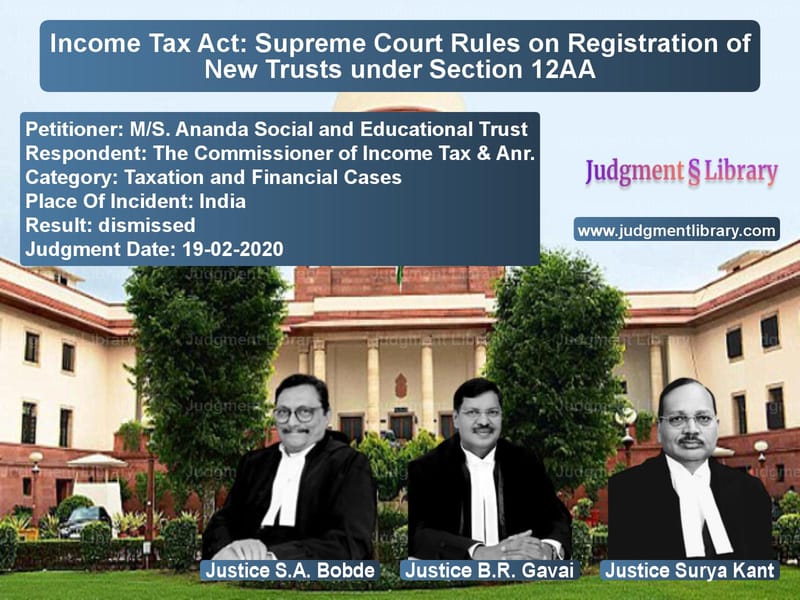

Income Tax Act: Supreme Court Rules on Registration of New Trusts under Section 12AA

The case of M/S. Ananda Social and Educational Trust vs. The Commissioner of Income Tax & Anr. is a landmark ruling that clarifies the conditions under which a newly formed trust can apply for tax exemption under Section 12AA of the Income Tax Act, 1961. The Supreme Court ruled that a trust does not need to have carried out activities before applying for registration under Section 12AA and that the Commissioner of Income Tax (CIT) must evaluate the genuineness of the trust’s objectives rather than demand proof of past activities.

Background of the Case

The appellant, M/S. Ananda Social and Educational Trust, applied for registration under Section 12AA of the Income Tax Act, which allows charitable trusts to obtain tax exemptions. The trust was registered as a society on May 30, 2008, and applied for registration under Section 12AA on July 10, 2008. However, the Commissioner of Income Tax rejected the application on the ground that the trust had not yet undertaken any charitable activities.

The Income Tax Appellate Tribunal (ITAT) overturned this decision, ruling that registration should be granted based on the trust’s objectives. However, the Revenue Department appealed to the High Court, which reversed the ITAT ruling and upheld the CIT’s decision, stating that the Commissioner was justified in rejecting the application.

Aggrieved by this, the appellant approached the Supreme Court.

Arguments of the Petitioner (Ananda Social and Educational Trust)

- The appellant argued that the Income Tax Act does not require a trust to have started activities before applying for registration.

- They contended that Section 12AA mandates the Commissioner to assess the trust’s objects and genuineness, not to demand proof of past activities.

- They referred to the rulings of the Delhi, Karnataka, and Punjab & Haryana High Courts, which held that newly formed trusts should be granted registration if their objects are charitable.

- The appellant further argued that denying registration solely based on non-performance of activities would defeat the purpose of Section 12AA.

Arguments of the Respondent (Commissioner of Income Tax & Anr.)

- The respondent contended that Section 12AA requires the Commissioner to assess both the objectives and the genuineness of a trust’s activities.

- They argued that if a trust has not yet started operations, it is impossible to evaluate whether its activities are genuine.

- They relied on the Kerala High Court’s decision in Self Employers Service Society vs. Commissioner of Income Tax (2001), where it was held that a trust must carry out activities before seeking registration.

- The respondent submitted that granting tax exemptions to trusts that had not commenced operations could lead to misuse of the tax exemption system.

Supreme Court’s Judgment

A bench comprising Chief Justice S.A. Bobde, Justice B.R. Gavai, and Justice Surya Kant ruled in favor of the appellant, overturning the High Court’s judgment. The Supreme Court made the following key observations:

“Since Section 12AA pertains to the registration of a trust and not to the assessment of what a trust has actually done, the term ‘activities’ in the provision includes ‘proposed activities.’”

The Court held that the Commissioner of Income Tax must assess whether:

- The trust’s objectives are genuinely charitable in nature.

- The proposed activities of the trust align with its stated objectives.

The judgment clarified that an application for registration cannot be rejected solely on the basis that no activities have yet been conducted:

“A newly formed trust may not have carried out any activity, but it can still be registered under Section 12AA if its stated objectives are charitable and genuine.”

The Court distinguished between the registration process under Section 12AA and the assessment process for tax exemption under Sections 11 and 12. It emphasized that once a trust is registered, the tax authorities can later scrutinize its activities to determine whether they align with its charitable objectives.

Finally, the Supreme Court upheld the judgments of the Delhi, Karnataka, and Punjab & Haryana High Courts while disapproving the contrary view taken by the Kerala High Court.

Key Takeaways from the Judgment

- New trusts can apply for registration: A trust does not need to have undertaken activities before applying for Section 12AA registration.

- Assessment is based on objectives, not activities: The Commissioner must evaluate whether the trust’s objectives are genuine and charitable.

- Tax exemption and registration are separate: While registration under Section 12AA is based on objectives, tax exemptions are granted based on actual activities.

- Future scrutiny remains open: The Income Tax Department can later assess whether the trust is complying with its charitable objectives.

- Legal clarity on registration process: This judgment settles conflicting rulings from different High Courts and provides uniformity in how tax authorities should handle trust registrations.

Impact of the Judgment

The ruling has significant implications for newly formed charitable organizations. It ensures that:

- Genuine charitable trusts are not unfairly denied tax benefits due to technical reasons.

- Trusts can plan their charitable activities without first having to meet unnecessary bureaucratic hurdles.

- The registration process under Section 12AA is streamlined and consistent across India.

- Fraudulent trusts can still be scrutinized at a later stage if they fail to adhere to their stated objectives.

Conclusion

The Supreme Court’s decision in M/S. Ananda Social and Educational Trust vs. The Commissioner of Income Tax & Anr. provides much-needed clarity on the registration of newly formed trusts under Section 12AA of the Income Tax Act. By ruling that trusts do not need to have commenced activities before registration, the Court has reinforced the importance of evaluating charitable objectives rather than focusing on procedural technicalities. This landmark judgment will benefit new charitable organizations and ensure a fairer implementation of tax exemption laws.

Petitioner Name: M/S. Ananda Social and Educational Trust.Respondent Name: The Commissioner of Income Tax & Anr..Judgment By: Justice S.A. Bobde, Justice B.R. Gavai, Justice Surya Kant.Place Of Incident: India.Judgment Date: 19-02-2020.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: MS. Ananda Social a vs The Commissioner of Supreme Court of India Judgment Dated 19-02-2020.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Income Tax Disputes

See all petitions in Tax Refund Disputes

See all petitions in GST Law

See all petitions in Banking Regulations

See all petitions in Judgment by S. A. Bobde

See all petitions in Judgment by B R Gavai

See all petitions in Judgment by Surya Kant

See all petitions in dismissed

See all petitions in supreme court of India judgments February 2020

See all petitions in 2020 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category