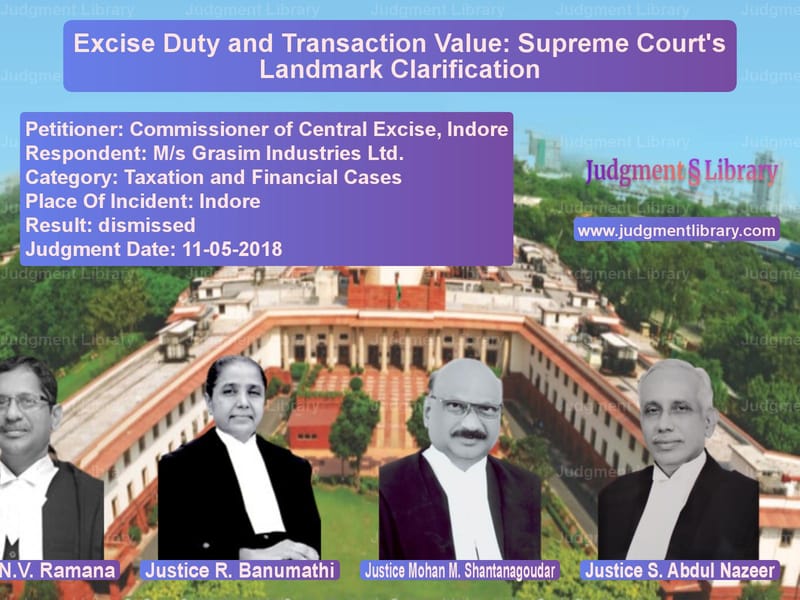

Excise Duty and Transaction Value: Supreme Court’s Landmark Clarification

The Supreme Court of India, in its judgment in the case of Commissioner of Central Excise, Indore v. M/s Grasim Industries Ltd., addressed a critical issue concerning the determination of excise duty under the Central Excise Act, 1944. The Court examined whether additional charges levied by the assessee—such as packing charges, wear and tear charges, facility charges, service charges, and rental charges—should be included in the valuation for excise duty.

The case brought forward a long-standing conflict in legal interpretation regarding the scope of ‘transaction value’ introduced in 2000 as part of the amendments to Section 4 of the Central Excise Act. The central question was whether the valuation for excise duty should extend beyond manufacturing cost and manufacturing profit, incorporating other costs incurred before the first sale.

Background and Key Issues

The dispute arose when the Revenue sought to include ancillary charges in the transaction value for excise duty determination. The assessees, however, contended that only the core manufacturing cost should be considered.

The key legal issues framed by the Court were:

- Does Section 4 of the Central Excise Act (as amended from July 1, 2000) operate independently, or is it subject to Section 3?

- How should Sections 3 and 4 be interpreted in determining the scope of excise duty valuation?

- Did the introduction of ‘transaction value’ signify a departure from the earlier ‘normal price’ approach?

Petitioner’s Arguments

The Commissioner of Central Excise, Indore, argued that excise duty should be determined based on transaction value, which includes various charges levied on customers. They relied heavily on the Supreme Court’s ruling in Union of India v. Bombay Tyre International Ltd., which had previously held that all costs incurred up to the point of sale must be considered in calculating excise duty.

The petitioner emphasized that:

- Excise duty is imposed on the manufacture of goods and must include costs that enhance product value.

- The 2000 amendment replaced ‘normal price’ with ‘transaction value’ to broaden the scope of valuation.

- Charges such as packing, storage, delivery, and related expenses should be considered in valuation.

Respondent’s Arguments

The respondent, M/s Grasim Industries Ltd., countered by asserting that excise duty should be confined to manufacturing cost and profit. They referred to the Supreme Court’s ruling in Commissioner of Central Excise, Pondicherry v. Acer India Ltd., which had clarified that software, when sold separately from hardware, was not dutiable even if both were combined.

The respondent’s primary arguments were:

- Excise duty should be imposed only on the intrinsic manufacturing value of goods.

- Ancillary charges levied post-manufacture should not form part of the valuation for duty.

- Transaction value should not alter the essential principle of excise duty as a levy on manufacture.

Supreme Court’s Observations

The Supreme Court extensively analyzed the historical development of excise duty in India, referencing significant rulings, including:

- Central Provinces and Berar Sales of Motor Spirit and Lubricants Taxation Act, 1938 – which first defined excise duty as a levy on manufactured goods.

- Bombay Tyre International Ltd. Case – which emphasized that excise duty should consider factors enhancing the value of goods.

- Acer India Ltd. Case – which provided context for differentiating excisable and non-excisable elements.

The Court stated:

“Excise is a levy on manufacture and upon the manufacturer who is entitled under law to pass on the burden to the first purchaser of the manufactured goods. The levy of excise flows from a constitutional authorisation under Entry 84 of List I of the Seventh Schedule to the Constitution of India.”

Key Judgment Excerpts

The Court ruled that the concept of ‘transaction value’ introduced in 2000 includes additional costs beyond mere manufacturing expenses:

“Transaction value as defined in Section 4(3)(d) brought into force by the Amendment Act, 2000, statutorily engrafts the additions to the ‘normal price’ under the old Section 4 as held to be permissible in Bombay Tyre International Ltd.”

The Court further elaborated on the relationship between Sections 3 and 4:

“The measure of the levy contemplated in Section 4 of the Act will not be controlled by the nature of the levy. So long as a reasonable nexus is discernible between the measure and the nature of the levy, both Section 3 and Section 4 would operate in their respective fields.”

Final Decision

The Supreme Court upheld the broad interpretation of ‘transaction value’ and ruled that additional charges incurred before the first sale must be considered in the valuation for excise duty. The petition was dismissed, reinforcing the principle that excise duty is not merely a tax on the manufacturing process but also includes ancillary costs that enhance product value.

Petitioner Name: Commissioner of Central Excise, Indore.Respondent Name: M/s Grasim Industries Ltd..Judgment By: Justice Ranjan Gogoi, Justice N.V. Ramana, Justice R. Banumathi, Justice Mohan M. Shantanagoudar, Justice S. Abdul Nazeer.Place Of Incident: Indore.Judgment Date: 11-05-2018.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Commissioner of Cent vs Ms Grasim Industrie Supreme Court of India Judgment Dated 11-05-2018.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Income Tax Disputes

See all petitions in GST Law

See all petitions in Tax Evasion Cases

See all petitions in Judgment by Ranjan Gogoi

See all petitions in Judgment by N.V. Ramana

See all petitions in Judgment by R. Banumathi

See all petitions in Judgment by Mohan M. Shantanagoudar

See all petitions in Judgment by S. Abdul Nazeer

See all petitions in dismissed

See all petitions in supreme court of India judgments May 2018

See all petitions in 2018 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category