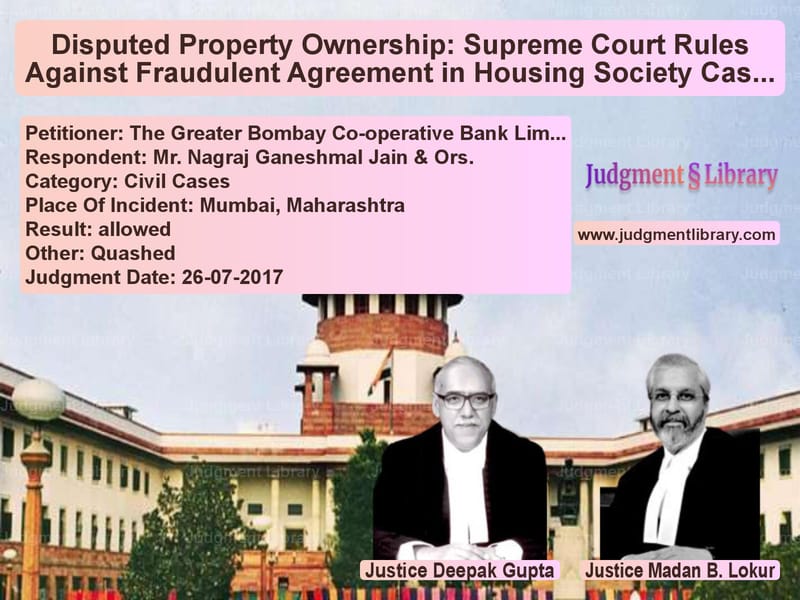

Disputed Property Ownership: Supreme Court Rules Against Fraudulent Agreement in Housing Society Case

The case of The Greater Bombay Co-operative Bank Limited v. Mr. Nagraj Ganeshmal Jain & Ors. concerns a dispute over the ownership of a flat in a housing society in Mumbai. The key issue was whether an unregistered agreement to sell could confer ownership rights and whether a bank’s attachment of the property for loan recovery was legally valid.

Background of the Case

The flat in question, located at New Shrinath Kunj Co-operative Housing Society, Vile Parle (West), Mumbai, was originally owned by Shri Dhillon P. Shah. Both he and his wife, Smt. Shivangi P. Shah, were directors of M/s. Mahaganesh Texpro Private Limited. The company had taken a cash credit facility of Rs. 2.25 crores from The Greater Bombay Co-operative Bank Limited, with the directors serving as guarantors.

When the company defaulted on loan repayment, the bank obtained a recovery certificate for Rs. 2,98,94,363 in August 2001 and initiated attachment proceedings. The bank sought to recover the dues by attaching and selling properties owned by the Shahs, including the flat in question and another bungalow. While the bungalow was sold, the dispute over the flat escalated when Nagraj Ganeshmal Jain (Respondent No.1) claimed ownership based on an unregistered agreement to sell dated October 4, 1995.

Key Legal Issues Before the Court

- Was the attachment of the flat by the bank valid?

- Did an unregistered agreement to sell confer ownership rights?

- Was the claim of ownership by Respondent No.1 genuine?

- Could Respondent No.1 demand membership in the housing society based on the alleged agreement?

Arguments of the Petitioner (The Greater Bombay Co-operative Bank Limited)

The bank contended that:

- The flat was lawfully attached in 2001 as part of loan recovery proceedings.

- Neither Mr. Shah nor his wife ever disclosed that they had sold the flat before their deaths.

- The alleged agreement to sell was never registered and did not transfer ownership rights.

- Respondent No.1 never attempted to claim ownership or membership in the society until much later, indicating fraudulent intent.

- A forensic expert’s report found discrepancies in the signature of Mr. Shah on the alleged agreement.

Arguments of the Respondent (Nagraj Ganeshmal Jain)

Respondent No.1 argued:

- He had purchased the flat from Mr. Shah through an agreement to sell in 1995 and had taken possession in 1996.

- He had been paying electricity and maintenance bills for the flat.

- The attachment by the bank was invalid because the agreement to sell predated it.

- He had the right to be recognized as the flat owner and be granted membership in the housing society.

Supreme Court’s Analysis and Judgment

The Supreme Court, comprising Deepak Gupta and Madan B. Lokur, ruled in favor of the bank, making the following key observations:

1. Unregistered Agreement to Sell Does Not Confer Ownership

- The Court cited Suraj Lamp & Industries (P) Ltd. v. State of Haryana (2012), which held that a property sale must be executed through a registered conveyance deed.

- An agreement to sell, even if executed, does not transfer ownership and cannot override legal attachment proceedings.

2. Fraudulent Intent Behind the Agreement

- The original agreement was never produced; only a photocopy was presented.

- Forensic analysis showed discrepancies in Mr. Shah’s signature on the document.

- Neither Mr. Shah nor his wife ever disclosed the sale of the flat before their deaths, despite multiple legal proceedings.

- Respondent No.1 only asserted ownership after Mr. Shah’s death, indicating an attempt to wriggle out of loan recovery proceedings.

3. Housing Society Membership Claim Rejected

- The Court ruled that Respondent No.1 could not claim membership in the housing society since he had no legal ownership over the flat.

- His claim was an attempt to create ownership rights that did not exist in law.

Final Judgment

- The Supreme Court allowed the bank’s appeal and set aside the Bombay High Court’s judgment.

- It ruled that Respondent No.1 had no right, title, or interest in the flat.

- The attachment by the bank was declared valid.

- Respondent No.1 was denied membership in the housing society.

Conclusion

This judgment reinforces the legal principle that ownership of immovable property cannot be transferred without a registered sale deed. It also serves as a cautionary tale against fraudulent claims based on unregistered agreements, especially in cases where loan recovery proceedings are involved.

The ruling is significant for banking institutions and housing societies, reaffirming that legal formalities cannot be bypassed to create ownership rights. It also underscores the importance of verifying the authenticity of property transactions before recognizing claims of ownership.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: The Greater Bombay C vs Mr. Nagraj Ganeshmal Supreme Court of India Judgment Dated 26-07-2017.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Property Disputes

See all petitions in Debt Recovery

See all petitions in Landlord-Tenant Disputes

See all petitions in Judgment by Deepak Gupta

See all petitions in Judgment by Madan B. Lokur

See all petitions in allowed

See all petitions in Quashed

See all petitions in supreme court of India judgments July 2017

See all petitions in 2017 judgments

See all posts in Civil Cases Category

See all allowed petitions in Civil Cases Category

See all Dismissed petitions in Civil Cases Category

See all partially allowed petitions in Civil Cases Category