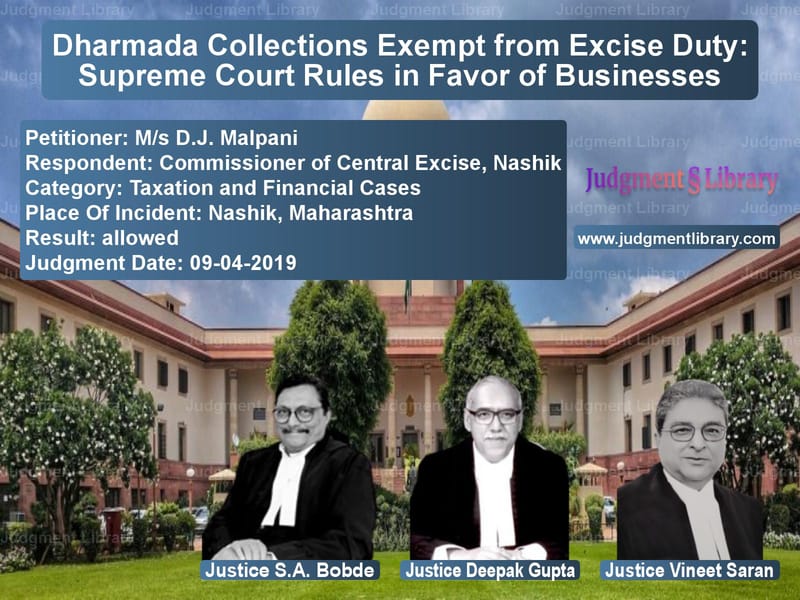

Dharmada Collections Exempt from Excise Duty: Supreme Court Rules in Favor of Businesses

The Supreme Court of India has ruled that ‘Dharmada’ collections—voluntary donations collected for charity by businesses—cannot be included in the assessable value of goods for the purpose of excise duty. In the case of M/s D.J. Malpani vs. Commissioner of Central Excise, Nashik, the Court set aside the decisions of lower tax authorities that had sought to impose excise duty on these collections, reaffirming the principle that Dharmada amounts do not form part of the transaction value of goods sold.

Background of the Case

The appellant, M/s D.J. Malpani, is a manufacturer of goods under Chapter 24 of the Central Excise Act, 1944. While selling these goods, the appellant collected an additional amount labeled as ‘Dharmada’ on the invoices. This amount was voluntarily contributed by buyers and credited to charitable activities. The dispute arose when the Central Excise authorities issued show-cause notices claiming that Dharmada should be included in the assessable value of goods and subjected to excise duty.

Initially, the adjudicating authority ruled in favor of the appellant, holding that Dharmada was a voluntary donation and could not be treated as part of the sale price. However, in a subsequent review, the Commissioner of Central Excise, Aurangabad, overturned this ruling, arguing that Dharmada was an inseparable part of the transaction value. The Central Excise and Service Tax Appellate Tribunal (CESTAT) upheld the Commissioner’s view, relying on an earlier Supreme Court decision in Collector vs. Panchmukhi Engineering Works. The appellant then moved the Supreme Court, arguing that the decision in Panchmukhi was wrongly applied.

Key Legal Issues Before the Supreme Court

- Whether the voluntary Dharmada collections can be included in the assessable value of goods for the purpose of excise duty.

- Whether the decision in Collector vs. Panchmukhi Engineering Works was applicable to this case.

- Whether the voluntary nature of Dharmada payments distinguishes them from other surcharges imposed by businesses.

Arguments Before the Supreme Court

Appellant’s (M/s D.J. Malpani) Contentions:

- The appellant argued that Dharmada collections were voluntary donations meant for charitable purposes and were not part of the consideration for the sale of goods.

- The company emphasized that these amounts were separately accounted for and directly transferred to charitable trusts.

- It contended that the decision in Panchmukhi Engineering Works was not applicable as that case dealt with a mandatory surcharge imposed under government regulations, whereas Dharmada was purely voluntary.

- The appellant relied on the Supreme Court’s earlier decision in Bijli Cotton Mills (P) Ltd. vs. Commissioner of Income Tax, where the Court held that Dharmada donations could not be treated as trading receipts.

Respondent’s (Commissioner of Central Excise) Counterarguments:

- The Excise Department argued that Dharmada collections were an integral part of the price of goods and should be included in the transaction value.

- It relied on the principle that any amount collected from buyers as part of a sale transaction is subject to excise duty unless explicitly excluded by law.

- The Department cited Panchmukhi Engineering Works, where the Supreme Court had ruled that amounts collected as part of a price structure must be included in the assessable value.

Supreme Court’s Observations

The Supreme Court carefully examined the nature of Dharmada collections and concluded that they were not part of the consideration for the sale of goods. The Court made the following key observations:

- “The Dharmada collections were voluntarily given by the buyers and were not a compulsory payment forming part of the sale price.”

- “These amounts were earmarked for charity and did not accrue to the business as trading receipts.”

- “The principle laid down in Bijli Cotton Mills applies here—Dharmada collections are not income and do not form part of the consideration for a sale.”

- “The ruling in Panchmukhi Engineering Works is distinguishable, as that case involved a government-mandated surcharge, whereas Dharmada is purely voluntary.”

The Court emphasized that excise duty is levied on the transaction value, which means the price paid for goods. Since Dharmada was given as a voluntary donation and not as consideration for goods, it could not be included in the assessable value.

Final Judgment

The Supreme Court ruled in favor of the appellant, setting aside the decision of the CESTAT and the Commissioner of Central Excise. The key directives in the judgment were:

- Dharmada collections cannot be included in the assessable value of goods for the purpose of excise duty.

- Amounts collected voluntarily and earmarked for charity do not form part of the consideration for a sale.

- The decision in Panchmukhi Engineering Works does not apply to cases where the payment in question is voluntary.

- The appeal was allowed, and the excise duty demand was quashed.

Conclusion

This landmark ruling clarifies the distinction between voluntary donations and sale consideration. By holding that Dharmada collections are not subject to excise duty, the Supreme Court has provided relief to businesses that collect voluntary donations for charity. The judgment reaffirms that excise duty applies only to amounts that form part of the sale price and not to unrelated contributions made at the buyer’s discretion.

Petitioner Name: M/s D.J. Malpani.Respondent Name: Commissioner of Central Excise, Nashik.Judgment By: Justice S.A. Bobde, Justice Deepak Gupta, Justice Vineet Saran.Place Of Incident: Nashik, Maharashtra.Judgment Date: 09-04-2019.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Ms D.J. Malpani vs Commissioner of Cent Supreme Court of India Judgment Dated 09-04-2019.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Income Tax Disputes

See all petitions in Tax Refund Disputes

See all petitions in Banking Regulations

See all petitions in Judgment by S. A. Bobde

See all petitions in Judgment by Deepak Gupta

See all petitions in Judgment by Vineet Saran

See all petitions in allowed

See all petitions in supreme court of India judgments April 2019

See all petitions in 2019 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category