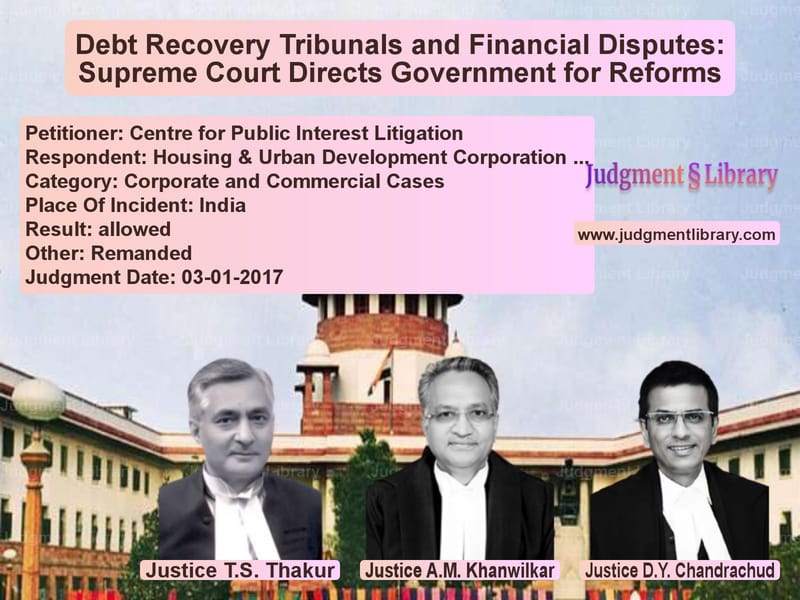

Debt Recovery Tribunals and Financial Disputes: Supreme Court Directs Government for Reforms

The Supreme Court of India, in the case of Centre for Public Interest Litigation vs. Housing & Urban Development Corporation Ltd & Ors., addressed a critical issue concerning the inefficiency and backlog of cases in Debt Recovery Tribunals (DRTs) across India. The judgment emphasized the urgent need for systemic reforms to strengthen these tribunals to ensure speedy resolution of financial disputes, particularly those involving public sector banks and financial institutions.

Background of the Case

The Centre for Public Interest Litigation (CPIL) filed a writ petition highlighting the alarming backlog in Debt Recovery Tribunals, which were originally established under the Recovery of Debts Due to Banks and Financial Institutions Act, 1993 (RDB Act). The petition outlined the following key concerns:

- As of September 30, 1990, more than 15 lakh cases involving Rs. 5,622 crores in dues from public sector banks and Rs. 391 crores from financial institutions were pending in courts.

- Despite the establishment of 34 DRTs and five Debt Recovery Appellate Tribunals (DRATs), case disposals remained sluggish.

- More than 70,000 cases involving approximately Rs. 5 lakh crores were pending before DRTs, with many cases unresolved for over a decade.

The inefficiencies of these tribunals had severe implications for banks and financial institutions, leading to prolonged litigation and substantial financial losses.

Petitioner’s Arguments

- The petitioner argued that the DRTs were failing in their objective due to inadequate infrastructure and a shortage of judicial manpower.

- The Recovery of Debts Due to Banks and Financial Institutions Act, 1993, mandated resolution of recovery applications within 180 days, but cases had remained pending for years.

- The government’s enforcement mechanisms under the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI Act) had also not been effective.

- There was an urgent need for reforms to improve case management and expedite debt recovery.

Respondents’ Arguments

- The Union government acknowledged the issue and stated that several measures were being taken to improve the efficiency of DRTs.

- The Enforcement of Security Interest and Recovery of Debt Laws and Miscellaneous Provisions (Amendment) Bill, 2016, had been introduced to address these concerns.

- The government emphasized that new legislative measures would help expedite debt recovery.

- Steps were being taken to appoint more judicial officers and improve the physical infrastructure of DRTs.

Key Observations by the Supreme Court

- The Court noted that legislative changes alone would not resolve the problem unless supported by significant improvements in infrastructure and human resources.

- The Court emphasized that the backlog in DRTs was hampering financial institutions’ ability to recover dues efficiently.

- The resignation of the Chairperson of the Debts Recovery Appellate Tribunal (DRAT) at Allahabad due to lack of infrastructure highlighted the gravity of the issue.

- Parliamentary intervention was necessary, but administrative efficiency was equally important for the effective functioning of tribunals.

Final Judgment and Directives

The Supreme Court issued a set of directives to the Union government to address the inefficiencies in DRTs:

- The government was ordered to submit an affidavit within four weeks detailing steps to improve infrastructure and staffing of DRTs and DRATs.

- The government had to clarify whether the amended legislation’s timelines for case disposal were realistic given existing tribunal resources.

- A scientific study was required to assess whether the infrastructure could meet the demands of pending cases.

- The Union government had to provide a timeline for upgrading infrastructure and judicial manpower.

- The Court sought empirical data on cases pending for over ten years and a list of corporate entities where the outstanding dues exceeded Rs. 500 crore.

The Court ruled:

“Legislative changes to provide for expeditious disposal of proceedings before the Debt Recovery Tribunals may not by themselves achieve the intended object so long as the infrastructure provided to the Tribunals is not commensurate with the burden of the work and nature of judicial duties.”

Implications of the Judgment

This judgment has far-reaching consequences for India’s financial sector:

- It underscores the need for comprehensive administrative and legislative reforms in the DRT system.

- The ruling ensures greater accountability on the government to expedite case disposal and strengthen debt recovery mechanisms.

- The judgment is expected to improve confidence among banks and financial institutions by streamlining recovery processes.

- It paves the way for better enforcement of SARFAESI Act provisions, reducing bad debts and improving the overall health of the banking sector.

Conclusion

The Supreme Court’s decision in Centre for Public Interest Litigation vs. Housing & Urban Development Corporation Ltd & Ors. is a landmark judgment that highlights the inefficiencies of Debt Recovery Tribunals and the urgent need for systemic reforms. By directing the government to improve infrastructure and judicial manpower, the Court has taken a proactive approach to ensuring that financial disputes are resolved efficiently, benefiting both the banking sector and the economy at large.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Centre for Public In vs Housing & Urban Deve Supreme Court of India Judgment Dated 03-01-2017.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Bankruptcy and Insolvency

See all petitions in Judgment by T.S. Thakur

See all petitions in Judgment by A M Khanwilkar

See all petitions in Judgment by Dhananjaya Y Chandrachud

See all petitions in allowed

See all petitions in Remanded

See all petitions in supreme court of India judgments January 2017

See all petitions in 2017 judgments

See all posts in Corporate and Commercial Cases Category

See all allowed petitions in Corporate and Commercial Cases Category

See all Dismissed petitions in Corporate and Commercial Cases Category

See all partially allowed petitions in Corporate and Commercial Cases Category