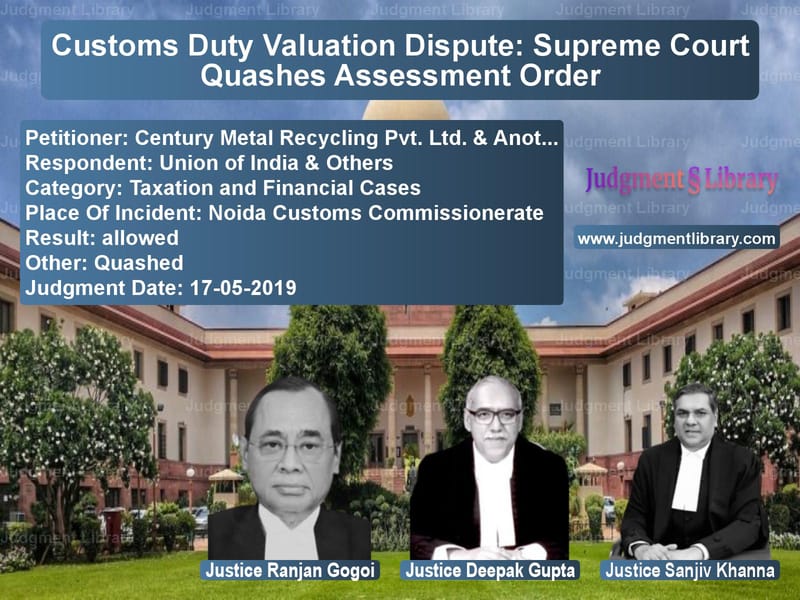

Customs Duty Valuation Dispute: Supreme Court Quashes Assessment Order

The Supreme Court of India, in the case of Century Metal Recycling Pvt. Ltd. & Another vs. Union of India & Others, delivered a significant judgment concerning the valuation of imported goods under the Customs Act, 1962. The case centered on the customs authorities’ rejection of declared transaction values for imported aluminum scrap and their insistence on higher valuation without valid justification.

The Court quashed the assessment order passed by the Principal Commissioner of Customs, Noida Customs Commissionerate, and directed adherence to the statutory provisions governing valuation. This ruling is crucial for importers as it reinforces the principles of fairness in customs valuation and protects businesses from arbitrary assessments.

Background of the Case

The appellants, Century Metal Recycling Pvt. Ltd. and its director Gauri Shankar Agarwala, are engaged in the manufacturing of aluminum alloys and regularly import aluminum waste as raw material. Their grievance was that customs officials at the Noida Customs Commissionerate consistently refused to clear imported consignments based on the declared transaction value, compelling them to accept higher valuations determined by the customs authorities.

Key contentions raised by the appellants included:

- Customs officers routinely discarded the transaction value declared in the Bill of Entry and insisted on revised valuation.

- Importers were coerced into issuing consent letters accepting the customs valuation to avoid excessive delays, demurrage, and storage charges.

- The customs department violated Section 14 of the Customs Act, 1962, by disregarding the actual transaction value and relying on an arbitrary valuation mechanism.

- Instead of following statutory provisions, customs officers based assessments on a Valuation Alert dated December 1, 2016, issued by the Central Board of Excise and Customs (CBEC).

Legal Issues in the Case

The Supreme Court examined the following legal questions:

- Can customs authorities reject declared transaction values without valid reasons?

- Does the issuance of a Valuation Alert justify deviation from Section 14 of the Customs Act?

- Are importers compelled to accept customs valuation under duress?

- Does the customs assessment comply with the Customs Valuation (Determination of Value of Imported Goods) Rules, 2007?

Arguments by the Appellants (Century Metal Recycling Pvt. Ltd.)

The appellants argued:

- The customs authorities forcibly rejected declared values, without issuing written reasons.

- Importers were pressured into issuing consent letters agreeing to arbitrary valuation to prevent financial losses due to delays.

- Section 14 of the Customs Act, 1962 mandates that transaction value should be accepted unless there are valid reasons to doubt its accuracy.

- The customs authorities failed to adhere to the Customs Valuation (Determination of Value of Imported Goods) Rules, 2007.

Arguments by the Respondents (Union of India & Others)

The customs department countered:

- The appellants had voluntarily agreed to the revised valuation, making their challenge untenable.

- The Valuation Alert issued by CBEC provided a reliable benchmark for assessing aluminum scrap imports.

- The customs department had the right to reject declared values if they found discrepancies.

- The alternative remedy of filing an appeal under Section 128 of the Customs Act was available.

Supreme Court’s Key Observations

The Supreme Court, after reviewing the facts and legal provisions, made the following critical observations:

1. Rejection of Declared Value Without Justification Is Unlawful

- Under Section 14(1) of the Customs Act, transaction value should be accepted unless there is a reason to doubt its accuracy.

- Customs authorities failed to provide written reasons for rejecting declared values.

- Merely issuing a Valuation Alert does not justify overriding declared transaction values.

2. Importers Were Coerced into Accepting Higher Valuations

- The Court noted that importers had no practical choice but to comply with customs valuation to avoid demurrage and other charges.

- Obtaining a letter of consent under financial duress does not amount to voluntary acceptance.

3. The Assessment Order Violated Customs Valuation Rules

- As per Rule 12 of the Customs Valuation Rules, 2007, customs officials must provide importers with an opportunity to justify the declared value.

- Customs authorities failed to conduct a proper valuation process, rendering their assessment illegal.

4. Alternative Remedy Not a Bar to Writ Jurisdiction

- Ordinarily, importers must appeal under Section 128 of the Customs Act.

- However, since the assessment order was patently illegal, the Court exercised its writ jurisdiction to quash it.

Final Judgment

The Supreme Court ruled:

- The assessment order dated April 7, 2017 was quashed and set aside.

- The customs authorities were directed to conduct valuation strictly as per Section 14 of the Customs Act and relevant valuation rules.

- The Court reiterated that importers must not be compelled to accept higher valuations under duress.

Implications of the Judgment

This ruling has several significant implications:

1. Strengthening Fair Customs Valuation

- Customs officers cannot arbitrarily reject transaction values without providing valid reasons.

- The decision reinforces procedural safeguards in customs valuation.

2. Protection for Importers

- The judgment protects importers from coercion and financial exploitation by customs officials.

- It affirms that valuation disputes must be resolved transparently and fairly.

3. Limits on the Use of Valuation Alerts

- Valuation Alerts issued by CBEC cannot be the sole basis for rejecting declared values.

- Customs officials must independently assess transaction values with due process.

Conclusion

The Supreme Court’s ruling in Century Metal Recycling Pvt. Ltd. & Another vs. Union of India & Others is a landmark decision ensuring fair customs valuation. The judgment protects importers from arbitrary assessments and reinforces the legal framework governing customs valuation.

This ruling will likely influence future cases involving customs disputes, ensuring that valuation assessments adhere strictly to the law.

Petitioner Name: Century Metal Recycling Pvt. Ltd. & Another.Respondent Name: Union of India & Others.Judgment By: Justice Ranjan Gogoi, Justice Deepak Gupta, Justice Sanjiv Khanna.Place Of Incident: Noida Customs Commissionerate.Judgment Date: 17-05-2019.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Century Metal Recycl vs Union of India & Oth Supreme Court of India Judgment Dated 17-05-2019.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Banking Regulations

See all petitions in Tax Refund Disputes

See all petitions in Customs and Excise

See all petitions in Judgment by Ranjan Gogoi

See all petitions in Judgment by Deepak Gupta

See all petitions in Judgment by Sanjiv Khanna

See all petitions in allowed

See all petitions in Quashed

See all petitions in supreme court of India judgments May 2019

See all petitions in 2019 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category