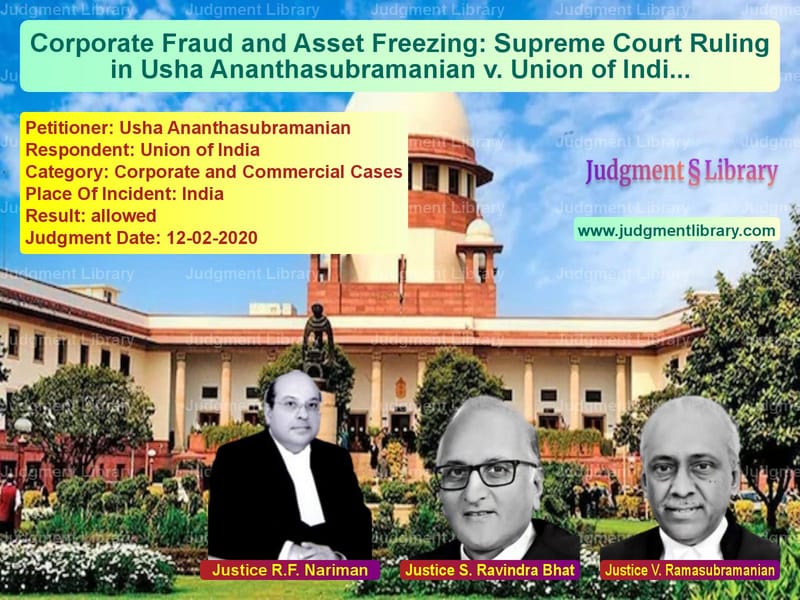

Corporate Fraud and Asset Freezing: Supreme Court Ruling in Usha Ananthasubramanian v. Union of India

The case of Usha Ananthasubramanian v. Union of India centers around the Punjab National Bank (PNB) fraud scandal involving Nirav Modi and Gitanjali Gems Ltd. The Supreme Court examined whether the assets of Usha Ananthasubramanian, the former MD & CEO of PNB, could be frozen under the provisions of the Companies Act, 2013, for her alleged role in failing to prevent the fraud.

The case arose after a charge sheet was filed by the Central Bureau of Investigation (CBI) against several officials of PNB and the directors of Gitanjali Gems Ltd. The National Company Law Tribunal (NCLT) and the National Company Law Appellate Tribunal (NCLAT) had ordered the freezing of assets of multiple individuals, including Ananthasubramanian, under Sections 241 and 339 of the Companies Act. The Supreme Court was called upon to decide whether such an order was within the jurisdiction of the NCLT and NCLAT.

Arguments by the Petitioner

Senior Advocate C.S. Vaidyanathan, representing the petitioner, argued that Ananthasubramanian’s role in the fraud was limited to negligence in taking preventive steps rather than active participation. He stated:

“Any order that freezes assets of the appellant in the exercise of jurisdiction under Section 241 of the Companies Act would be without jurisdiction.”

He contended that the Companies Act provisions could only be applied to individuals involved in the mismanagement of the specific company in question (Gitanjali Gems Ltd.) and not to officials of unrelated corporate entities like Punjab National Bank.

Arguments by the Respondent

The Additional Solicitor General, Sanjay Jain, representing the Union of India, defended the NCLT and NCLAT’s orders, arguing:

“Where a person is liable for fraudulent conduct of business, the jurisdiction under Section 339 is very wide and would include freezing the assets of any person who was knowingly a party to the carrying on of the fraudulent conduct of business.”

He contended that since Ananthasubramanian was heading PNB during the fraud, her assets could be frozen under the law.

Supreme Court’s Analysis

The Supreme Court examined the scope of Sections 241, 337, and 339 of the Companies Act. It observed:

“It is clear that powers under these sections cannot possibly be utilized in order that a person who may be the head of some other organization be roped in, and his or her assets be attached.”

The Court held that the provisions could only apply to individuals engaged in fraudulent activities within the mismanaged company itself (Gitanjali Gems Ltd.) and not external entities like PNB.

Final Verdict

The Supreme Court ruled in favor of the petitioner and set aside the NCLT and NCLAT orders freezing her assets. However, the Court clarified that its decision would not affect ongoing investigations by the CBI or the Serious Fraud Investigation Office (SFIO).

Petitioner Name: Usha Ananthasubramanian.Respondent Name: Union of India.Judgment By: Justice R.F. Nariman, Justice S. Ravindra Bhat, Justice V. Ramasubramanian.Place Of Incident: India.Judgment Date: 12-02-2020.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Usha Ananthasubraman vs Union of India Supreme Court of India Judgment Dated 12-02-2020.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Company Law

See all petitions in Corporate Governance

See all petitions in unfair trade practices

See all petitions in Judgment by Rohinton Fali Nariman

See all petitions in Judgment by S Ravindra Bhat

See all petitions in Judgment by V. Ramasubramanian

See all petitions in allowed

See all petitions in supreme court of India judgments February 2020

See all petitions in 2020 judgments

See all posts in Corporate and Commercial Cases Category

See all allowed petitions in Corporate and Commercial Cases Category

See all Dismissed petitions in Corporate and Commercial Cases Category

See all partially allowed petitions in Corporate and Commercial Cases Category