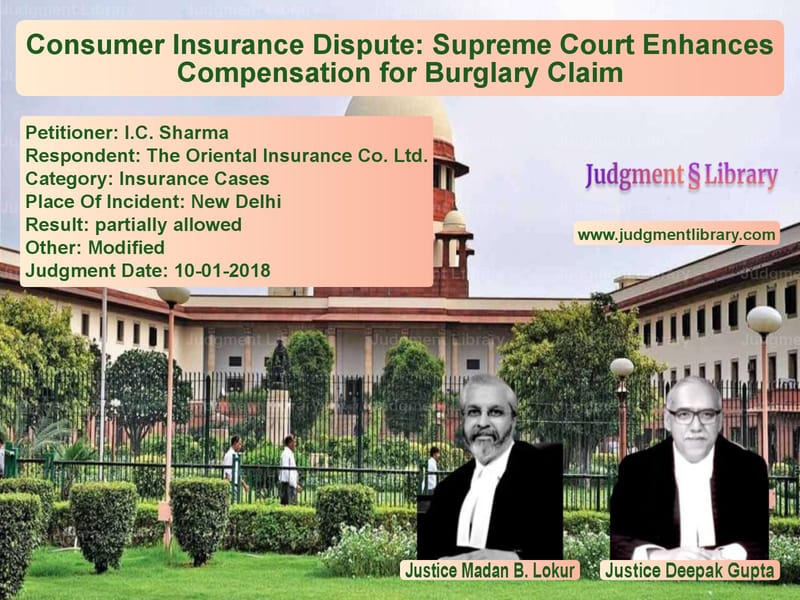

Consumer Insurance Dispute: Supreme Court Enhances Compensation for Burglary Claim

The Supreme Court of India, in its judgment on January 10, 2018, ruled on a significant consumer dispute regarding an insurance claim for burglary. The case, I.C. Sharma v. The Oriental Insurance Co. Ltd., involved a challenge to the compensation awarded under a householder’s insurance policy. The appellant, a consumer, contested the insurer’s rejection of his full claim, arguing that the insurance company wrongly applied the principle of under-insurance and failed to honor the policy terms. The Supreme Court ultimately enhanced the compensation and provided clarity on how under-insurance should be applied.

Background of the Case

The case arose when the appellant, I.C. Sharma, suffered a burglary at his residence between January 27 and January 30, 2008, while he was in the United Kingdom. Upon being informed by a neighbor, he lodged an FIR at Mehrauli Police Station and reported the incident to the insurer, The Oriental Insurance Co. Ltd. Sharma had been renewing his householder’s insurance policy since December 23, 2000, covering household articles, including jewelry and other valuables.

Initially, the insurer offered Rs. 3,500 as compensation, which the appellant refused. Later, an increased offer of Rs. 29,920 was also rejected, leading Sharma to file a consumer complaint. The District Consumer Forum dismissed his claim, stating that many of the stolen articles were not listed in the policy. However, the State Consumer Commission overruled this decision, awarding him Rs. 4,03,150.

Both Sharma and the insurer challenged this ruling before the National Consumer Disputes Redressal Commission (NCDRC). The insurer argued that many claimed items were not covered, while Sharma sought additional compensation. The NCDRC reduced the awarded amount to Rs. 49,929, citing under-insurance and lack of invoices for certain stolen items.

Aggrieved by this, Sharma filed an appeal before the Supreme Court.

Arguments by the Petitioner (I.C. Sharma)

The petitioner contended that:

- His policy covered all household items under a consolidated sum, and listing individual items was no longer required under the new insurance scheme.

- The insurer arbitrarily rejected claims for certain items despite their inclusion in the policy.

- The insurance company had changed its policy structure, yet it failed to inform him of any requirement for updated lists.

- He was wrongly denied compensation for watches, electrical appliances, and silver cutlery, all of which were stolen.

Arguments by the Respondent (Oriental Insurance Co. Ltd.)

The insurance company argued that:

- The insured had failed to provide an updated list of items, making it difficult to verify the claim.

- Many of the stolen items, such as silver cutlery, did not fall under covered categories like kitchenware.

- The principle of under-insurance should be applied since the insured amount was lower than the actual value of claimed items.

- Without purchase invoices, the claimed value of some items could not be verified.

Observations of the Supreme Court

The Supreme Court reviewed the claim and found that:

- “Once the insurance company itself changed its policy from ‘as per list policies’ to ‘policies for consolidated amounts,’ then an insured is not expected to give item-wise details along with valuation.”

- “If the insurer desires item-wise valuation, it is their duty to inform the insured at the time of issuing or renewing the policy.”

- “The insured is entitled to full coverage up to the insured amount when all items in a category are lost, rather than applying under-insurance calculations.”

- “Rejecting claims solely due to the absence of purchase invoices is unreasonable, as many household items are acquired over time and may not have bills.”

Final Verdict

The Supreme Court enhanced the compensation, directing the insurer to pay:

- Rs. 1,00,500 for stolen jewelry and valuables, as they were covered under the insured amount.

- Rs. 66,000 for stolen electrical and mechanical appliances.

- Rs. 28,000 for miscellaneous items, including Rs. 20,000 for stolen watches.

- Rs. 7,000 for repairing locks, doors, and other damages due to burglary.

- Rs. 25,000 as compensation for litigation expenses.

- Interest at 12% per annum on the awarded amounts from January 1, 2009, until the date of payment.

Conclusion

This ruling clarifies the obligations of insurers under household insurance policies and protects consumers from unfair rejections of claims. The judgment reinforces the principle that insurers cannot impose arbitrary conditions post-policy issuance and must honor coverage as per the policy terms.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: I.C. Sharma vs The Oriental Insuran Supreme Court of India Judgment Dated 10-01-2018.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Insurance Settlements

See all petitions in Other Insurance Cases

See all petitions in Judgment by Madan B. Lokur

See all petitions in Judgment by Deepak Gupta

See all petitions in partially allowed

See all petitions in Modified

See all petitions in supreme court of India judgments January 2018

See all petitions in 2018 judgments

See all posts in Insurance Cases Category

See all allowed petitions in Insurance Cases Category

See all Dismissed petitions in Insurance Cases Category

See all partially allowed petitions in Insurance Cases Category