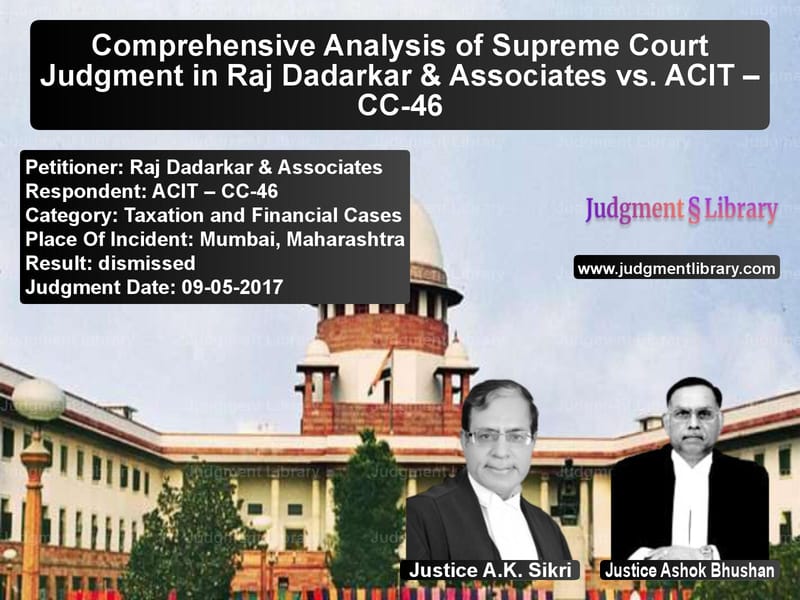

Comprehensive Analysis of Supreme Court Judgment in Raj Dadarkar & Associates vs. ACIT – CC-46

The Supreme Court of India’s ruling in Raj Dadarkar & Associates vs. ACIT – CC-46, delivered on May 9, 2017, stands as a landmark decision in the realm of tax law. This case provides significant legal clarity on the classification of income generated from properties used for commercial purposes under the Income Tax Act, 1961. Justices A.K. Sikri and Ashok Bhushan meticulously examined the nature of property income and the criteria that determine whether it falls under ‘Income from House Property’ or ‘Profits and Gains from Business or Profession.’

Introduction

The case revolves around Raj Dadarkar & Associates, a real estate development firm that transformed a property into a shopping center. The firm initially declared income from this property as ‘Profits and Gains from Business or Profession’ (business income), arguing that their active management and commercial exploitation of the property qualified the earnings as business income. However, the Income Tax Department reclassified this income under ‘Income from House Property,’ significantly affecting the firm’s tax liabilities. The primary contention was whether the firm, as a ‘deemed owner’ under the Income Tax Act, should have its income classified as property income despite its commercial activities.

Legal Issues at Stake

The Supreme Court had to address several pivotal issues:

- Whether Raj Dadarkar & Associates could be classified as a ‘deemed owner’ of the property under Sections 22 and 27 of the Income Tax Act.

- Whether the income from the property, which was primarily used for commercial activities, should be categorized as ‘Income from House Property’ or ‘Profits and Gains from Business or Profession.’

- The broader implications of this classification on tax liabilities and financial planning for businesses engaged in real estate development and leasing.

Arguments and Judicial Proceedings

Arguments by Raj Dadarkar & Associates

The petitioners contended that their primary business activity was leasing and managing the shopping center, which involved substantial operational involvement. They argued that their income should not be viewed as passive rental income but rather as business income, given the level of managerial effort and resources invested in maintaining the commercial nature of the premises.

Arguments by the Income Tax Department

The Income Tax Department, on the other hand, asserted that the firm’s control over the property and the terms of the lease agreements meant that it should be classified as a ‘deemed owner.’ Under the provisions of the Income Tax Act, such deemed ownership results in income being treated as ‘Income from House Property,’ irrespective of the commercial activities conducted on the premises.

Judicial Analysis and Decision

The Supreme Court analyzed the statutory provisions of the Income Tax Act, particularly focusing on:

- Section 22, which outlines the taxation of income from house property.

- Section 27, which defines the concept of ‘deemed ownership.’

The Court concluded that, despite the commercial nature of the shopping center, the firm’s status as a ‘deemed owner’ necessitated the classification of its income as ‘Income from House Property.’ The judgment emphasized that the nature of ownership and control plays a crucial role in determining the appropriate tax treatment of income, reinforcing the statutory framework governing property taxation.

Implications of the Judgment

The ruling in this case has far-reaching consequences for property owners, real estate developers, and business entities involved in leasing and managing commercial spaces. Some key implications include:

- Clarification on Deemed Ownership: This ruling sets a clear precedent on when an entity can be classified as a ‘deemed owner’ under tax laws.

- Tax Planning Considerations: Businesses involved in commercial real estate must carefully structure their property holdings and leases to optimize tax liabilities.

- Impact on Future Legal Disputes: The judgment will serve as a reference point for future cases concerning the classification of property income.

Conclusion

The Supreme Court’s decision in Raj Dadarkar & Associates vs. ACIT – CC-46 is a landmark ruling in the domain of tax law, providing essential clarity on the classification of income from commercial properties. By affirming the classification of such income under ‘Income from House Property,’ the Court has reinforced the statutory definitions and legal interpretations that govern property taxation in India. This judgment will continue to influence how businesses approach real estate investment, leasing, and tax planning for years to come.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Raj Dadarkar & Assoc vs ACIT – CC-46 Supreme Court of India Judgment Dated 09-05-2017.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Income Tax Disputes

See all petitions in Corporate Compliance

See all petitions in GST Law

See all petitions in Banking Regulations

See all petitions in Tax Refund Disputes

See all petitions in Judgment by A.K. Sikri

See all petitions in Judgment by Ashok Bhushan

See all petitions in dismissed

See all petitions in supreme court of India judgments May 2017

See all petitions in 2017 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category