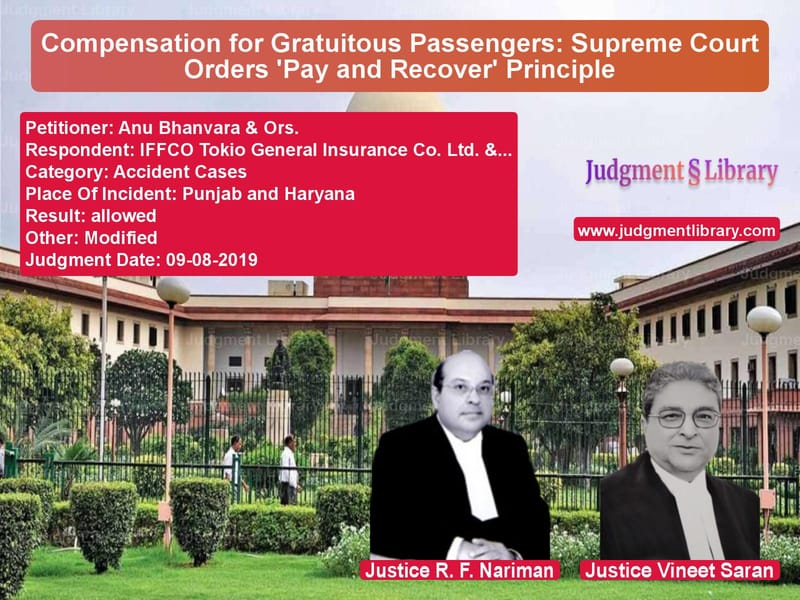

Compensation for Gratuitous Passengers: Supreme Court Orders ‘Pay and Recover’ Principle

The case of Anu Bhanvara & Ors. v. IFFCO Tokio General Insurance Co. Ltd. & Ors. pertains to a significant legal issue in motor accident compensation claims. The Supreme Court was called upon to decide whether an insurance company should be liable to pay compensation to gratuitous passengers in a goods vehicle and whether the principle of ‘pay and recover’ should be applied.

Background of the Case

The appellants, Anu Bhanvara and Rohit Kumar, were traveling in a jeep (which was registered as a goods vehicle) when it met with an accident. Both sustained serious injuries, leading to permanent disability. The Motor Accidents Claims Tribunal (MACT) initially dismissed the claim, stating that the negligence of the driver was not proven. However, the Punjab and Haryana High Court overturned this decision, holding that the accident was caused due to the composite negligence of the driver of the jeep and another vehicle. The High Court also ruled that since the appellants were gratuitous passengers in a goods vehicle, the insurance company was not liable to compensate them.

Key Issues Before the Supreme Court

- Whether the compensation awarded by the High Court was adequate.

- Whether the insurance company could be held liable to pay the compensation despite the appellants being gratuitous passengers.

- Whether the ‘pay and recover’ principle should be applied.

Arguments of the Parties

Appellants (Injured Passengers):

- The compensation awarded was inadequate given the extent of permanent disability suffered.

- Since the vehicle was insured, the insurance company should be directed to pay the compensation.

- As per previous Supreme Court rulings, the ‘pay and recover’ principle should be applied, ensuring that the victims receive compensation first, and the insurance company may later recover the amount from the vehicle owner.

Respondents (Insurance Company & Vehicle Owner):

- The insurance policy did not cover gratuitous passengers in a goods vehicle.

- The High Court correctly held that the insurance company was not liable to compensate the claimants.

- The ‘pay and recover’ principle should not be applied in this case.

Supreme Court’s Observations

The Supreme Court reviewed previous judgments on similar matters and noted:

“The claimants in the present case are young children who have suffered permanent disability on account of the injuries sustained in the accident. Thus, keeping in view the peculiar facts and circumstances of this case, we are of the considered view that the principle of ‘pay and recover’ should be directed to be invoked in the present case.”

The Court further stated:

“The insurance of the vehicle, though as a goods vehicle, is not disputed by the parties. Hence, in such circumstances, it would be just and proper to direct the insurer to first compensate the claimants and then recover the amount from the vehicle owner.”

Final Judgment

The Supreme Court modified the High Court’s decision and ruled:

“The respondent No.1 – insurance company shall be liable to pay the awarded compensation to the claimants in both appeals. However, respondent No.1 – insurance company shall have the right to realize the said amount of compensation from the respondents No.2 and 3 (driver and owner of the vehicle) in accordance with law.”

Key Takeaways from the Judgment

- The Supreme Court reaffirmed the principle of ‘pay and recover’ in motor accident cases involving gratuitous passengers in a goods vehicle.

- The insurer must first pay compensation to the injured victims, ensuring timely relief.

- The insurer retains the right to recover the compensated amount from the vehicle owner and driver.

Implications of the Judgment

This ruling has significant implications for motor accident compensation claims in India. It ensures that victims receive compensation without prolonged delays while maintaining the insurer’s right to recover the amount from the actual liable party. The decision reinforces the humanitarian approach of the court in cases involving vulnerable victims, especially minors who have suffered permanent disability.

Conclusion

The Supreme Court’s decision in this case aligns with previous rulings favoring the ‘pay and recover’ principle, ensuring that accident victims are not left without recourse due to technical exclusions in insurance policies. This judgment serves as a critical precedent for future cases involving insurance liability for gratuitous passengers in goods vehicles.

Petitioner Name: Anu Bhanvara & Ors..Respondent Name: IFFCO Tokio General Insurance Co. Ltd. & Ors..Judgment By: Justice R. F. Nariman, Justice Vineet Saran.Place Of Incident: Punjab and Haryana.Judgment Date: 09-08-2019.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Anu Bhanvara & Ors. vs IFFCO Tokio General Supreme Court of India Judgment Dated 09-08-2019.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Compensation Disputes

See all petitions in Motor Vehicle Act

See all petitions in Negligence Claims

See all petitions in Judgment by Rohinton Fali Nariman

See all petitions in Judgment by Vineet Saran

See all petitions in allowed

See all petitions in Modified

See all petitions in supreme court of India judgments August 2019

See all petitions in 2019 judgments

See all posts in Accident Cases Category

See all allowed petitions in Accident Cases Category

See all Dismissed petitions in Accident Cases Category

See all partially allowed petitions in Accident Cases Category