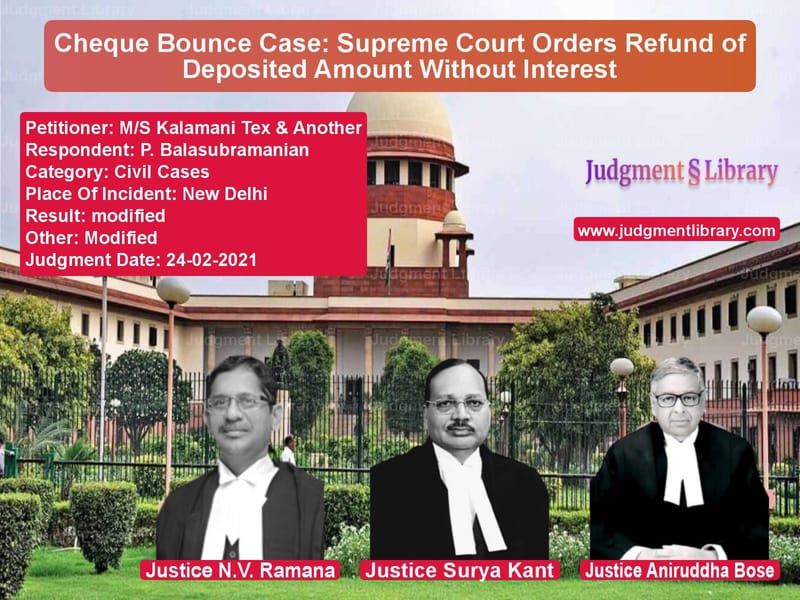

Cheque Bounce Case: Supreme Court Orders Refund of Deposited Amount Without Interest

The Supreme Court of India recently ruled in the case of M/S Kalamani Tex & Another vs. P. Balasubramanian, clarifying the legal position regarding the refund of deposited amounts in cheque bounce cases. The Court modified its earlier judgment by deleting the requirement to pay interest on the refunded amount, thus affirming a strict interpretation of financial liabilities in such disputes.

Background of the Case

The dispute originated from a cheque bounce case filed under Section 138 of the Negotiable Instruments Act, 1881. The appellant, M/S Kalamani Tex, had issued a cheque to the respondent, P. Balasubramanian, which was dishonored due to insufficient funds.

The key facts of the case are:

- The respondent initiated legal proceedings after the cheque issued by the appellant was dishonored.

- The trial court convicted the appellant under Section 138 of the Negotiable Instruments Act and imposed a monetary penalty.

- The appellant challenged the conviction in the Supreme Court, which ruled on February 10, 2021, directing the Registry to transfer ₹11,20,000 along with accrued interest to the respondent within two weeks.

- Subsequently, it was found that the amount was lying in a non-interest earning account.

Petitioner’s (M/S Kalamani Tex) Arguments

The appellants filed a Miscellaneous Application (M.A. No. 364 of 2021) seeking modification of the Supreme Court’s order, contending:

- The amount deposited with the UCO Bank, Supreme Court Compound, New Delhi, was in a non-interest-bearing account.

- The order directing the payment of interest should be modified since no interest had accrued on the deposited amount.

- It would be unfair to impose an additional financial liability on the appellants due to a procedural issue.

Respondent’s (P. Balasubramanian) Arguments

The respondent countered:

- The appellants had delayed the payment, causing financial distress.

- The Supreme Court’s original order should be upheld to ensure fair compensation.

- The appellants should not be relieved of their liability based on technicalities.

Supreme Court’s Observations

The Supreme Court, comprising Justices N.V. Ramana, Surya Kant, and Aniruddha Bose, made the following key observations:

- The Court acknowledged that the amount had been lying in a non-interest-bearing account.

- It was unjust to direct payment of interest when no interest had accrued.

- “We delete the words ‘……along with interest accrued thereupon……’ from paragraph 22 of the judgment dated 10.02.2021.”

- The primary objective of Section 138 is to ensure compensation for dishonored cheques, but such liability should not be extended beyond the actual financial obligations.

The Court emphasized:

“Since the amount was deposited in a non-interest-bearing account, it would be unfair to impose an additional interest burden on the appellants.”

Final Judgment

The Supreme Court ruled:

- The previous order was modified to delete the interest payment clause.

- The Registry was directed to transfer ₹11,20,000 to the respondent within two weeks from the order date.

- The miscellaneous application (M.A. No. 364 of 2021) was disposed of accordingly.

Impact of the Judgment

This ruling has significant implications for cheque bounce cases:

- Clarification on Interest Obligations: The judgment sets a precedent that interest cannot be imposed on deposited amounts if they were placed in non-interest-bearing accounts.

- Fair Liability Assessment: The ruling ensures that financial penalties in cheque bounce cases remain proportionate and justifiable.

- Guidance for Future Cases: The decision clarifies how courts should handle financial compensation in cases under the Negotiable Instruments Act.

- Ensuring Procedural Fairness: The Court upheld the principle that no party should bear financial burdens beyond what is legally justifiable.

Conclusion

The Supreme Court’s ruling in M/S Kalamani Tex & Another vs. P. Balasubramanian reaffirms the importance of fairness in financial disputes. By modifying its previous order and ensuring that no undue burden was placed on the appellants, the Court has provided clarity on interest obligations in cheque bounce cases.

This judgment sets an important precedent, ensuring that judicial directives are aligned with financial realities while upholding the intent of the Negotiable Instruments Act.

Petitioner Name: M/S Kalamani Tex & Another.Respondent Name: P. Balasubramanian.Judgment By: Justice N.V. Ramana, Justice Surya Kant, Justice Aniruddha Bose.Place Of Incident: New Delhi.Judgment Date: 24-02-2021.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: ms-kalamani-tex-&-a-vs-p.-balasubramanian-supreme-court-of-india-judgment-dated-24-02-2021.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Cheque Dishonour Cases

See all petitions in Contract Disputes

See all petitions in Dispute Resolution Mechanisms

See all petitions in Judgment by N.V. Ramana

See all petitions in Judgment by Surya Kant

See all petitions in Judgment by Aniruddha Bose

See all petitions in Modified

See all petitions in Modified

See all petitions in supreme court of India judgments February 2021

See all petitions in 2021 judgments

See all posts in Civil Cases Category

See all allowed petitions in Civil Cases Category

See all Dismissed petitions in Civil Cases Category

See all partially allowed petitions in Civil Cases Category