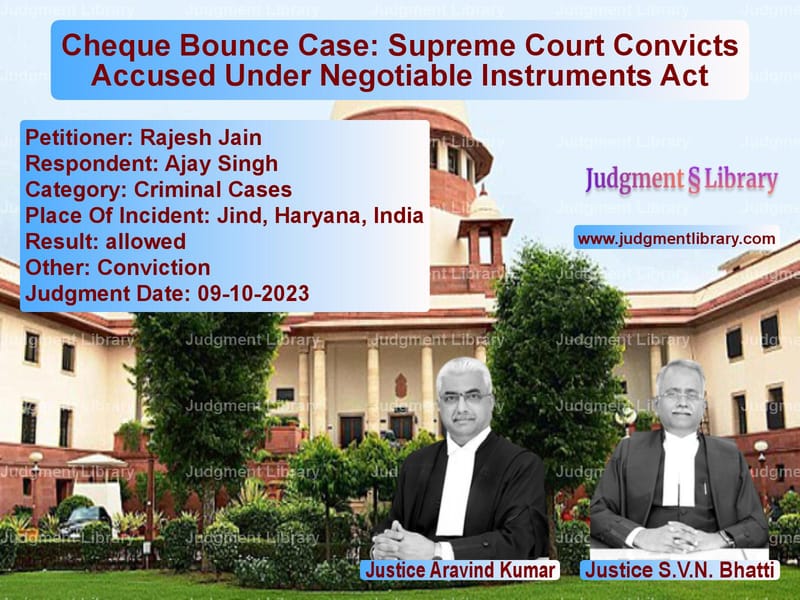

Cheque Bounce Case: Supreme Court Convicts Accused Under Negotiable Instruments Act

The Supreme Court of India recently delivered a landmark judgment in Rajesh Jain v. Ajay Singh, ruling on a cheque bounce case under Section 138 of the Negotiable Instruments Act, 1881 (NI Act). The judgment focused on the validity of a dishonored cheque, the presumption in favor of the complainant, and the accused’s failure to discharge the evidential burden.

Background of the Case

The case revolved around a financial transaction between the appellant, Rajesh Jain, and the respondent, Ajay Singh. The respondent, along with his wife, allegedly borrowed money from the appellant on March 1, 2014. The complainant claimed he had lent Rs. 6,00,000 in good faith, believing the respondent would honor his promise to repay the loan along with interest.

Despite multiple assurances, the respondent failed to repay the amount. He allegedly changed his phone number and evaded contact. In 2017, the complainant managed to trace the respondent, who promised to clear his dues by selling land in Nepal and receiving arrears from the 7th Pay Commission.

As a partial repayment, the respondent issued a post-dated cheque for Rs. 6,95,204 (Cheque No. 163044, dated October 19, 2017). However, the cheque was dishonored due to ‘insufficient funds.’ The complainant sent a legal notice on October 26, 2017, demanding repayment, but the respondent failed to comply. Consequently, the complainant filed a case under Section 138 of the NI Act.

Trial Court Proceedings

- The complainant presented evidence, including the dishonored cheque, bank return memo, legal notice, and postal receipts.

- The accused admitted borrowing Rs. 20,00,000 but claimed he had already repaid part of the amount.

- The accused denied issuing the cheque and alleged that the complainant was demanding an inflated amount.

- The Trial Court acquitted the accused, citing inconsistencies in the complainant’s evidence.

The acquittal was based on the following grounds:

- The legal notice was unsigned.

- The complainant failed to specify the dates and amounts of loans disbursed.

- The complainant was engaged in money lending without a valid license under the Punjab Registration of Money Lenders Act, 1938.

- The legal notice was issued before the cheque return memo, rendering it premature.

- The complainant failed to justify how the loaned amount increased to Rs. 6,95,204.

High Court Proceedings

- The complainant appealed the acquittal before the Punjab and Haryana High Court.

- The High Court upheld the Trial Court’s findings, stating that the accused had successfully rebutted the presumption under Section 139 of the NI Act.

- The complainant failed to prove that the cheque was issued for a legally enforceable debt.

Supreme Court’s Observations

The Supreme Court analyzed whether the presumption under Section 139 of the NI Act had been rebutted by the accused. It referred to key principles from previous judgments, including:

- Rangappa v. Mohan (2010) – Stated that once a cheque is issued, it is presumed to be for a legally enforceable debt unless rebutted.

- Bharat Barrel v. Amin Chand (1999) – Held that the accused must prove the non-existence of liability by a preponderance of probabilities.

- Basalingappa v. Mudibasappa (2019) – Clarified that rebuttal evidence can include cross-examination and inconsistencies in the complainant’s case.

The Supreme Court found that:

- The accused admitted borrowing money and making partial payments, which reinforced the complainant’s claim.

- The accused’s defense was inconsistent. He initially denied any dealings but later admitted borrowing Rs. 20,00,000.

- The claim that the cheque was misused by the complainant was unsubstantiated and lacked corroborative evidence.

- The Trial Court misapplied the burden of proof, shifting it entirely onto the complainant instead of requiring the accused to rebut the presumption.

The Court criticized the approach of the lower courts:

“Once the presumption under Section 139 was given effect to, the Courts ought to have proceeded on the premise that the cheque was issued in discharge of a debt/liability. The entire focus should have shifted to the accused’s case, since the activation of the presumption shifts the evidential burden.”

Final Judgment

The Supreme Court allowed the appeal, set aside the High Court’s judgment, and convicted the respondent under Section 138 of the NI Act. The Court imposed the following sentence:

- The accused must pay a fine of Rs. 13,90,408 (twice the cheque amount).

- In case of default, the accused will undergo simple imprisonment for one year.

Implications of the Judgment

The ruling reinforces the importance of honoring financial commitments and ensures that cheque dishonor cases are decided in a fair manner. Key takeaways include:

- Presumption under Section 139 is strong – Accused must provide compelling evidence to rebut it.

- Failure to prove misuse of cheque weakens defense – Mere allegations without supporting evidence will not suffice.

- Legal notices must be properly issued – Courts will scrutinize procedural lapses but will not entertain frivolous defenses.

- Consistency in defense matters – Accused cannot make contradictory claims during trial.

The Supreme Court’s decision sets a precedent for cheque bounce cases, ensuring that defaulters cannot evade liability through technicalities and inconsistent defenses.

Petitioner Name: Rajesh Jain.Respondent Name: Ajay Singh.Judgment By: Justice Aravind Kumar, Justice S.V.N. Bhatti.Place Of Incident: Jind, Haryana, India.Judgment Date: 09-10-2023.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: rajesh-jain-vs-ajay-singh-supreme-court-of-india-judgment-dated-09-10-2023.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Fraud and Forgery

See all petitions in Cheque Dishonour Cases

See all petitions in Judgment by Aravind Kumar

See all petitions in Judgment by S.V.N. Bhatti

See all petitions in allowed

See all petitions in Conviction

See all petitions in supreme court of India judgments October 2023

See all petitions in 2023 judgments

See all posts in Criminal Cases Category

See all allowed petitions in Criminal Cases Category

See all Dismissed petitions in Criminal Cases Category

See all partially allowed petitions in Criminal Cases Category