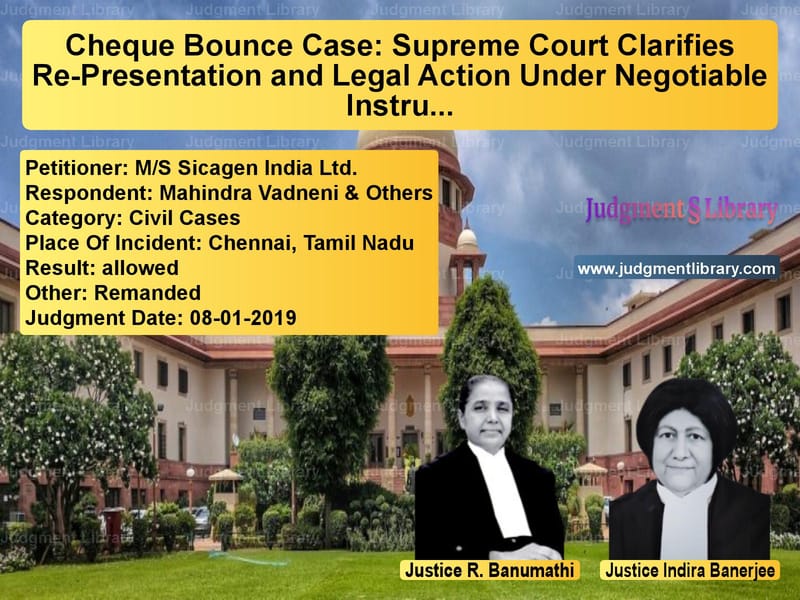

Cheque Bounce Case: Supreme Court Clarifies Re-Presentation and Legal Action Under Negotiable Instruments Act

The case of M/S. Sicagen India Ltd. vs. Mahindra Vadneni & Others involved a crucial issue regarding the re-presentation of a dishonored cheque and whether a second statutory notice under Section 138 of the Negotiable Instruments Act, 1881, can form the basis of a criminal complaint. The Supreme Court’s decision in this case is significant as it clarifies the rights of a cheque holder and the permissible course of action when a cheque is dishonored multiple times.

Background of the Case

M/S Sicagen India Ltd., the appellant in this case, was involved in business transactions with the respondents. In the course of business dealings, the respondents issued three cheques:

- Cheque No. 316693 dated 20.07.2009 for Rs. 1,44,362/-

- Cheque No. 316663 dated 30.07.2009 for Rs. 4,26,400/-

- Cheque No. 316692 dated 10.08.2009 for Rs. 4,48,656/-

These cheques were presented for collection but were dishonored and returned with the endorsement “insufficient funds.” Following this, the appellant issued a statutory notice on 31.08.2009 demanding payment. However, the cheques were re-presented, and once again, they were dishonored for the same reason. The appellant then issued a second statutory notice on 25.01.2010 and, upon non-payment, filed a complaint under Section 138 of the Negotiable Instruments Act.

Petitioner’s Arguments (M/S Sicagen India Ltd.)

- The appellant argued that there is no restriction in law against re-presenting a cheque and initiating prosecution based on a subsequent dishonor.

- The complaint was based on a valid statutory notice issued after the second dishonor of the cheque, making the action legally sustainable.

- The purpose of Section 138 is to ensure that cheques are honored and that a defaulting drawer cannot escape liability merely because the payee attempted to give him a second chance.

Respondent’s Arguments (Mahindra Vadneni & Others)

- The respondents contended that the complaint was not maintainable since it was not filed based on the first statutory notice dated 31.08.2009.

- Once a statutory notice is issued, the complainant cannot issue a second notice and initiate prosecution afresh.

- The High Court had correctly held that the complaint filed on the basis of the second statutory notice was not valid.

Supreme Court’s Judgment

The Supreme Court, in a judgment delivered by Justices R. Banumathi and Indira Banerjee, reversed the decision of the High Court and upheld the validity of the complaint filed based on the second statutory notice. The key findings were:

- Legality of Second Presentation: The Court reaffirmed that there is no bar on re-presenting a dishonored cheque within the validity period (six months from the date of issue or the validity of the cheque, whichever is earlier).

- Validity of Second Statutory Notice: The Court relied on the precedent set in MSR Leathers vs. S. Palaniappan & Another, which held that a payee can present a cheque multiple times and initiate prosecution based on the last dishonor.

- Purpose of Section 138: The Court emphasized that the objective of Section 138 is to ensure that cheques are honored. Allowing prosecution based on the latest dishonor aligns with the legislative intent.

Observations from the Judgment

The Court stated:

“Applying the ratio of MSR Leathers, the complaint filed based on the second statutory notice is not barred, and the High Court ought not to have quashed the criminal complaint.”

It further clarified:

“There is nothing in the provisions of Section 138 of the Act that forbids the holder of the cheque from making successive presentations and instituting criminal proceedings based on the subsequent dishonor.”

Impact of the Judgment

This ruling has significant implications for negotiable instruments law:

- It confirms that a cheque holder can re-present a dishonored cheque and issue a fresh statutory notice.

- It prevents drawers from escaping liability by exploiting technicalities in the law.

- It ensures that cheque transactions retain their credibility in commercial dealings.

Conclusion

The Supreme Court’s judgment in this case reaffirms the principle that cheque bounce cases should be interpreted in a manner that upholds the integrity of financial transactions. The ruling clarifies that prosecution can be based on a subsequent dishonor, ensuring that defaulters do not escape liability due to procedural technicalities.

Petitioner Name: M/S Sicagen India Ltd..Respondent Name: Mahindra Vadneni & Others.Judgment By: Justice R. Banumathi, Justice Indira Banerjee.Place Of Incident: Chennai, Tamil Nadu.Judgment Date: 08-01-2019.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: MS Sicagen India Lt vs Mahindra Vadneni & O Supreme Court of India Judgment Dated 08-01-2019.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Cheque Dishonour Cases

See all petitions in Contract Disputes

See all petitions in Debt Recovery

See all petitions in Judgment by R. Banumathi

See all petitions in Judgment by Indira Banerjee

See all petitions in allowed

See all petitions in Remanded

See all petitions in supreme court of India judgments January 2019

See all petitions in 2019 judgments

See all posts in Civil Cases Category

See all allowed petitions in Civil Cases Category

See all Dismissed petitions in Civil Cases Category

See all partially allowed petitions in Civil Cases Category