Cheque Bounce Case: Supreme Court Acquits Accused in Section 138 Negotiable Instruments Act Case

In a significant ruling, the Supreme Court of India addressed a cheque bounce case under Section 138 of the Negotiable Instruments Act, 1881. The case, Basalingappa vs. Mudibasappa, revolved around whether the accused had successfully rebutted the presumption of debt, leading to his acquittal by the trial court. However, the Karnataka High Court had overturned this acquittal and convicted the accused, prompting an appeal before the Supreme Court.

The apex court ultimately ruled in favor of the accused, setting aside the High Court’s conviction and restoring the trial court’s judgment of acquittal. The ruling reaffirms that while there is a presumption under Section 139 of the Act in favor of the holder of a cheque, the accused can rebut this presumption by raising a probable defense, shifting the burden back to the complainant.

Background of the Case

The case originated from a cheque issued by the accused, Basalingappa, to the complainant, Mudibasappa, which was dishonored due to insufficient funds. The complainant initiated legal proceedings under Section 138 of the Negotiable Instruments Act, claiming that the cheque was issued to discharge a debt.

Key developments in the case:

- On February 27, 2012, the accused issued a cheque of Rs. 6,00,000 in favor of the complainant.

- The cheque was presented for clearance on March 1, 2012, but was returned due to insufficient funds.

- The complainant sent a legal notice on March 12, 2012, demanding payment.

- After non-payment, a complaint was filed on April 25, 2012 under Section 138.

- The trial court acquitted the accused, finding that he had successfully rebutted the presumption of debt.

- The Karnataka High Court overturned the acquittal and convicted the accused.

- The accused appealed to the Supreme Court.

Arguments by the Appellant (Basalingappa)

The accused presented the following arguments:

- The cheque was not issued to discharge any legally enforceable debt.

- There was no documentary evidence proving that the complainant had the financial capacity to lend Rs. 6,00,000.

- The complainant had initiated multiple cases under Section 138 against different individuals, indicating a pattern of misusing cheques.

- There were inconsistencies in the complainant’s testimony regarding when and how the loan was advanced.

- The presumption under Section 139 of the Act was successfully rebutted, and the High Court erred in convicting him.

Arguments by the Respondent (Mudibasappa)

The complainant countered with the following arguments:

- The accused admitted his signature on the cheque, establishing a prima facie case under Section 138.

- Under Section 139, there is a presumption that the cheque was issued to discharge a legally enforceable debt.

- The accused failed to provide direct evidence proving that the cheque was issued for a different purpose.

- The High Court rightly held that the trial court’s findings were perverse and unjustified.

Supreme Court’s Observations and Ruling

The Supreme Court examined the relevant provisions of the Negotiable Instruments Act and reaffirmed key legal principles:

“Once the execution of a cheque is admitted, a presumption shall be raised under Section 139 that the cheque was issued in discharge of a debt or liability.”

However, the Court clarified that this presumption is rebuttable:

“The accused is not required to prove his defense beyond a reasonable doubt. He only needs to establish a probable defense, shifting the burden back to the complainant.”

The Court also noted inconsistencies in the complainant’s testimony, particularly regarding the date and manner in which the loan was given:

“When the accused questioned the complainant’s financial capacity to lend Rs. 6,00,000, no documentary evidence was provided to support his claim.”

The Court criticized the High Court for reversing the trial court’s acquittal without properly considering the defense evidence:

“The High Court was unduly influenced by the fact that the accused did not reply to the legal notice. The failure to reply does not automatically lead to a conviction under Section 138.”

Final Ruling

The Supreme Court set aside the High Court’s judgment and restored the trial court’s acquittal:

- The accused was acquitted of charges under Section 138 of the Negotiable Instruments Act.

- The Court reiterated that an accused can rebut the presumption of debt by raising a probable defense.

- The complainant’s failure to prove financial capacity cast serious doubts on the legitimacy of the alleged loan.

Implications of the Judgment

The Supreme Court’s ruling has significant implications for cheque bounce cases:

- Reaffirming the rebuttable nature of Section 139: This case sets a precedent that while presumption exists, it can be rebutted by raising a probable defense.

- Burden of proof in Section 138 cases: The ruling clarifies that the burden shifts back to the complainant once the accused raises a plausible defense.

- Necessity of proving financial capacity: Complainants must provide credible evidence of their ability to lend money in large amounts.

- High Court’s role in acquittals: The ruling emphasizes that High Courts should not overturn acquittals unless the trial court’s findings are perverse.

This judgment serves as a crucial guideline for lower courts handling cheque bounce cases and reinforces the principle that the presumption of debt is not absolute but subject to rebuttal.

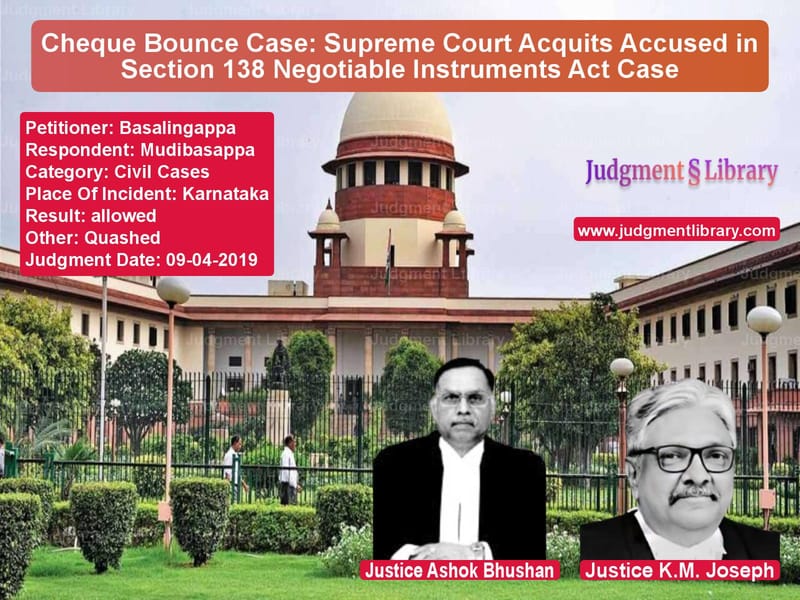

Petitioner Name: Basalingappa.Respondent Name: Mudibasappa.Judgment By: Justice Ashok Bhushan, Justice K.M. Joseph.Place Of Incident: Karnataka.Judgment Date: 09-04-2019.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Basalingappa vs Mudibasappa Supreme Court of India Judgment Dated 09-04-2019.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Cheque Dishonour Cases

See all petitions in Debt Recovery

See all petitions in Judgment by Ashok Bhushan

See all petitions in Judgment by K.M. Joseph

See all petitions in allowed

See all petitions in Quashed

See all petitions in supreme court of India judgments April 2019

See all petitions in 2019 judgments

See all posts in Civil Cases Category

See all allowed petitions in Civil Cases Category

See all Dismissed petitions in Civil Cases Category

See all partially allowed petitions in Civil Cases Category