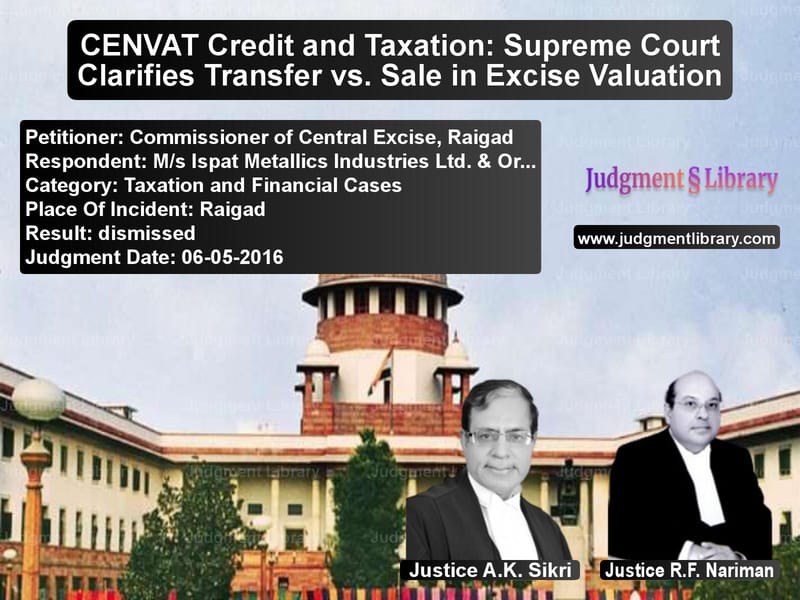

CENVAT Credit and Taxation: Supreme Court Clarifies Transfer vs. Sale in Excise Valuation

The case of Commissioner of Central Excise, Raigad vs. M/s Ispat Metallics Industries Ltd. & Ors. deals with an important issue concerning the Central Value Added Tax (CENVAT) credit system and the distinction between transfer and sale for excise duty valuation. The Supreme Court of India examined whether iron ore pellets moved between sister companies should be treated as a taxable sale or a non-taxable transfer.

Background of the Case

The appellant, Commissioner of Central Excise, challenged a ruling by the Customs, Excise, and Service Tax Appellate Tribunal (CESTAT), which had overturned the demand of excise duty, penalty, and interest against Ispat Industries Limited (IIL). IIL had procured iron ore pellets and claimed CENVAT credit but later transferred some of these raw materials to its sister concern, Ispat Metallics Industries Ltd. (IMIL). The Excise Department argued that this constituted a sale and that additional excise duty was payable.

Arguments Presented

Petitioner’s Argument: The Excise Department contended that the transaction between IIL and IMIL was a sale, making additional duty payable. They also argued that debit notes raised for costs such as bank charges and interest should be included in the valuation for excise purposes.

Respondent’s Argument: IIL maintained that the transfer was part of a joint procurement policy between the two companies, meaning no sale had occurred. They relied on a circular issued by the Central Board of Excise and Customs (CBEC) in 2002, which provided guidance on determining the assessable value when no sale was involved.

Judgment Analysis

The Supreme Court upheld the decision of CESTAT, ruling that:

- The movement of iron ore pellets between IIL and IMIL was a transfer rather than a sale, making additional excise duty inapplicable.

- The relevant excise duty valuation rule required that in cases of transfers, the value should be taken from the original invoice of the supplier.

- Post-manufacturing expenses like bank charges and interest could not be included in excise valuation, as excise duty applies only to goods, not financial costs.

Final Verdict

The Supreme Court dismissed the appeals, confirming that no additional excise duty was due on the transfers and that debit notes for bank charges and interest should not be included in the excise valuation.

Key Takeaways

- CENVAT credit rules distinguish between sale and transfer, affecting excise duty liability.

- When raw materials are moved between sister companies without a sale, the supplier’s invoice value is used for duty assessment.

- Post-manufacturing financial costs are not subject to excise duty.

- The ruling reinforces that tax authorities must adhere to established valuation guidelines and circulars issued by the CBEC.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Commissioner of Cent vs Ms Ispat Metallics Supreme Court of India Judgment Dated 06-05-2016-1741860703431.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Income Tax Disputes

See all petitions in Customs and Excise

See all petitions in Tax Evasion Cases

See all petitions in Judgment by A.K. Sikri

See all petitions in Judgment by Rohinton Fali Nariman

See all petitions in dismissed

See all petitions in supreme court of India judgments May 2016

See all petitions in 2016 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category