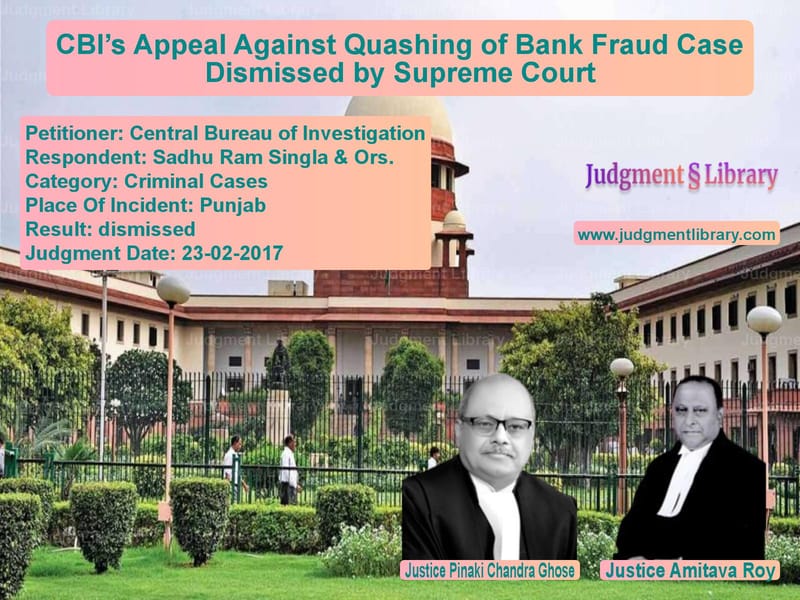

CBI’s Appeal Against Quashing of Bank Fraud Case Dismissed by Supreme Court

Introduction

The Supreme Court of India, in the case of Central Bureau of Investigation v. Sadhu Ram Singla & Ors., ruled on whether an FIR involving serious charges of fraud and forgery against bank officials and private individuals could be quashed based on a settlement between the parties. The Court upheld the decision of the Punjab and Haryana High Court, which had quashed the FIR and the subsequent criminal proceedings, citing the principles laid down in earlier cases regarding quashing of non-compoundable offenses.

This judgment is significant in clarifying the circumstances under which a High Court can quash criminal proceedings in financial fraud cases, even when the offense is non-compoundable.

Background of the Case

The case involved allegations of fraudulent credit limit enhancement and financial misrepresentation by the directors of M/s. Rom Industries Ltd. The key facts are as follows:

- M/s. Rom Industries Ltd., Bhatinda, availed credit facilities from a consortium of banks led by the State Bank of Patiala.

- In 1996, the company claimed to have suffered a loss of Rs. 38.08 crores due to the destruction of stocks in a cyclone at Bedi Port, Jamnagar.

- The State Bank of Patiala alleged that the company fraudulently obtained higher credit limits by submitting false stock statements.

- The Central Bureau of Investigation (CBI) registered FIR No. SIA-2001-E-0006 dated 28.12.2001, under Sections 420, 467, 468, and 471 of the Indian Penal Code (IPC).

- A charge-sheet was filed against the directors of the company, including Sadhu Ram Singla.

During the pendency of the proceedings, the company entered into a One Time Settlement with the bank and repaid Rs. 6 crores, following which the bank withdrew its recovery proceedings before the Debt Recovery Tribunal (DRT). The accused then approached the Punjab and Haryana High Court seeking quashing of the FIR and criminal proceedings.

Key Legal Issues Considered

The Supreme Court examined the following questions:

- Whether the High Court was justified in quashing the FIR and criminal proceedings based on a settlement in a case involving non-compoundable offenses.

- Whether financial fraud cases affecting public interest should be quashed merely because the affected bank settled the dues.

- The role of judicial discretion under Section 482 of the Criminal Procedure Code (CrPC) in quashing criminal proceedings.

Petitioner’s (CBI’s) Arguments

The CBI, represented by the Additional Solicitor General, argued:

- The charges involved serious economic offenses, including forgery and cheating, which are not compoundable under Section 320 of the CrPC.

- The settlement between the company and the bank did not absolve the accused from criminal liability.

- The High Court erred in quashing the FIR and criminal proceedings based on private settlement.

Respondent’s (Accused’s) Arguments

The respondents, represented by senior counsel, countered:

- The dispute was primarily financial and had been amicably settled.

- The bank, the primary aggrieved party, had withdrawn its claims.

- The High Court exercised its discretion appropriately under Section 482 of the CrPC.

Supreme Court’s Observations

The Supreme Court observed that while economic offenses generally have serious ramifications, courts must assess each case individually. The Court stated:

“While economic offenses affecting public interest require stringent treatment, cases where financial institutions have willingly settled disputes may be treated differently.”

It further noted:

“The High Court exercised its jurisdiction under Section 482 CrPC judiciously and within established legal principles.”

The Supreme Court referred to its earlier ruling in Gian Singh v. State of Punjab, which allowed quashing of criminal proceedings in certain non-compoundable cases if doing so would serve justice.

Final Judgment

The Supreme Court ruled:

- The appeal filed by the CBI was dismissed.

- The Punjab and Haryana High Court’s order quashing the FIR and criminal proceedings was upheld.

- The case did not warrant further criminal prosecution given the settlement and absence of overriding public interest concerns.

Significance of the Judgment

This ruling has important implications for financial fraud cases:

- It establishes that non-compoundable economic offenses may still be quashed if the dispute has been resolved amicably.

- It clarifies the discretion of High Courts under Section 482 CrPC.

- It prevents unnecessary prolongation of litigation where the primary aggrieved party has withdrawn claims.

Implications for Banking and Financial Disputes

The judgment provides clarity for financial institutions:

- Banks entering into settlements can influence the outcome of criminal proceedings.

- Economic offenses do not always require prosecution if the victim institution does not seek further action.

- The judiciary can assess the nature of fraud cases on a case-by-case basis.

Conclusion

The Supreme Court’s decision in CBI v. Sadhu Ram Singla & Ors. reinforces the judicial discretion in quashing criminal proceedings involving financial disputes. By upholding the High Court’s decision, the judgment ensures that unnecessary litigation does not burden the courts when disputes are amicably settled. The ruling sets a precedent for future cases involving bank fraud and economic offenses.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Central Bureau of In vs Sadhu Ram Singla & O Supreme Court of India Judgment Dated 23-02-2017.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Fraud and Forgery

See all petitions in Banking Regulations

See all petitions in Judgment by Pinaki Chandra Ghose

See all petitions in Judgment by Amitava Roy

See all petitions in dismissed

See all petitions in supreme court of India judgments February 2017

See all petitions in 2017 judgments

See all posts in Criminal Cases Category

See all allowed petitions in Criminal Cases Category

See all Dismissed petitions in Criminal Cases Category

See all partially allowed petitions in Criminal Cases Category