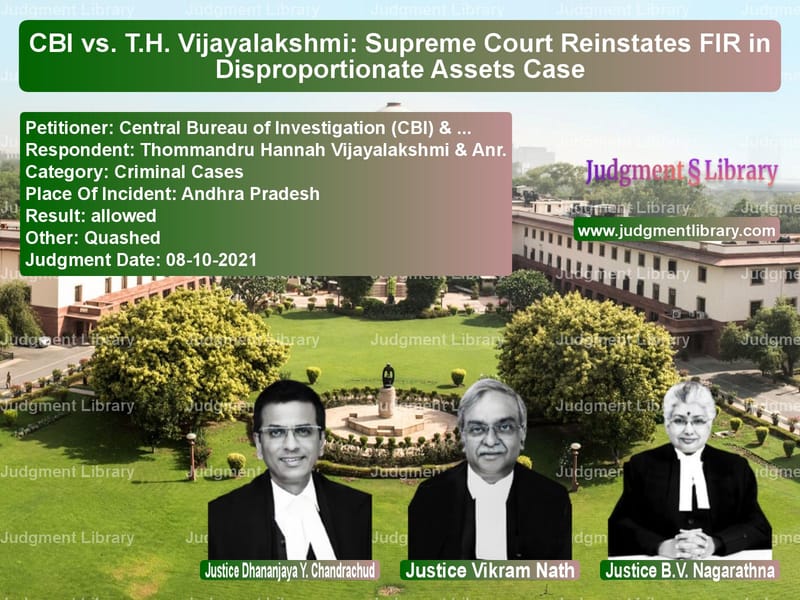

CBI vs. T.H. Vijayalakshmi: Supreme Court Reinstates FIR in Disproportionate Assets Case

The Supreme Court of India recently delivered a judgment in the case of Central Bureau of Investigation (CBI) & Anr. vs. Thommandru Hannah Vijayalakshmi & Anr., overturning the Telangana High Court’s decision to quash an FIR against the respondent. The case pertains to allegations of disproportionate assets against a high-ranking civil servant and her spouse, a minister in the Andhra Pradesh government.

Background of the Case

The case arose from an FIR registered by the CBI’s Anti-Corruption Branch, Chennai, on September 20, 2017, against the first respondent, an IRS officer serving as Commissioner of Income Tax (Audit-II), Tamil Nadu & Puducherry, and her spouse, an MLA and Minister in the Andhra Pradesh government. The allegations were that the respondent was in possession of disproportionate assets amounting to ₹1,10,81,692, which was 22.86% higher than her known sources of income during the check period from April 1, 2010, to February 29, 2016.

The Telangana High Court quashed the FIR, holding that the CBI should have conducted a preliminary inquiry before registering the case, as required by the CBI Manual and previous Supreme Court judgments. The High Court also found that the FIR’s calculations were inaccurate, leading to the conclusion that no disproportionate assets existed.

Petitioner’s Arguments (CBI)

The CBI challenged the Telangana High Court’s order, contending that:

- The High Court overstepped its jurisdiction by scrutinizing the FIR’s details and conducting a virtual trial.

- A preliminary inquiry is not mandatory before registering an FIR if the information prima facie discloses a cognizable offense.

- The respondents’ reliance on income tax returns and other financial documents does not conclusively prove that their assets were legally acquired.

- The High Court erred in substituting the FIR’s allegations with its own calculations and findings.

Respondent’s Arguments (Vijayalakshmi & Anr.)

The respondents defended the Telangana High Court’s judgment, arguing that:

- The CBI failed to conduct a preliminary inquiry before filing the FIR, violating established legal precedents.

- The allegations in the FIR were based on inaccurate calculations, which the High Court had correctly rectified.

- Their income and assets were duly reported in income tax filings, departmental disclosures, and election affidavits.

- The case was politically motivated, as the second respondent was a minister belonging to a rival political party.

Supreme Court’s Analysis

The Supreme Court, led by Dr. Dhananjaya Y. Chandrachud, Vikram Nath, and B.V. Nagarathna, examined two key issues:

1. Is a Preliminary Inquiry Mandatory Before Registering an FIR?

The Court ruled that a preliminary inquiry is not mandatory in cases of alleged corruption. Citing Lalita Kumari v. Govt. of UP, the Court reiterated that a preliminary inquiry may be conducted in certain cases, but its absence does not invalidate an FIR if the complaint prima facie discloses a cognizable offense.

The judgment stated:

“Since the institution of a Preliminary Enquiry in cases of corruption is not made mandatory before the registration of an FIR under the CrPC, PC Act, or even the CBI Manual, directing otherwise would amount to stepping into the legislative domain.”

2. Was the High Court Justified in Quashing the FIR?

The Supreme Court criticized the Telangana High Court for engaging in a fact-finding exercise at the FIR stage. It emphasized that a High Court should only determine whether an FIR prima facie discloses a cognizable offense and should not conduct a mini-trial.

Referring to the judgment in State of Haryana v. Bhajan Lal, the Court held:

“The High Court has overstepped its jurisdiction by virtually conducting a trial, scrutinizing evidence, and pronouncing a verdict on the FIR’s merits.”

Judgment and Conclusion

The Supreme Court allowed the CBI’s appeal and set aside the Telangana High Court’s order quashing the FIR. It directed the investigation to continue, assuring that the respondents would be given an opportunity to explain their sources of income before the investigation concludes.

The ruling underscores that:

- CBI does not require a preliminary inquiry before registering an FIR if the complaint discloses a cognizable offense.

- Courts must refrain from scrutinizing FIR details at the quashing stage and should not engage in fact-finding.

- Income tax returns and official disclosures do not automatically prove the legitimacy of assets in disproportionate assets cases.

The judgment reaffirms that anti-corruption investigations should not be hindered by procedural objections and that courts must adhere to established legal principles when deciding petitions to quash FIRs.

Judges: The judgment was delivered by Dr. Dhananjaya Y. Chandrachud, Vikram Nath, and B.V. Nagarathna.

Petition Result: Allowed

Petitioner Name: Central Bureau of Investigation (CBI) & Anr..Respondent Name: Thommandru Hannah Vijayalakshmi & Anr..Judgment By: Justice Dhananjaya Y. Chandrachud, Justice Vikram Nath, Justice B.V. Nagarathna.Place Of Incident: Andhra Pradesh.Judgment Date: 08-10-2021.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: central-bureau-of-in-vs-thommandru-hannah-vi-supreme-court-of-india-judgment-dated-08-10-2021.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Money Laundering Cases

See all petitions in Fraud and Forgery

See all petitions in Extortion and Blackmail

See all petitions in Judgment by Dhananjaya Y Chandrachud

See all petitions in Judgment by Vikram Nath

See all petitions in Judgment by B.V. Nagarathna

See all petitions in allowed

See all petitions in Quashed

See all petitions in supreme court of India judgments October 2021

See all petitions in 2021 judgments

See all posts in Criminal Cases Category

See all allowed petitions in Criminal Cases Category

See all Dismissed petitions in Criminal Cases Category

See all partially allowed petitions in Criminal Cases Category