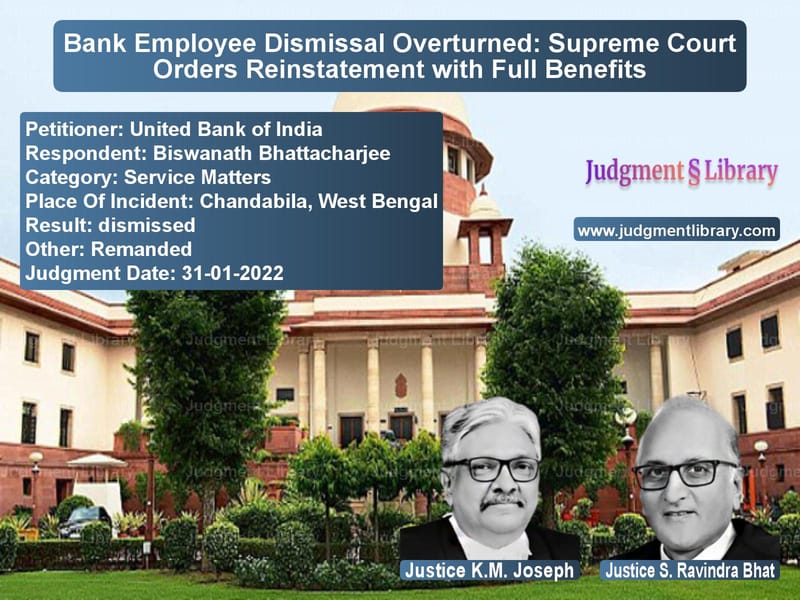

Bank Employee Dismissal Overturned: Supreme Court Orders Reinstatement with Full Benefits

The Supreme Court of India recently ruled in favor of a dismissed bank employee in the case of United Bank of India vs. Biswanath Bhattacharjee. The case revolved around alleged financial misappropriation involving the Integrated Rural Development Project (IRDP) loans at the Chandabila branch of United Bank of India. The Supreme Court set aside the dismissal order and directed the bank to reinstate the employee with all due benefits.

Background of the Case

The respondent, Biswanath Bhattacharjee, was employed as a cashier-cum-clerk at United Bank of India since 1971 and was later promoted to Junior Management Officer. He served as the branch manager of the Chandabila branch from December 1988 to May 1990. Disciplinary proceedings were initiated against him in 1997, alleging that he sanctioned IRDP loans to 12 fictitious beneficiaries, leading to a financial discrepancy of ₹60,000.

The bank accused him of misappropriating subsidy amounts and deliberately ensuring that crucial documents related to the loan disbursement went missing. Despite his denial, the bank conducted an inquiry and terminated his employment in 2002. His appeal against dismissal was rejected by the bank’s appellate authority in 2003, prompting him to challenge the decision in the Calcutta High Court.

High Court Proceedings

The single bench of the High Court upheld the dismissal, but the division bench overturned this ruling, holding that the charges were not substantiated by sufficient evidence. The bank then challenged this decision in the Supreme Court.

Arguments by the Bank

The United Bank of India contended that:

- The High Court erred by re-evaluating evidence, which is beyond its jurisdiction in judicial review.

- The disciplinary authority’s findings were based on solid evidence, including testimonies of seven beneficiaries who denied receiving loans.

- The confessional statement of co-accused employees substantiated the misappropriation.

- The respondent’s past record of misconduct justified the dismissal.

Arguments by the Employee

The respondent, represented by Advocate Kunal Chatterji, argued that:

- The charges were baseless and not supported by concrete evidence.

- He was transferred out of the branch in 1990, but the charges were brought seven years later.

- The alleged confession used against him was neither signed nor admitted by him.

- The bank failed to provide crucial documents requested during the inquiry, causing serious prejudice.

Supreme Court’s Observations

The Supreme Court bench, comprising Justice K.M. Joseph and Justice S. Ravindra Bhat, analyzed the inquiry process and evidence. The Court ruled:

“The High Court has rightly scrutinized the evidence. The finding of guilt was based on no direct evidence linking the respondent to any misappropriation.”

“The confessional statement used against the respondent was not signed by him and was inadmissible as evidence. No independent witness corroborated the allegations.”

Key Legal Findings

The Supreme Court made several crucial observations:

- Judicial Review in Disciplinary Cases: Courts can interfere if findings are based on irrelevant considerations, lack evidence, or are perverse.

- Insufficiency of Evidence: The absence of direct evidence and reliance on a dubious confession weakened the case against the employee.

- Failure of Natural Justice: The bank’s failure to provide requested documents to the respondent violated his right to a fair inquiry.

- Past Conduct Cannot Justify Present Charges: An employee’s prior minor misconduct cannot be the basis for dismissal if the charges under review are unproven.

Final Judgment

The Supreme Court upheld the High Court’s decision and ruled:

“The appeal is dismissed. The respondent’s services are deemed to be reinstated. The bank shall calculate all his benefits, including arrears of salary, increments, and pension entitlements, within three months.”

Legal Implications

This judgment has significant implications for employment law and disciplinary proceedings:

- Burden of Proof: Employers must provide concrete evidence in disciplinary proceedings.

- Fairness in Inquiry: Employees must be given access to documents that form the basis of charges against them.

- Judicial Oversight: High Courts can review disciplinary actions if findings are unreasonable or unsupported by evidence.

Conclusion

The Supreme Court’s ruling serves as a reminder that disciplinary actions must be based on credible evidence and due process. The decision ensures that bank employees are not unfairly penalized based on assumptions and unverified allegations.

Petitioner Name: United Bank of India.Respondent Name: Biswanath Bhattacharjee.Judgment By: Justice K.M. Joseph, Justice S. Ravindra Bhat.Place Of Incident: Chandabila, West Bengal.Judgment Date: 31-01-2022.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: united-bank-of-india-vs-biswanath-bhattachar-supreme-court-of-india-judgment-dated-31-01-2022.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Employment Disputes

See all petitions in Disciplinary Proceedings

See all petitions in Termination Cases

See all petitions in Public Sector Employees

See all petitions in Judgment by K.M. Joseph

See all petitions in Judgment by S Ravindra Bhat

See all petitions in dismissed

See all petitions in Remanded

See all petitions in supreme court of India judgments January 2022

See all petitions in 2022 judgments

See all posts in Service Matters Category

See all allowed petitions in Service Matters Category

See all Dismissed petitions in Service Matters Category

See all partially allowed petitions in Service Matters Category