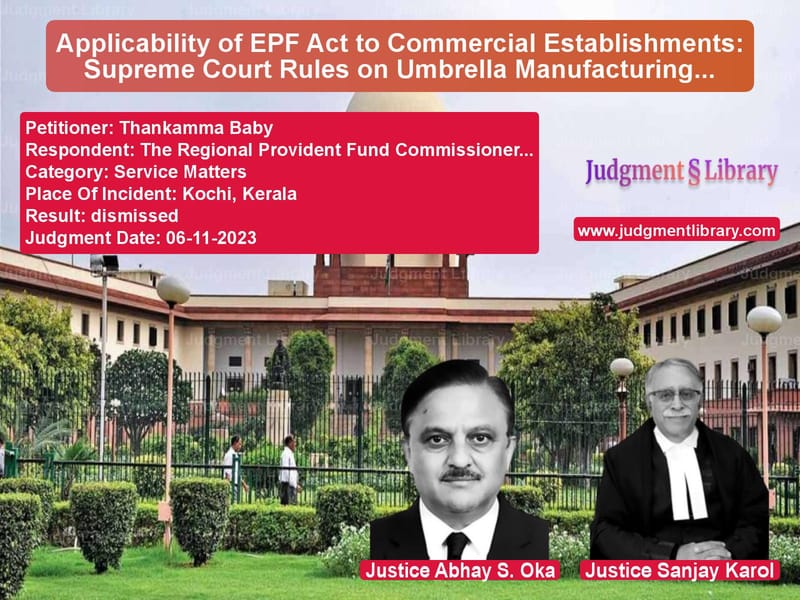

Applicability of EPF Act to Commercial Establishments: Supreme Court Rules on Umbrella Manufacturing Business

The case of Thankamma Baby v. The Regional Provident Fund Commissioner, Kochi, Kerala revolves around a dispute concerning the applicability of the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 (EPF Act). The key issue before the Supreme Court was whether an umbrella manufacturing and selling business falls under the definition of ‘trading and commercial establishments’ and is thus liable to comply with the EPF Act.

Background of the Case

The appellant, Thankamma Baby, was engaged in the business of assembling and selling umbrellas. The Regional Provident Fund Commissioner (RPFC) issued a notice on December 30, 1997, stating that the EPF Act applied to the appellant’s business, as it was classified under ‘trading and commercial establishments’ by a government notification dated March 7, 1962. This notification, issued under clause (b) of sub-section (3) of Section 1 of the EPF Act, brought certain commercial establishments under the purview of the law.

The appellant challenged the applicability of the EPF Act to her business. However, the inquiry conducted under Section 7A of the EPF Act upheld the applicability of the Act. The appellant’s review petition and subsequent appeal before the Appellate Authority were both dismissed. Further, a writ petition before the Kerala High Court was also dismissed, leading to the present appeal before the Supreme Court.

Key Legal Issues

The main issues before the Supreme Court were:

- Whether an establishment engaged in manufacturing and selling umbrellas qualifies as a ‘trading and commercial establishment’ under the government notification.

- Whether the provisions of the EPF Act apply to such an establishment, given that it is not listed in Schedule I of the Act.

- Whether the appellant’s business is exempt from the EPF Act under Section 16.

Arguments of the Appellant

The appellant’s counsel contended:

- Clause (a) of sub-section (3) of Section 1 applies only to factories engaged in industries specified in Schedule I of the EPF Act. Since the appellant’s industry was not listed in Schedule I, it should not be covered under the Act.

- Clause (b) of sub-section (3) does not refer to factories. The term ‘any other establishment’ mentioned in clause (b) does not include factories, implying that the appellant’s business should not be considered a ‘commercial establishment’ under the notification.

- The respondent had admitted before the Kerala High Court that the umbrella manufacturing unit was not part of the industries listed in Schedule I.

- The appellant’s business primarily involved manufacturing rather than commercial trading, making it distinct from businesses intended to be covered under the notification.

Arguments of the Respondent

The respondent (Regional Provident Fund Commissioner) argued:

- The appellant’s business was not limited to manufacturing but also included the sale of umbrellas.

- Assembling and selling umbrellas falls under the category of ‘trading and commercial establishments’ as per the government notification dated March 7, 1962.

- The High Court and other lower authorities had rightly determined that the establishment was covered under the EPF Act.

Supreme Court’s Observations

1. Interpretation of Section 1(3) of the EPF Act

The Supreme Court analyzed the provisions of the EPF Act, particularly Section 1(3), which states:

“(a) To every establishment which is a factory engaged in any industry specified in Schedule I and in which twenty or more persons are employed, and

(b) To any other establishment employing twenty or more persons or class of such establishments which the Central Government may, by notification in the Official Gazette, specify in this behalf.”

The Court emphasized that clause (b) is applicable to all establishments that are not covered under clause (a). Thus, a government notification could validly bring a factory or establishment under the EPF Act, even if it was not listed in Schedule I.

2. Applicability of the Government Notification

The Supreme Court ruled that the notification dated March 7, 1962, covered trading and commercial establishments, and since the appellant’s business involved both assembling and selling umbrellas, it qualified as a trading and commercial establishment.

“The respondent has recorded a finding of fact that the business of the establishment of the appellant was of assembling umbrellas and selling the same in her own outlet. Thus, the establishment of the appellant is a commercial establishment.”

3. EPF Act as a Social Welfare Legislation

The Court reiterated that the EPF Act is a social justice measure aimed at ensuring financial security for employees. Citing the Constitution Bench ruling in Mohmedalli v. Union of India, the Court stated that the underlying objective of the EPF Act is to bring all employees within its fold as and when deemed appropriate by the government.

4. No Exemption Under Section 16

The Supreme Court found that the appellant had not claimed any exemption under Section 16 of the EPF Act. Since the establishment was not specifically exempted, the Act applied to it by default.

Final Judgment

The Supreme Court dismissed the appeals and upheld the Kerala High Court’s judgment, confirming that the appellant’s umbrella business was covered under the EPF Act.

“The case of the appellant will be governed by the said notification issued under clause (b) of sub-Section (3) of Section 1.”

Additionally, the Court granted the appellant three months to pay any outstanding provident fund dues.

Key Takeaways

1. Broad Applicability of the EPF Act

This ruling clarifies that the EPF Act applies to various businesses, including those engaged in both manufacturing and trading.

2. Government’s Authority to Expand EPF Coverage

The judgment affirms that the government has the power to bring additional establishments under the EPF Act through notifications.

3. Compliance Obligations for Businesses

Businesses engaged in commercial activities must ensure compliance with labor laws to avoid legal disputes.

Conclusion

The Supreme Court’s judgment in this case reinforces the importance of social security for employees and broadens the applicability of the EPF Act. Businesses engaged in commercial activities, even if they include manufacturing components, should take note of their obligations under labor laws.

Petitioner Name: Thankamma Baby.Respondent Name: The Regional Provident Fund Commissioner, Kochi, Kerala.Judgment By: Justice Abhay S. Oka, Justice Sanjay Karol.Place Of Incident: Kochi, Kerala.Judgment Date: 06-11-2023.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: thankamma-baby-vs-the-regional-provide-supreme-court-of-india-judgment-dated-06-11-2023.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Employment Disputes

See all petitions in Public Sector Employees

See all petitions in Contractual Employment

See all petitions in Judgment by Abhay S. Oka

See all petitions in Judgment by Sanjay Karol

See all petitions in dismissed

See all petitions in supreme court of India judgments November 2023

See all petitions in 2023 judgments

See all posts in Service Matters Category

See all allowed petitions in Service Matters Category

See all Dismissed petitions in Service Matters Category

See all partially allowed petitions in Service Matters Category