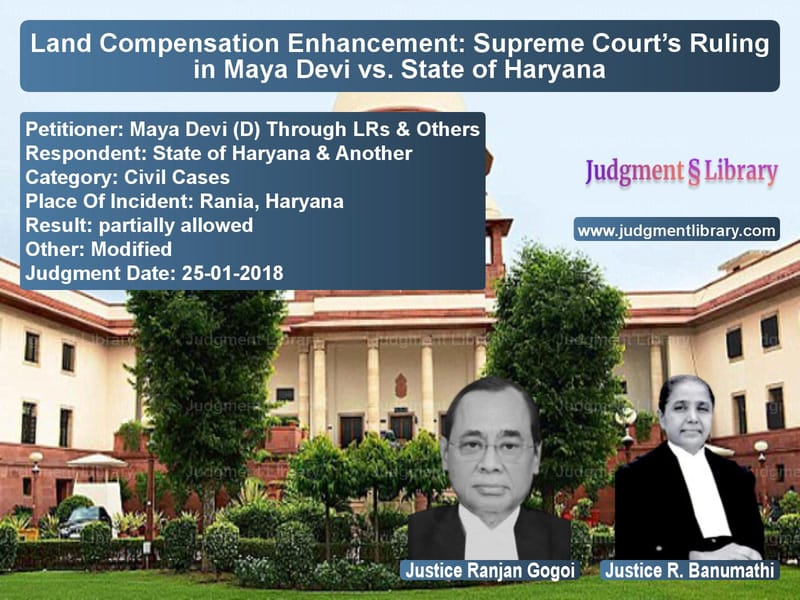

Land Compensation Enhancement: Supreme Court’s Ruling in Maya Devi vs. State of Haryana

The case of Maya Devi (D) Through LRs & Others vs. State of Haryana & Another is a significant ruling regarding land acquisition compensation. The Supreme Court examined whether the compensation awarded for acquired land was fair and whether further enhancement was justified.

Background of the Case

The dispute arose when the Haryana State Warehousing Corporation acquired 40 kanal and 8 marlas of land in Rania for the construction of a warehouse/godown. The acquisition was carried out through a notification issued on February 12, 1988 under Section 4(1) of the Land Acquisition Act, 1894. Out of the total land acquired, 21 kanal and 6 marlas belonged to the appellants.

The relevant timeline of legal proceedings:

- May 19, 1990: The Land Acquisition Officer awarded a compensation of Rs. 75,000 per acre.

- February 15, 1993: The Additional District Judge, Sirsa dismissed the appellants’ reference petition for enhanced compensation.

- 1993: The appellants filed an appeal before the Punjab and Haryana High Court seeking enhancement.

- 2013: The High Court enhanced the compensation to Rs. 2,19,413 per acre based on an exemplar sale deed dated May 26, 1983.

- August 1, 2014: The appellants withdrew their Special Leave Petition (SLP) before the Supreme Court with liberty to file a review before the High Court.

- 2016: The High Court dismissed the review petition.

- 2018: The appellants approached the Supreme Court, challenging the dismissal of their review petition.

Key Legal Issues

- Whether the post-notification sale deed dated December 27, 1988 should have been considered for determining market value.

- Whether the deduction of 67.5% for development charges was justified.

- Whether the compensation awarded in an adjacent land acquisition case (Rs. 7,26,000 per acre for land acquired in 1989) should be considered.

Arguments by the Parties

Arguments by the Appellants (Landowners)

- The sale deed dated December 27, 1988 should be considered as it was executed only ten months after the notification.

- The deduction of 67.5% for development charges was excessive.

- The compensation for nearby acquired land (notified on March 27, 1989) was Rs. 7,26,000 per acre, which is more than three times higher than the compensation awarded to the appellants.

Arguments by the Respondents (State of Haryana)

- The December 27, 1988 sale deed was post-notification and, therefore, could not be considered.

- The deduction of 67.5% was appropriate given that the land required development.

- The compensation in the adjacent land case was based on different considerations and should not be applied to the present case.

Supreme Court’s Observations

On Consideration of Post-Notification Sale Deeds

- “The compensation to be awarded shall be determined based upon the market value of the acquired land at the date of the publication of the notification under Section 4(1).”

- “Post-notification instances cannot be taken into consideration for determining the compensation of the acquired land.”

On Deduction for Development

- “The High Court applied a maximum deduction of 67.5%, which appears excessive.”

- “One-third deduction is generally considered reasonable unless specific development costs justify a higher deduction.”

- “The compensation should be recalculated based on a 33.3% deduction instead of 67.5%.”

On Comparison with Nearby Land Compensation

- “The compensation awarded for the March 27, 1989 acquisition cannot be used as a direct reference, but it does indicate a higher valuation of land in the area.”

- “The compensation for the appellants’ land should be adjusted to reflect reasonable market trends.”

Supreme Court’s Final Judgment

The Supreme Court modified the High Court’s decision and enhanced the compensation:

- The compensation per acre was increased to Rs. 4,43,258 after applying a one-third deduction instead of 67.5%.

- The appellants were entitled to statutory benefits as per the Land Acquisition Act.

- The appeals were partially allowed.

Legal Significance of the Judgment

This ruling establishes key legal principles:

- Exclusion of Post-Notification Sales: The judgment reinforces that only pre-notification sale deeds can be considered for market value determination.

- Development Deduction Limits: The Court ruled that excessive deductions should be avoided, and one-third is a reasonable cut in most cases.

- Comparable Sales in Adjacent Acquisitions: While not determinative, higher compensation for nearby acquisitions can influence land valuation.

Conclusion

The Supreme Court’s ruling in Maya Devi vs. State of Haryana ensures that landowners receive fair compensation for acquisitions. By adjusting the deduction percentage and rejecting post-notification sales, the judgment strengthens transparency in land valuation for acquisitions.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Maya Devi (D) Throug vs State of Haryana & A Supreme Court of India Judgment Dated 25-01-2018.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Property Disputes

See all petitions in Damages and Compensation

See all petitions in Judgment by Ranjan Gogoi

See all petitions in Judgment by R. Banumathi

See all petitions in partially allowed

See all petitions in Modified

See all petitions in supreme court of India judgments January 2018

See all petitions in 2018 judgments

See all posts in Civil Cases Category

See all allowed petitions in Civil Cases Category

See all Dismissed petitions in Civil Cases Category

See all partially allowed petitions in Civil Cases Category