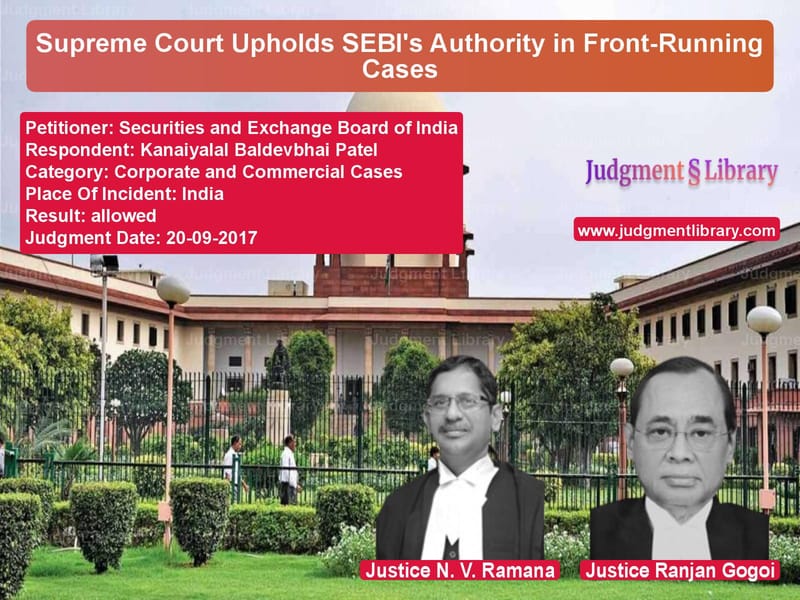

Supreme Court Upholds SEBI’s Authority in Front-Running Cases

The Supreme Court of India, in its landmark judgment in the case of Securities and Exchange Board of India (SEBI) v. Kanaiyalal Baldevbhai Patel and other related appeals, provided a comprehensive analysis of front-running in securities trading and whether non-intermediary front-running constitutes a violation under the Securities and Exchange Board of India (Prohibition of Fraudulent and Unfair Trade Practices Relating to Securities Market) Regulations, 2003 (FUTP 2003).

Background of the Case

The case arose from SEBI’s investigation into various individuals, including Kanaiyalal Baldevbhai Patel and Sujit Karkera, for allegedly engaging in front-running. Front-running refers to a practice where a trader, based on non-public information regarding impending large transactions, places orders ahead of such trades to profit from the anticipated price movements. SEBI alleged that Patel and others received confidential information from traders working at financial institutions and executed trades based on this privileged knowledge.

SEBI had imposed monetary penalties and trading restrictions on the accused traders, leading them to challenge the regulator’s jurisdiction and interpretation of the law before the Securities Appellate Tribunal (SAT). The SAT initially ruled in favor of the traders, holding that non-intermediaries could not be held liable for front-running under FUTP 2003. SEBI subsequently appealed to the Supreme Court, arguing that front-running undermines market integrity and should be subject to strict regulation regardless of whether the perpetrator is an intermediary or not.

Key Legal Issues

The Supreme Court considered several pivotal questions:

- Whether front-running by non-intermediaries falls within the ambit of fraudulent and unfair trade practices under FUTP 2003.

- Whether SEBI had the jurisdiction to penalize traders engaging in such activities even when they were not registered intermediaries.

- The broader implications of front-running on market fairness and investor confidence.

Arguments by SEBI

SEBI, represented by its legal team, contended that:

- The core objective of FUTP 2003 is to maintain a fair and transparent securities market by prohibiting fraudulent activities, including front-running.

- While the regulation explicitly prohibits front-running by intermediaries, the broader language of the law covers all fraudulent and unfair practices.

- Allowing non-intermediary front-running to go unpunished would create an unfair market environment and erode investor confidence.

- The accused traders had engaged in a practice that exploited non-public information at the expense of institutional investors, violating the fundamental principles of market integrity.

Arguments by the Respondents

The respondents, led by their legal counsel, countered:

- That the law, as it stood, only penalized front-running by registered intermediaries such as brokers and sub-brokers.

- Their trading activities were not covered under FUTP 2003, as they were acting in their individual capacities and not as market intermediaries.

- There was no clear statutory provision under which SEBI could prosecute them, making the penalties imposed by SEBI legally untenable.

- The transactions were based on market intelligence rather than confidential information, and thus, they did not constitute fraudulent or unfair trade practices.

Supreme Court’s Judgment

The Supreme Court, after extensive deliberations, ruled in favor of SEBI and upheld its authority to penalize non-intermediaries for front-running under FUTP 2003. The key observations of the Court were:

- The definition of fraud under FUTP 2003 is broad enough to cover front-running, regardless of whether the person engaging in it is an intermediary or not.

- Market integrity and investor protection are paramount, and any practice that disrupts fair market functioning should be subject to regulatory scrutiny.

- The legislative intent behind FUTP 2003 was to prevent all forms of unfair trade practices, not just those committed by registered intermediaries.

- SEBI, as the regulatory authority, has the power to interpret and enforce laws in a manner that upholds the principles of transparency and fairness in the securities market.

Key Observations from the Judgment

In its ruling, the Supreme Court made several critical observations regarding the importance of market integrity:

“The prohibition against fraudulent and unfair trade practices must be interpreted in a manner that upholds the primary objective of investor protection. Allowing any form of front-running would create an unequal playing field and harm market participants.”

The Court further noted:

“The argument that only intermediaries are liable under FUTP 2003 is flawed. The law seeks to prevent fraud in all its forms, and an interpretation that limits its applicability only to registered intermediaries would be contrary to the legislative intent.”

Impact of the Judgment

This ruling has far-reaching implications for India’s securities markets:

- It establishes that SEBI has the authority to act against all individuals and entities engaging in fraudulent trading practices.

- It reinforces the principle that market abuse laws should be interpreted broadly to prevent regulatory loopholes.

- The decision provides clarity on the legal framework surrounding front-running and ensures that similar violations will be penalized in the future.

- Market participants, including traders and financial institutions, must exercise greater caution in handling sensitive trade information.

Conclusion

The Supreme Court’s ruling in SEBI v. Kanaiyalal Baldevbhai Patel sets a crucial precedent in securities regulation. By holding non-intermediaries accountable for front-running, the Court has strengthened the framework for market integrity in India. This decision ensures that no individual can exploit confidential trade information for personal gain without facing regulatory consequences.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Securities and Excha vs Kanaiyalal Baldevbha Supreme Court of India Judgment Dated 20-09-2017.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Corporate Governance

See all petitions in unfair trade practices

See all petitions in Company Law

See all petitions in Judgment by N.V. Ramana

See all petitions in Judgment by Ranjan Gogoi

See all petitions in allowed

See all petitions in supreme court of India judgments September 2017

See all petitions in 2017 judgments

See all posts in Corporate and Commercial Cases Category

See all allowed petitions in Corporate and Commercial Cases Category

See all Dismissed petitions in Corporate and Commercial Cases Category

See all partially allowed petitions in Corporate and Commercial Cases Category