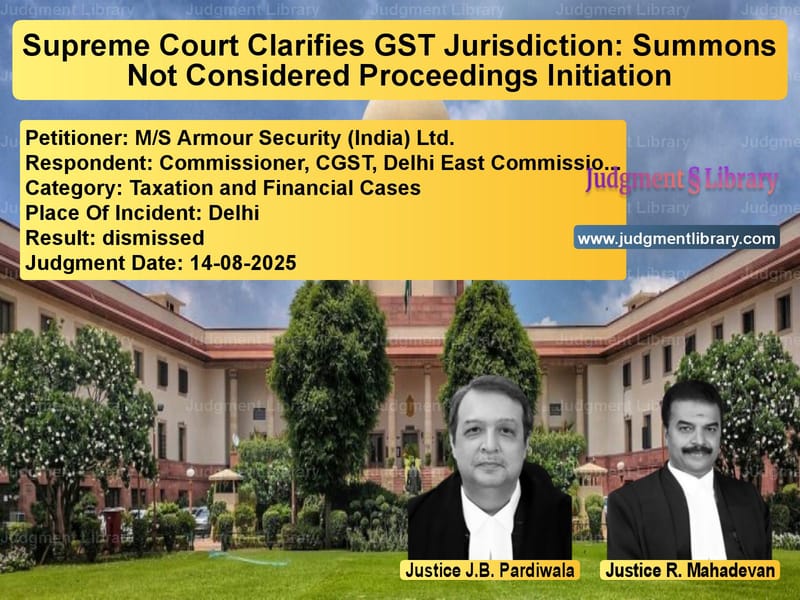

Supreme Court Clarifies GST Jurisdiction: Summons Not Considered Proceedings Initiation

In a significant ruling that clarifies the jurisdictional boundaries between Central and State GST authorities, the Supreme Court has dismissed a petition challenging the issuance of summons by Central GST authorities when State authorities had already initiated proceedings on the same subject matter. The case involved M/S Armour Security (India) Ltd., which had challenged summons issued by the Commissioner, CGST, Delhi East Commissionerate, arguing that since the State GST authorities had already issued show cause notices on the same issues, the Central authorities were barred from initiating parallel proceedings under Section 6(2)(b) of the CGST Act. The Supreme Court’s detailed judgment provides crucial clarity on what constitutes ‘initiation of proceedings’ under the GST framework and establishes important guidelines for preventing jurisdictional conflicts between Central and State tax authorities.

The legal dispute began when Armour Security (India) Ltd. received a show cause notice dated November 18, 2024, from State GST authorities raising a demand of approximately Rs. 1.24 crore for the tax period April 2020-March 2021. The notice alleged net tax under-declaration due to non-reconciliation of turnovers and excess claim of Input Tax Credit (ITC). Subsequently, on January 16, 2025, Central GST authorities conducted a search at the company’s premises under Section 67(2) of the CGST Act and issued summons to four directors requiring them to produce documents. Another summons followed on January 23, 2025, prompting the company to approach the Delhi High Court, arguing that the Central authorities lacked jurisdiction since the State authorities had already initiated proceedings on the same subject matter.

The petitioner’s senior counsel, Mr. Sridhar Potaraju, made several key arguments before the Supreme Court. He contended that “Section 6(2)(b) of the CGST Act expressly prohibits parallel proceedings on the same subject matter by both the State and the Central GST authorities.” He further argued that “the High Court erred in interpreting Section 6(2)(b) as being limited to proceedings under Sections 73 and 74 respectively, or other similar provisions” and that “the statutory bar under Section 6(2)(b) does not apply to summons issued under Section 70 of the CGST Act.” Mr. Potaraju emphasized the importance of harmony as a foundational principle of cooperative federalism underlying the GST regime, stating that “once either the State or Central authority initiates proceedings, the other is expected to act in aid of those proceedings and provide all necessary inputs to ensure their effective culmination.”

The Supreme Court, after extensive analysis of the GST framework and various High Court decisions, delivered a comprehensive judgment that addressed the core issue of whether the issuance of summons constitutes ‘initiation of proceedings’ under Section 6(2)(b). The Court firmly stated that “the expression ‘initiation of any proceedings’ occurring in Section 6(2)(b) refers to the formal commencement of adjudicatory proceedings by way of issuance of a show cause notice, and does not encompass the issuance of summons, or the conduct of any search, or seizure etc.” This distinction between preliminary inquiries and formal proceedings formed the cornerstone of the Court’s reasoning.

The judgment extensively analyzed the unique framework of the GST regime, which envisages two distinct concepts: ‘single interface’ and ‘cross-empowerment.’ The Court explained that “the concept of a ‘single interface’ was introduced to prevent the burden of dual administrative control and to streamline compliance” while “cross-empowerment pertains to empowering both the Central and State tax administrations to simultaneously undertake enforcement actions against a tax-payer.” The Court clarified that these concepts, while appearing contradictory at first glance, are actually complementary and designed to work in tandem.

In its detailed analysis, the Court made several crucial observations about the nature of summons under the GST framework. The Court noted that “a summons is not the culmination of an investigation, but merely a step in its course” and that “at the stage of issuing a summons, the Department is primarily engaged in gathering information regarding a possible contravention of law, which may subsequently form the basis for proceedings against an assessee.” This distinction between evidence gathering and formal proceedings was central to the Court’s conclusion that summons do not constitute ‘proceedings’ under Section 6(2)(b).

The Court also provided important clarification on what constitutes ‘subject matter’ for the purposes of Section 6(2)(b), establishing a twofold test: “first, the subject matter will be considered the same if an authority has already proceeded on an identical liability of tax or alleged offence by the assessee on the same facts; and secondly, if the demand or relief sought is identical.” This test provides much-needed clarity for taxpayers and authorities alike in determining when the statutory bar against parallel proceedings applies.

In its concluding remarks, the Court issued comprehensive guidelines to prevent jurisdictional conflicts and ensure harmonious implementation of the GST regime. The guidelines include provisions for inter-authority communication, mechanisms for resolving jurisdictional disputes, and procedures for taxpayers to follow when faced with potentially overlapping inquiries. The Court emphasized that “the Departments act in harmony and maintain heightened vigilance with respect to intelligence inputs received by them, so as to give full effect to the legislative intent underlying the GST regime.”

The Supreme Court’s judgment represents a significant step toward resolving the jurisdictional ambiguities that have plagued the GST regime since its implementation. By clearly distinguishing between preliminary inquiries and formal proceedings, and by establishing practical guidelines for coordination between Central and State authorities, the Court has provided a framework that balances the need for effective tax enforcement with the protection of taxpayers from undue harassment through parallel proceedings. The ruling reinforces the cooperative federalism principles underlying GST while ensuring that tax authorities can effectively discharge their enforcement responsibilities without jurisdictional conflicts.

Petitioner Name: M/S Armour Security (India) Ltd..Respondent Name: Commissioner, CGST, Delhi East Commissionerate & Anr..Judgment By: Justice J.B. Pardiwala, Justice R. Mahadevan.Place Of Incident: Delhi.Judgment Date: 14-08-2025.Result: dismissed.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: ms-armour-security-vs-commissioner,-cgst,-supreme-court-of-india-judgment-dated-14-08-2025.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in GST Law

See all petitions in Tax Evasion Cases

See all petitions in Tax Refund Disputes

See all petitions in Judgment by J.B. Pardiwala

See all petitions in Judgment by R. Mahadevan

See all petitions in dismissed

See all petitions in supreme court of India judgments August 2025

See all petitions in 2025 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category