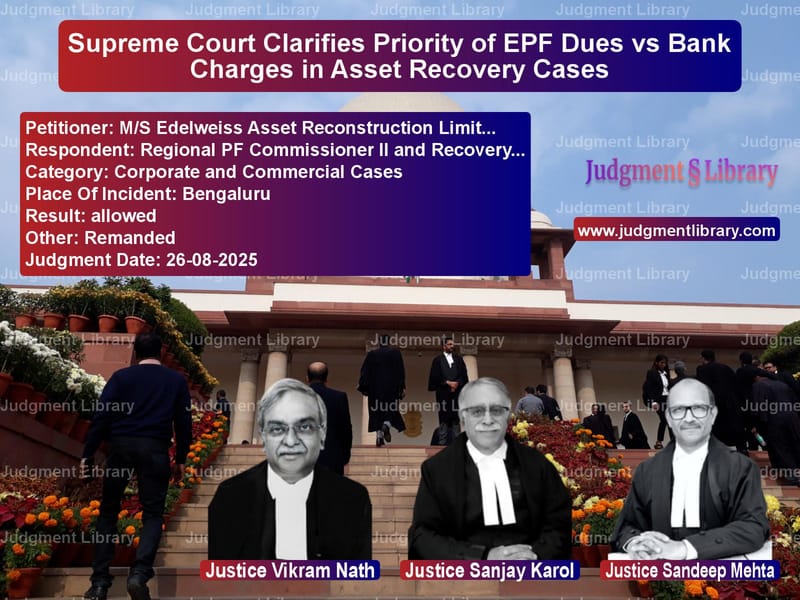

Supreme Court Clarifies Priority of EPF Dues vs Bank Charges in Asset Recovery Cases

In a significant ruling that clarifies the complex interplay between employee welfare legislation and banking recovery laws, the Supreme Court of India has delivered an important judgment regarding the priority of claims when a company defaults on both employee provident fund dues and bank loans. The case involved Edelweiss Asset Reconstruction Company, which found itself caught between competing claims from the Employees’ Provident Fund Organisation and several banks, all seeking recovery from the sale proceeds of properties belonging to a defaulting company.

The legal battle emerged from the financial troubles of M/s Acropetal Technologies Pvt. Ltd., which had defaulted on its provident fund contributions since July 2013. The EPFO had determined a liability of approximately Rs. 1.29 crore against the company in 2015, while simultaneously, multiple banks had declared the company’s accounts as non-performing assets and initiated recovery proceedings through property auctions. This created a classic conflict between social welfare legislation protecting workers’ rights and banking laws protecting secured creditors.

The Competing Claims

The case presented a complex web of competing claims over three different properties. Axis Bank had auctioned the Attibele property for approximately Rs. 12 crores, while Edelweiss ARC, acting on behalf of State Bank of India and State Bank of Travancore, had sold two other properties – the Kammanahalli property and Palya property – for a total of approximately Rs. 7 crores. The EPFO sought to recover its dues from all these sale proceeds, leading to legal battles about which entity had priority over the recovered amounts.

Edelweiss ARC had already paid Rs. 75 lakhs to the EPFO under court directions and had expressed willingness to pay an additional amount, but argued that the substantial balance of EPFO dues should be recovered from Axis Bank, which had realized significantly more from its property auction. The company’s position was that “the balance amount of EPFO may be recovered from the Axis Bank as EARC has already paid an amount of Rs.75 lakhs which is proportionate to the sale consideration received by it.”

The Legal Arguments

The appellant, Edelweiss ARC, presented a nuanced argument acknowledging the priority of EPF dues but questioning the distribution of liability among different secured creditors. The company contended that “the appellant in the appeal has admitted that the dues of EPFO have a first charge.” However, they argued that “the balance payment of Rs.1,30,52,221/- approximately may be recovered from the Axis Bank.” This proportional approach formed the crux of their legal strategy.

Axis Bank, on the other hand, relied on the special protections afforded to secured creditors under banking legislation. The bank argued that “in view of the provisions contained in Section 35 of the SARFAESI, the dues of the Bank being secured would have a priority over the sales taxes and other dues payable to the Government or local authority and, therefore, no recovery can be made from Axis Bank till such time its entire dues are liquidated and satisfied.”

The EPFO maintained its position based on the special status given to workers’ welfare contributions under provident fund legislation. The organization argued that “the High Court has rightly dismissed the petition of the appellant and, therefore, it is entitled to recover the balance amount” and emphasized that “the appellant had not impleaded Axis Bank before the High Court and, therefore, the contention of the appellant that balance recovery may be made from Axis Bank cannot be sustained.”

The Supreme Court’s Analysis

The three-judge bench comprising Justices Vikram Nath, Sanjay Karol, and Sandeep Mehta recognized the complexity of the legal issues involved and the need for a comprehensive examination of the competing statutory claims. The Court noted that “It is true that the appellant did not implead Axis Bank as a party-respondent before the High Court. However, before this Court, Axis Bank was impleaded and is now represented and duly heard.”

The Court identified the core legal question as “the priority of first charge amongst the EPFO and the secured creditors i.e. the Axis Bank and other two Banks, namely, State Bank of India and the State Bank of Travancore (now taken over by SBI) in view of Section 11(2) of the PF Act.”

The Remand Decision

In a significant procedural ruling, the Supreme Court decided that the matter required fresh consideration by the High Court with all necessary parties properly represented. The Court held that “In our considered opinion, it would be appropriate that the High Court first deals with the issues raised by Axis Bank that it has first charge and priority over and above the EPFO to satisfy its dues from the secured property in view of Section 35 of the SARFAESI Act.”

The Court specifically directed that “The High Court will examine the priority of first charge amongst the EPFO and the secured creditors i.e. the Axis Bank and other two Banks, namely, State Bank of India and the State Bank of Travancore (now taken over by SBI) in view of Section 11(2) of the PF Act.”

The Supreme Court also provided important guidance to the High Court for its fresh consideration, noting that “The High Court will take into consideration, the relevant fact relating to the charge having been created by the EPFO over the properties to be auctioned by the Axis Bank prior to the auction. Material in this regard has been placed before us.”

Legal Implications

This judgment highlights the ongoing tension between social welfare legislation and commercial banking laws in India’s legal landscape. The Employees’ Provident Funds and Miscellaneous Provisions Act, 1952, under Section 11(2), gives EPF dues priority over other debts, characterizing them as first charges on the assets of the establishment. However, the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI Act), under Section 35, gives overriding effect to its provisions, potentially giving secured creditors priority.

The Supreme Court’s decision to remand the case rather than deciding the substantive issue itself indicates the complexity of balancing these competing statutory priorities. By directing the High Court to examine “the priority of first charge amongst the EPFO and the secured creditors” and specifically noting the timing of when EPFO created its charge over the properties, the Court has emphasized the importance of factual context in resolving such conflicts.

Broader Impact

This case has significant implications for asset reconstruction companies, banks, and the EPFO. For financial institutions, it underscores the importance of understanding the hierarchy of claims when dealing with distressed assets. For the EPFO, it reinforces the organization’s ability to pursue dues aggressively, even when multiple creditors are involved.

The Supreme Court’s approach also demonstrates the judiciary’s recognition of the practical complexities in recovery proceedings involving multiple properties and multiple creditors. By ensuring that all relevant parties are properly represented and that the High Court examines the specific factual matrix, the Court has laid the groundwork for a more comprehensive resolution of this important legal question.

As the case returns to the Karnataka High Court for fresh consideration, it will be watched closely by financial institutions, recovery agencies, and labor welfare organizations alike. The ultimate resolution will provide important clarity on how India’s legal system balances the competing interests of worker protection and financial sector stability in an increasingly complex economic environment.

Petitioner Name: M/S Edelweiss Asset Reconstruction Limited.Respondent Name: Regional PF Commissioner II and Recovery Officer, Bengaluru.Judgment By: Justice Vikram Nath, Justice Sanjay Karol, Justice Sandeep Mehta.Place Of Incident: Bengaluru.Judgment Date: 26-08-2025.Result: allowed.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: ms-edelweiss-asset-vs-regional-pf-commissi-supreme-court-of-india-judgment-dated-26-08-2025.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Debt Recovery

See all petitions in Bankruptcy and Insolvency

See all petitions in Corporate Compliance

See all petitions in Banking Regulations

See all petitions in Contract Disputes

See all petitions in Judgment by Vikram Nath

See all petitions in Judgment by Sanjay Karol

See all petitions in Judgment by Sandeep Mehta

See all petitions in allowed

See all petitions in Remanded

See all petitions in supreme court of India judgments August 2025

See all petitions in 2025 judgments

See all posts in Corporate and Commercial Cases Category

See all allowed petitions in Corporate and Commercial Cases Category

See all Dismissed petitions in Corporate and Commercial Cases Category

See all partially allowed petitions in Corporate and Commercial Cases Category