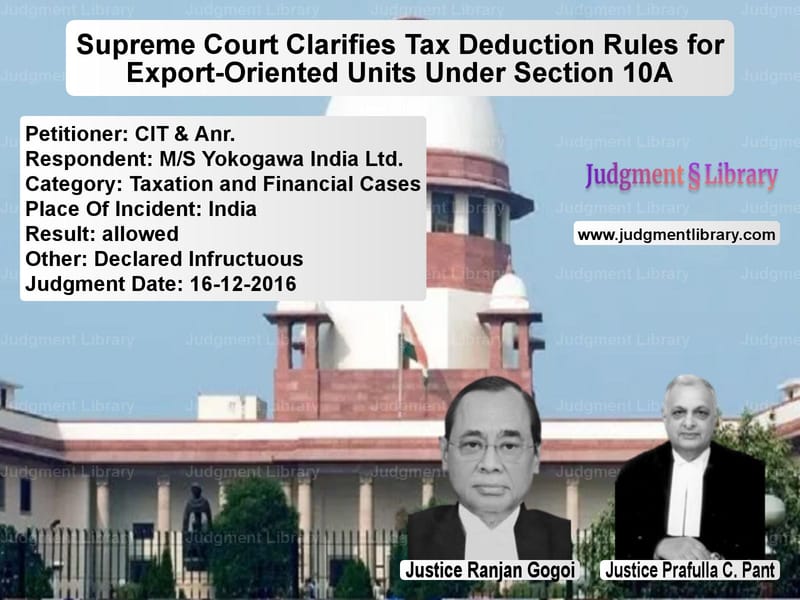

Supreme Court Clarifies Tax Deduction Rules for Export-Oriented Units Under Section 10A

The case of CIT & Anr. vs. M/S Yokogawa India Ltd. addressed a crucial question regarding the computation of tax deductions under Section 10A of the Income Tax Act, 1961. The Supreme Court ruled that the deduction under Section 10A must be applied at the stage of computing gross total income and not at the stage of computing total income under Chapter VI of the Act. The ruling resolved long-standing confusion on whether Section 10A confers an exemption or a deduction and how it should be computed.

Background of the Case

Section 10A of the Income Tax Act provides tax incentives to export-oriented units engaged in the software export business. The core dispute in this case was whether the deduction under Section 10A should be applied before or after aggregating business income. The Revenue (Income Tax Department) argued that profits of units claiming deduction under Section 10A should be included in the computation of total income before applying the deduction, whereas the taxpayer argued that such profits should be excluded at the initial stage itself.

Several High Courts had delivered conflicting judgments on this issue, leading to uncertainty for businesses operating in Software Technology Parks of India (STPI) and Special Economic Zones (SEZs). The case eventually reached the Supreme Court for final resolution.

Key Legal Issues

- Is Section 10A an exemption provision or a deduction provision?

- At what stage should the deduction under Section 10A be computed?

- Can losses from non-10A units be set off against the profits of a 10A unit?

- Can brought-forward business losses and unabsorbed depreciation be adjusted against the profits of a 10A unit?

- What is the impact of this ruling on other tax incentive provisions like Section 10B?

Arguments by the Petitioners (Income Tax Department)

- Section 10A, as amended, is a deduction provision rather than an exemption.

- Deductions should be applied after computing total income as per Chapter VI of the Income Tax Act.

- The losses of non-10A units should be allowed to be set off against the profits of 10A units.

- Brought-forward business losses and unabsorbed depreciation should be adjusted before computing the final taxable income.

Arguments by the Respondents (Yokogawa India Ltd.)

- The benefits under Section 10A should be applied at the stage of computing gross total income, before considering set-offs.

- Profits from a 10A unit should not be aggregated with other non-10A profits for tax computation.

- The amendment to Section 10A does not change its fundamental nature as an exemption provision.

- Non-10A business losses should not be adjusted against the profits of 10A units.

Supreme Court’s Judgment

The Supreme Court ruled in favor of the taxpayer, holding that:

- Section 10A provides a deduction at the stage of computing gross total income.

- The total income of an eligible unit under Section 10A should be computed separately before aggregation with other business income.

- Losses from other non-10A units should not be set off against the profits of a 10A unit before computing deductions.

- Unabsorbed depreciation and brought-forward business losses of non-10A units cannot be adjusted against profits of 10A units.

The Court stated:

“The deductions contemplated under Section 10A are qua the eligible undertaking of an assessee standing on its own and without reference to the other eligible or non-eligible units of the assessee.”

Impact of the Judgment

- Clarifies that deductions under Section 10A must be applied at the initial computation stage.

- Ensures that profits of 10A units are not diminished by setting off losses from non-10A units.

- Strengthens tax incentives for export-oriented units engaged in software exports.

- Provides clarity for tax authorities and taxpayers on the treatment of Section 10A deductions.

Analysis of the Judgment

The Supreme Court’s ruling is significant for multiple reasons:

- Judicial Recognition of Export-Oriented Incentives: The judgment upholds the intention of the legislature to provide incentives to software exporters and SEZ units.

- Consistency with Prior Rulings: The Court relied on past precedents, ensuring consistency in tax jurisprudence.

- Implications for Future Tax Planning: Businesses can now structure their finances confidently, knowing that Section 10A deductions will not be diluted by losses from other business units.

Future Implications

The judgment sets a strong precedent that will impact similar cases in the future. Some expected outcomes include:

- Uniform Taxation Approach: Tax authorities will have to apply Section 10A deductions consistently across all eligible businesses.

- Increased Investments in Export Units: The ruling will encourage businesses to set up operations in STPIs and SEZs.

- Regulatory Certainty: The decision eliminates ambiguity over how deductions should be computed, leading to more predictable tax outcomes.

Conclusion

The Supreme Court’s ruling in this case resolves the ambiguity in the application of Section 10A, reinforcing that deductions should be applied before aggregation with other business incomes. This decision has significant implications for businesses operating in Special Economic Zones (SEZs) and Export-Oriented Units (EOUs), ensuring that they receive full tax benefits as intended by the legislature.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: CIT & Anr. vs MS Yokogawa India L Supreme Court of India Judgment Dated 16-12-2016.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Income Tax Disputes

See all petitions in Judgment by Ranjan Gogoi

See all petitions in Judgment by Prafulla C. Pant

See all petitions in allowed

See all petitions in Declared Infructuous

See all petitions in supreme court of India judgments December 2016

See all petitions in 2016 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category