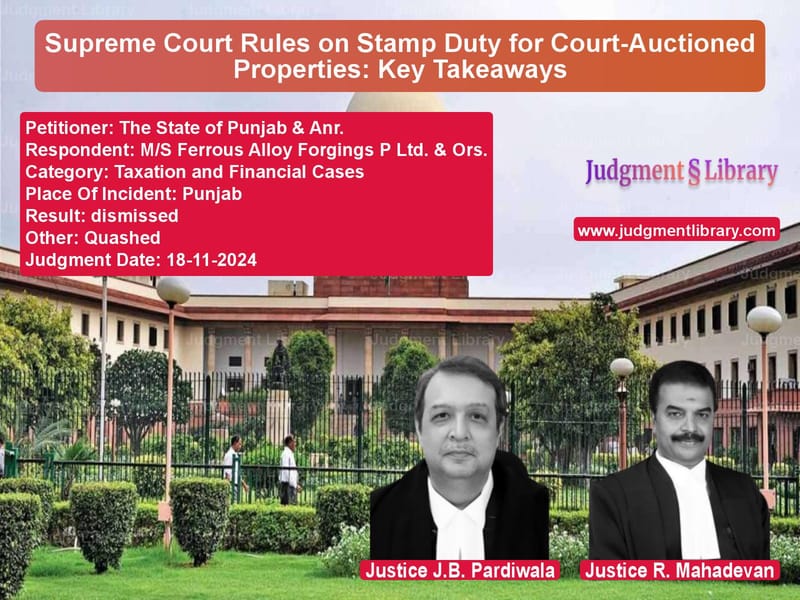

Supreme Court Rules on Stamp Duty for Court-Auctioned Properties: Key Takeaways

The case of The State of Punjab & Anr. vs. M/S Ferrous Alloy Forgings P Ltd. & Ors. revolves around an important legal question concerning the requirement of stamp duty for a sale certificate issued in a court auction. The Supreme Court of India, in its judgment dated November 19, 2024, clarified that a sale certificate issued by the court does not require compulsory registration and is not subject to stamp duty at the time of issuance.

Background of the Case

This legal dispute arose when M/s Punjab United Forge Limited was ordered to be wound up under the Companies Act, 1956. The Industrial Finance Corporation of India (IFCI) was given permission to auction the company’s mortgaged and hypothecated assets. M/s Ferrous Alloy Forging Pvt. Limited successfully bid for the assets, and the sale was confirmed by the High Court.

The key issue in this case was whether the successful auction purchaser, M/s Ferrous Alloy Forging Pvt. Limited, was required to pay stamp duty before obtaining the sale certificate. The High Court of Punjab and Haryana ruled in favor of the auction purchaser, directing that the original sale certificate be handed over without imposing a stamp duty requirement.

Legal Issues Involved

- Whether a sale certificate issued by a court requires registration under the Registration Act, 1908.

- Whether stamp duty must be paid at the time of issuance of the sale certificate.

- Whether the writ petition challenging the stamp duty demand was maintainable.

Petitioner’s Arguments

The State of Punjab, represented by learned counsel, contended:

- The auction purchaser was required to pay stamp duty under the provisions of the Indian Stamp Act before the sale certificate could be issued.

- The High Court erred in directing the refund of the stamp duty deposited by the auction purchaser.

- The sale certificate required compulsory registration, and non-registration would render the sale invalid.

- The writ petition filed by the auction purchaser was not maintainable as an alternative remedy was available.

Respondent’s Arguments

The auction purchaser, M/s Ferrous Alloy Forging Pvt. Limited, argued:

- A sale certificate issued in a court auction is not a sale deed and, therefore, does not attract stamp duty.

- Under Section 89(4) of the Registration Act, 1908, the sale certificate is only required to be filed with the Sub-Registrar and does not require compulsory registration.

- The demand for stamp duty by the Registrar was in contravention of well-established legal principles.

- The High Court was correct in exercising its writ jurisdiction as the demand was illegal and arbitrary.

Supreme Court’s Observations

The Supreme Court examined relevant legal provisions and precedents, making the following key observations:

1. Sale Certificate and Registration

The Court reiterated that a sale certificate issued in a court auction is merely evidence of the title of the auction purchaser. It does not create or extinguish any title, as the title is transferred upon confirmation of the sale by the court.

2. Applicability of Stamp Duty

The Supreme Court referred to previous judgments, including B. Arvind Kumar v. Govt. of India (2007), which held that a sale certificate issued by a court does not require compulsory registration. The Court ruled that:

- A sale certificate does not fall within the category of documents requiring compulsory registration under Section 17(1) of the Registration Act.

- Stamp duty is not payable at the time of issuance of the sale certificate unless the purchaser voluntarily seeks registration.

- The sale certificate must only be filed with the Sub-Registrar under Section 89(4) of the Registration Act.

3. Maintainability of the Writ Petition

The Court dismissed the State’s objection regarding the maintainability of the writ petition, ruling that:

- The High Court was correct in entertaining the writ petition as the demand for stamp duty was illegal.

- The principle that alternative remedies must be exhausted before invoking writ jurisdiction does not apply in cases of arbitrary and illegal action by public authorities.

Final Judgment

The Supreme Court upheld the decision of the High Court and dismissed the appeal filed by the State of Punjab. The key directives were:

- The original sale certificate must be handed over to the auction purchaser without requiring payment of stamp duty.

- A copy of the sale certificate should be sent to the Sub-Registrar for filing as per Section 89(4) of the Registration Act.

- The stamp duty deposited by the auction purchaser must be refunded.

- The sale certificate is valid evidence of title and does not require registration.

Impact of the Judgment

This ruling clarifies the legal position regarding the applicability of stamp duty to sale certificates issued in court auctions. The decision:

- Provides relief to auction purchasers by eliminating the need for unnecessary stamp duty payments.

- Strengthens the principle that sale certificates issued by courts do not require compulsory registration.

- Ensures that government authorities cannot impose stamp duty arbitrarily.

With this decision, the Supreme Court has reaffirmed the established legal principle that sale certificates in court auctions do not attract stamp duty at the time of issuance. This judgment will serve as a precedent for future cases involving similar disputes.

Petitioner Name: The State of Punjab & Anr..Respondent Name: M/S Ferrous Alloy Forgings P Ltd. & Ors..Judgment By: Justice J.B. Pardiwala, Justice R. Mahadevan.Place Of Incident: Punjab.Judgment Date: 18-11-2024.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: the-state-of-punjab-vs-ms-ferrous-alloy-fo-supreme-court-of-india-judgment-dated-18-11-2024.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Customs and Excise

See all petitions in Tax Refund Disputes

See all petitions in Banking Regulations

See all petitions in Judgment by J.B. Pardiwala

See all petitions in Judgment by R. Mahadevan

See all petitions in dismissed

See all petitions in Quashed

See all petitions in supreme court of India judgments November 2024

See all petitions in 2024 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category