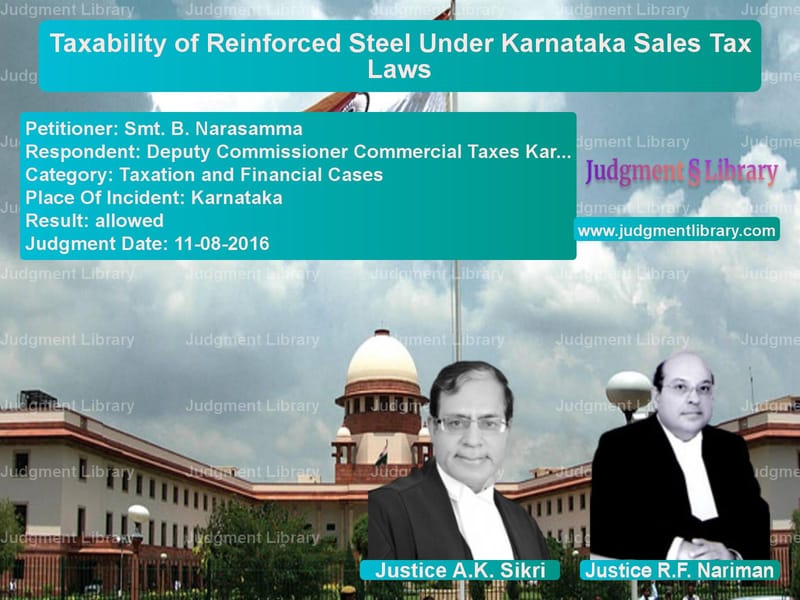

Taxability of Reinforced Steel Under Karnataka Sales Tax Laws

The Supreme Court of India recently delivered a judgment in the case of SMT. B. NARASAMMA vs. DEPUTY COMMISSIONER COMMERCIAL TAXES KARNATAKA & ANR. regarding the taxability of iron and steel reinforcements used in cement concrete structures under the Karnataka Sales Tax Act, 1957, and the Karnataka Value Added Tax Act, 2003.

The core issue in the case was whether iron and steel reinforcements retain their character as ‘iron and steel’ at the point of taxability or if they become a different taxable commodity when used in a works contract.

Background of the Case

The appellant, Smt. B. Narasamma, along with several other appellants, contested the tax levied on reinforced steel used in construction projects. The dispute revolved around whether iron and steel, when incorporated into cement structures, should continue to be taxed at the lower rate applicable to declared goods (4%) or at a higher rate applicable to general civil works contracts.

Arguments of the Petitioner

The petitioners, led by Senior Advocate Shri N. Venkatraman, contended that:

- The goods in question remained iron and steel despite being used in construction.

- Previous Supreme Court judgments in Builders’ Association of India vs. Union of India and Gannon Dunkerley & Co. vs. State of Rajasthan had already settled that tax must be levied at the point of accretion.

- Mere bending and cutting of steel rods did not change their nature, and they should still be taxed at the lower rate of 4%.

Arguments of the Respondent

The State of Karnataka, represented by Shri K.N. Bhat, argued that:

- Iron and steel products undergo transformation when incorporated into concrete structures and thus become taxable at a higher rate applicable to civil construction works.

- Reliance was placed on the Supreme Court judgment in State of Tamil Nadu vs. M/s. Pyare Lal Malhotra, which held that a change in the form of a commodity can lead to different taxation.

- Since reinforced steel became part of a building, it could not be taxed as a separate commodity.

Supreme Court’s Judgment

The Supreme Court, in its detailed judgment delivered by Justice R.F. Nariman and Justice A.K. Sikri, ruled in favor of the assessees. The key findings were:

- The ruling in Builders’ Association of India and Gannon Dunkerley was reaffirmed, stating that works contracts must comply with Section 15 of the Central Sales Tax Act, which restricts tax rates to 4%.

- The Court noted that mere bending and tying of steel rods did not alter their identity as iron and steel.

- The Supreme Court set aside the Karnataka High Court’s decision, ruling that reinforced steel should continue to be taxed as declared goods.

Conclusion

This judgment reinforces the principle that goods declared to be of special importance in inter-state trade cannot be arbitrarily taxed at a higher rate merely due to their usage in works contracts. The ruling will have a significant impact on taxation policies related to construction materials in Karnataka.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Smt. B. Narasamma vs Deputy Commissioner Supreme Court of India Judgment Dated 11-08-2016-1741878505880.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Income Tax Disputes

See all petitions in Tax Refund Disputes

See all petitions in Customs and Excise

See all petitions in Judgment by A.K. Sikri

See all petitions in Judgment by Rohinton Fali Nariman

See all petitions in allowed

See all petitions in supreme court of India judgments August 2016

See all petitions in 2016 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category