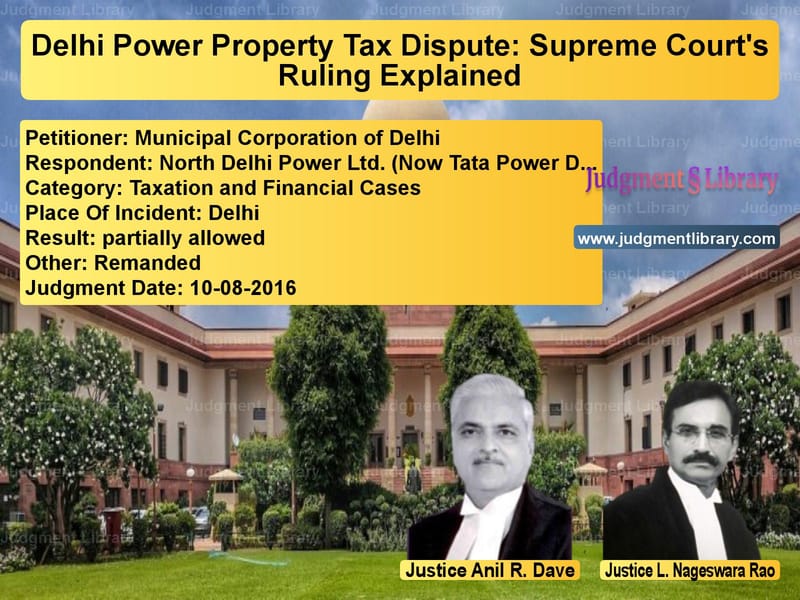

Delhi Power Property Tax Dispute: Supreme Court’s Ruling Explained

The case of Municipal Corporation of Delhi v. North Delhi Power Ltd. (Now Tata Power Delhi Distribution Ltd.) was a landmark legal battle regarding the applicability of property tax on a plot of 8,080 square meters. The Supreme Court, in its judgment dated August 10, 2016, analyzed the legal intricacies of municipal taxation, property ownership, and the licensing structure under the Delhi Electricity Reforms Act, 2000.

The case revolved around whether North Delhi Power Ltd. (later Tata Power Delhi Distribution Ltd.) was liable to pay property tax on the disputed land, or whether it was exempt due to its status as a licensee under the Delhi Government.

Background of the Case

The Municipal Corporation of Delhi (MCD) had determined the rateable value of a vacant plot allotted to North Delhi Power Ltd. (NDPL) at Rs. 58,53,960/- with effect from April 1, 2002. This led to the filing of an appeal by NDPL under Section 169 of the Delhi Municipal Corporation Act, 1957, contesting the tax liability.

The Additional District Judge ruled in favor of NDPL, stating that the land belonged to the Delhi Government and, therefore, was exempt from taxation under Section 119(1) of the Delhi Municipal Corporation Act. However, the High Court later reversed this decision, holding NDPL liable for the tax.

Key Legal Issues

The Supreme Court had to determine:

- Whether NDPL, as a licensee under the Delhi Electricity Reforms Act, was liable to pay property tax.

- Whether the land in question was owned by the Delhi Government or the Delhi Power Company Ltd. (the holding company).

- How the Delhi Electricity Reforms (Transfer Scheme) Rules, 2001, affected the taxability of the land.

Petitioner’s Arguments (Municipal Corporation of Delhi)

The MCD contended:

- The land was owned by the holding company, Delhi Power Company Ltd., and not the Government.

- Under Section 120(1)(c) of the Delhi Municipal Corporation Act, the entity with the right to let out unlet property was liable to pay taxes.

- NDPL had the right to sublet the property, making it responsible for the tax payment.

Respondent’s Arguments (Tata Power Delhi Distribution Ltd.)

NDPL, now Tata Power Delhi Distribution Ltd., argued:

- The land belonged to the Delhi Government, making it exempt from property tax under Section 119(1) of the Delhi Municipal Corporation Act.

- NDPL was merely a licensee and not a lessee, and therefore, it did not qualify as a taxable entity under the Delhi Municipal Corporation Act.

- The government’s decision on ownership, as per Rule 12(1) of the Transfer Scheme Rules, was final and binding.

Supreme Court’s Observations and Ruling

The Supreme Court examined the statutory provisions and previous rulings. The key observations from the judgment were:

On Ownership of the Land

“The land initially vested in the Government as a transitory step, but the final ownership was transferred to the holding company, Delhi Power Company Ltd.”

Thus, the court ruled that the land was not exempt under Section 119(1), as it was no longer government property.

On Tax Liability Under Section 120(1)(c)

The court clarified:

“If the distribution licence empowers the Distribution Company to let out the land, it would still have to pay the tax, notwithstanding its status as a licensee.”

This meant that Tata Power Delhi Distribution Ltd. could not claim exemption solely based on its licensee status.

On Remanding the Matter

The court upheld the High Court’s decision to remand the case to the Deputy Assessor and Collector of the MCD to determine whether the liability fell on the Distribution Company or the Holding Company.

Final Supreme Court Order

The court disposed of the appeals with the following directive:

“The Deputy Assessor and Collector of Municipal Corporation of Delhi shall consider the provisions of the Delhi Municipal Corporation Act, Delhi Electricity Reforms Act, Transfer Scheme Rules, and the Distribution licence for deciding the matter pertaining to the incidence of tax.”

Key Takeaways

- Ownership of the land was with the holding company, not the government, making it taxable.

- Licensee status did not automatically exempt a company from property tax.

- The authority to let out the property was a crucial factor in determining tax liability.

- The Supreme Court upheld the High Court’s order to remand the case for reassessment.

Impact of the Ruling

The decision established an important precedent in municipal taxation, particularly concerning corporate entities operating under government-granted licenses. The ruling ensured that companies benefiting from government land would not escape taxation based solely on their licensee status.

Ultimately, this case reaffirmed the principles of property taxation and clarified the legal position regarding government-owned land, leased or licensed to private entities.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Municipal Corporatio vs North Delhi Power Lt Supreme Court of India Judgment Dated 10-08-2016-1741878403986.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Income Tax Disputes

See all petitions in Judgment by Anil R. Dave

See all petitions in Judgment by L. Nageswara Rao

See all petitions in partially allowed

See all petitions in Remanded

See all petitions in supreme court of India judgments August 2016

See all petitions in 2016 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category