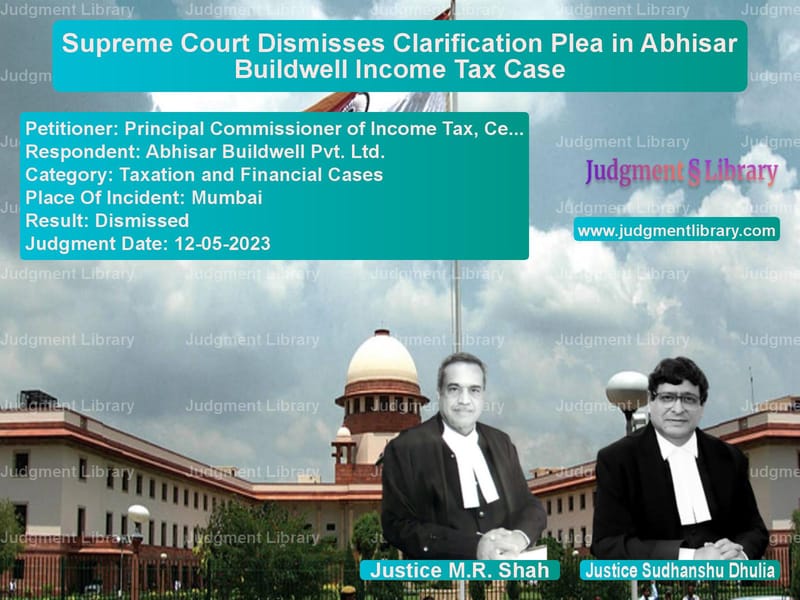

Supreme Court Dismisses Clarification Plea in Abhisar Buildwell Income Tax Case

The case of Principal Commissioner of Income Tax, Central-3 v. Abhisar Buildwell Pvt. Ltd. revolves around the applicability of Section 150(2) of the Income Tax Act, 1961, in reassessment proceedings initiated after a search operation. The Revenue filed a miscellaneous application seeking clarification on the limitation period for reassessment and the scope of findings in earlier Supreme Court rulings.

This judgment is significant as it addresses procedural limitations in reopening tax assessments and ensures that reassessment proceedings follow the prescribed legal framework.

Background of the Case

The dispute arose after a search operation was conducted on Abhisar Buildwell Pvt. Ltd., leading to the initiation of proceedings under Section 153A and Section 153C of the Income Tax Act. The Revenue sought to clarify whether:

- Reassessment could be initiated under Sections 147 and 148 for income that had escaped assessment, even if such income was not based on incriminating material found during the search.

- The findings in paragraphs 11 and 14 of an earlier Supreme Court judgment applied to all pending proceedings.

- The Assessing Officer (AO) had the power to initiate fresh reassessment proceedings within 60 days from the disposal of this application.

The Supreme Court had previously ruled that in the absence of incriminating material found during a search, assessments made under Section 153A and 153C could not include income that had escaped assessment independently. The Revenue sought clarification on whether such income could still be reassessed under general reassessment provisions.

Petitioner’s Arguments

The appellant, Principal Commissioner of Income Tax, Central-3, represented by Senior Advocate Neetu Sachdeva, contended:

- The Revenue was not seeking a review but merely a clarification on the applicability of Section 150(2) and reassessment provisions.

- The limitation for issuing a reassessment notice should be read in light of when an assessment under Section 153A or 153C was passed.

- Even if assessments under Section 153A and 153C were quashed due to the absence of incriminating material, the AO should still have the power to reassess such income under Section 147/148.

- The clarification sought was procedural and did not affect the substantive findings of the earlier Supreme Court judgment.

Respondent’s Arguments

The respondent, Abhisar Buildwell Pvt. Ltd., represented by Senior Advocate Dinesh Kumar, countered:

- The Revenue was effectively seeking a review of the Supreme Court’s judgment, which was not permissible through a clarification application.

- The reassessment provisions had to be applied strictly as per the statutory limitation periods.

- The Revenue was attempting to reopen assessments beyond the prescribed limitation period through procedural maneuvers.

- Once an assessment under Section 153A/153C was quashed, any attempt to reassess income that was not discovered during the search would violate the principle of finality in taxation.

Supreme Court Judgment

The case was heard by Justice M.R. Shah and Justice Sudhanshu Dhulia. The Supreme Court dismissed the Revenue’s clarification application and advised the government to file an appropriate review petition instead.

1. Clarification Application Cannot Be Used as a Review

The Court ruled that the clarification sought by the Revenue was, in effect, a review:

“Having gone through the averments made in the application and the prayers, we are of the opinion that the prayers sought can be said to be in the form of review which requires detailed consideration at length looking into the importance of the matter.”

2. Revenue Must File a Review Application

The Court directed the Revenue to file a formal review petition instead of seeking clarification:

“The present application in the form of clarification is not entertained and we relegate the Revenue to file an appropriate review application for the relief sought in the present application.”

3. No Decision on Merits

The Court clarified that it was not expressing any opinion on the merits of the Revenue’s plea:

“We observe that as we have not entered into the merits of the present application and we relegate the Revenue to file an appropriate review application, the review application be decided and disposed of in accordance with law and on its own merits.”

Read also: https://judgmentlibrary.com/supreme-court-orders-fresh-decision-in-income-tax-settlement-case/

Final Verdict

The Supreme Court ruled:

- The clarification application was dismissed.

- The Revenue was directed to file a review petition if it sought reconsideration of the previous ruling.

- No observations were made on the merits of the reassessment issue.

Conclusion

This judgment reinforces the principle that procedural applications cannot be used to bypass the established process of review. The ruling ensures that reassessment proceedings adhere to statutory limitations and protects taxpayers from prolonged litigation on settled matters.

Petitioner Name: Principal Commissioner of Income Tax, Central-3.Respondent Name: Abhisar Buildwell Pvt. Ltd..Judgment By: Justice M.R. Shah, Justice Sudhanshu Dhulia.Place Of Incident: Mumbai.Judgment Date: 12-05-2023.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: principal-commission-vs-abhisar-buildwell-pv-supreme-court-of-india-judgment-dated-12-05-2023.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Income Tax Disputes

See all petitions in Tax Evasion Cases

See all petitions in Tax Refund Disputes

See all petitions in Judgment by Mukeshkumar Rasikbhai Shah

See all petitions in Judgment by Sudhanshu Dhulia

See all petitions in dismissed

See all petitions in supreme court of India judgments May 2023

See all petitions in 2023 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category