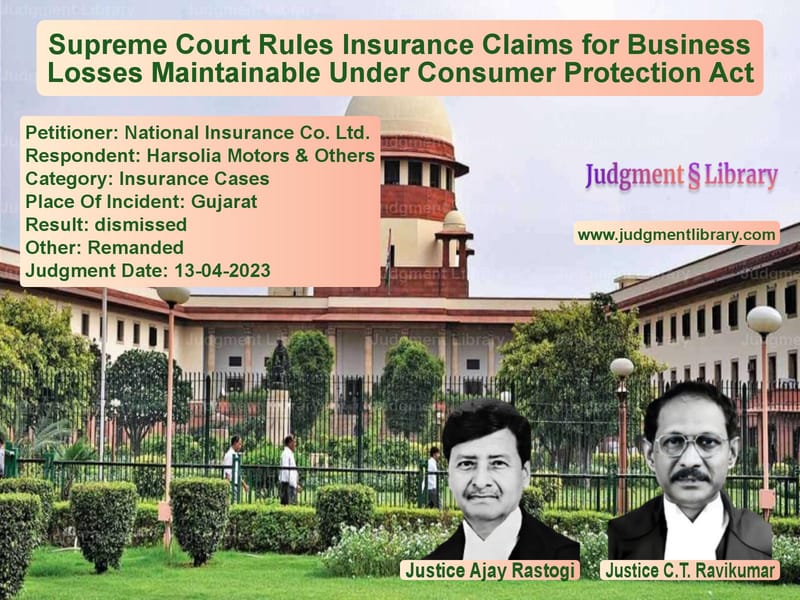

Supreme Court Rules Insurance Claims for Business Losses Maintainable Under Consumer Protection Act

The Supreme Court of India in National Insurance Co. Ltd. vs. Harsolia Motors & Others addressed a crucial issue regarding the maintainability of insurance claims filed by commercial enterprises under the Consumer Protection Act, 1986. The Court ruled that businesses that purchase insurance for risk indemnification are considered ‘consumers’ and can seek relief under the Act.

This judgment resolves a long-standing debate on whether corporate entities can file consumer complaints against insurers when insurance policies are taken for business protection rather than direct profit-making.

Background of the Case

The case emerged when Harsolia Motors and another business entity filed claims under their fire insurance policies after suffering damages during the 2002 Godhra riots. Harsolia Motors had taken an insurance policy covering Rs. 75.38 lakh, and another claimant had insurance coverage of Rs. 90 lakh.

Following the riots, their insured properties were damaged due to fire. While one of the claimants was compensated partially, the insurer National Insurance Co. Ltd. rejected Harsolia Motors’ claim, leading to a consumer complaint before the Gujarat State Consumer Disputes Redressal Commission.

Key Legal Issues

1. Can a business entity claim insurance as a ‘consumer’ under the Consumer Protection Act?

2. Does purchasing an insurance policy for business protection amount to a ‘commercial purpose’?

3. Does the Consumer Protection Act cover insurance disputes of commercial entities?

Arguments Presented

Petitioner (National Insurance Co. Ltd.) Arguments

- Businesses take insurance policies as part of risk management in commercial activities.

- Section 2(1)(d) of the Consumer Protection Act excludes transactions for ‘commercial purposes’.

- Allowing corporate entities to seek relief under the Consumer Protection Act would defeat the purpose of commercial courts under the Commercial Courts Act, 2015.

- Insurance claims by businesses should be treated as commercial disputes and not consumer grievances.

Respondents (Harsolia Motors & Others) Arguments

- Insurance policies are contracts of indemnity and are not intended to generate profit.

- Losses suffered in business operations due to unforeseen events do not fall under ‘commercial purpose’.

- The Consumer Protection Act was enacted to safeguard consumer rights, and insurance services should not be excluded.

- Rejecting insurance claims arbitrarily harms both businesses and individuals who rely on insurance for risk mitigation.

Supreme Court’s Observations

The Supreme Court, led by Justices Ajay Rastogi and C.T. Ravikumar, made the following key observations:

- Section 2(1)(d) of the Consumer Protection Act defines ‘consumer’ as any person who avails goods or services, excluding those used directly for profit generation.

- Insurance is a service that provides indemnity against unforeseen risks rather than a means of earning profit.

- A business purchasing insurance is protecting itself from financial loss rather than engaging in profit-making.

- The distinction must be made between activities undertaken to generate profit and risk management measures such as insurance.

- Claims under business insurance policies can be entertained under the Consumer Protection Act.

The Court stated:

“The hiring of insurance policy is clearly an act for indemnifying a risk of loss/damages, and there is no element of profit generation.”

Final Judgment

The Supreme Court ruled as follows:

- The judgment of the National Consumer Disputes Redressal Commission (NCDRC) recognizing the claims as maintainable was upheld.

- Commercial entities that avail insurance solely for indemnity against risks are considered ‘consumers’ under the Consumer Protection Act.

- State Consumer Commissions must adjudicate such cases on their merits without dismissing them as commercial disputes.

Implications of the Judgment

The ruling has significant implications for businesses and insurers:

- Expanded Consumer Protection: Commercial entities can now approach consumer forums for claims related to insurance disputes.

- Prevention of Arbitrary Denial: Insurers cannot reject claims under the pretext of commercial purpose.

- Judicial Precedent: Future cases involving insurance disputes for businesses will be assessed under consumer law.

- Impact on Insurance Industry: The ruling may lead to increased accountability for insurance companies in claim settlements.

Conclusion

The Supreme Court’s ruling in National Insurance Co. Ltd. vs. Harsolia Motors & Others reaffirms that insurance contracts are meant for indemnity rather than commercial profit. By allowing businesses to seek relief under consumer law, the judgment strengthens the rights of policyholders against arbitrary claim rejections by insurers.

Read also: https://judgmentlibrary.com/supreme-court-rules-on-insurance-liability-for-election-duty-deaths/

This decision marks a landmark shift in insurance jurisprudence, ensuring fair play in commercial insurance disputes while protecting consumer rights.

Petitioner Name: National Insurance Co. Ltd..Respondent Name: Harsolia Motors & Others.Judgment By: Justice Ajay Rastogi, Justice C.T. Ravikumar.Place Of Incident: Gujarat.Judgment Date: 13-04-2023.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: national-insurance-c-vs-harsolia-motors-&-ot-supreme-court-of-india-judgment-dated-13-04-2023.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Commercial Insurance Disputes

See all petitions in Insurance Settlements

See all petitions in Other Insurance Cases

See all petitions in Judgment by Ajay Rastogi

See all petitions in Judgment by C.T. Ravikumar

See all petitions in dismissed

See all petitions in Remanded

See all petitions in supreme court of India judgments April 2023

See all petitions in 2023 judgments

See all posts in Insurance Cases Category

See all allowed petitions in Insurance Cases Category

See all Dismissed petitions in Insurance Cases Category

See all partially allowed petitions in Insurance Cases Category