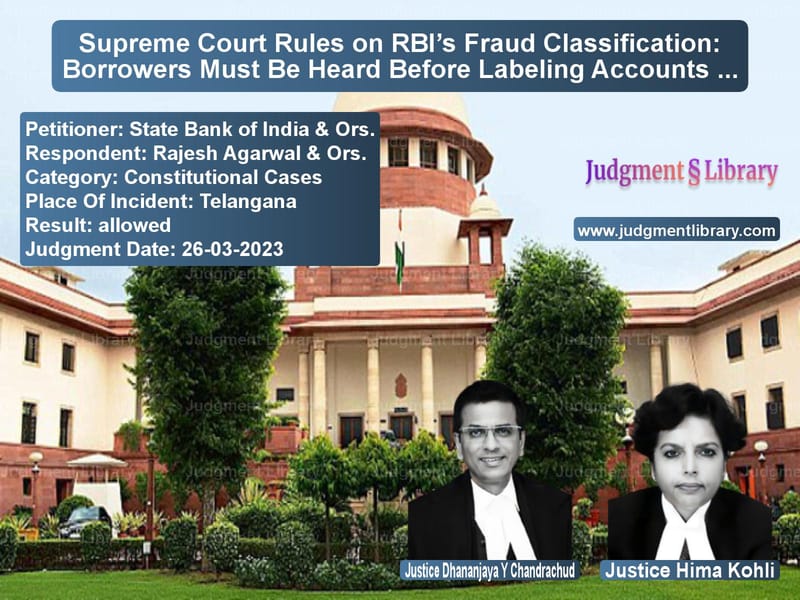

Supreme Court Rules on RBI’s Fraud Classification: Borrowers Must Be Heard Before Labeling Accounts as Fraud

The Supreme Court of India has recently delivered a significant judgment in the case of State Bank of India & Ors. v. Rajesh Agarwal & Ors., addressing the contentious issue of whether banks can classify a borrower’s account as fraudulent without giving them a hearing. The decision holds that the principles of natural justice must be upheld, and borrowers should be given an opportunity to defend themselves before their accounts are categorized as fraud.

This ruling has wide-ranging implications for borrowers, banks, and financial institutions, as it affects the implementation of the Reserve Bank of India’s (RBI) Master Directions on Frauds Classification and Reporting by Commercial Banks, which allows banks to unilaterally label accounts as fraudulent.

Background of the Case

The appeals before the Supreme Court arose from the RBI’s Master Directions, which permitted banks to classify accounts as fraudulent based on forensic audits and internal investigations. Borrowers across various High Courts had challenged this classification, arguing that they were not given a fair hearing before their accounts were marked as fraud.

The Telangana High Court ruled in favor of the borrowers, stating that natural justice must be read into the RBI’s guidelines. The RBI and lending banks appealed this decision before the Supreme Court.

Petitioners’ Arguments (State Bank of India & Ors.)

The banks and RBI, represented by Solicitor General Tushar Mehta, argued:

- The classification of an account as fraud is a necessary step to protect depositors and maintain financial discipline.

- Borrowers do not have a fundamental right to be heard before a fraud classification, as it is an internal banking matter.

- Fraud detection requires swift action, and delaying it with hearings would hamper investigations.

- The classification merely triggers a reporting obligation to investigative agencies; the final determination of fraud remains with the law enforcement authorities.

Respondents’ Arguments (Rajesh Agarwal & Ors.)

The borrowers, represented by Senior Advocate Dr. Abhishek Manu Singhvi, countered:

- Labeling an account as fraud has severe civil consequences, including debarring borrowers from accessing institutional finance for five years.

- The principle of audi alteram partem (right to be heard) is fundamental and should apply before such an adverse classification.

- The forensic audit process is flawed as it is often conducted without the borrower’s participation.

- In other areas of law, including willful defaulter classifications, borrowers are given a fair hearing; fraud classification should not be an exception.

Supreme Court’s Judgment

The Supreme Court, led by Chief Justice Dhananjaya Y Chandrachud, upheld the Telangana High Court’s ruling and held that the RBI’s fraud classification guidelines must comply with the principles of natural justice.

“The principles of natural justice, particularly the rule of audi alteram partem, has to be necessarily read into the Master Directions on Frauds to save it from the vice of arbitrariness.”

The Court ruled that:

- Borrowers must be given a hearing before their accounts are classified as fraudulent.

- Banks must furnish a copy of the forensic audit report to the borrower.

- Borrowers should have the right to submit their representations before any fraud classification decision is finalized.

- The final decision must be reasoned and communicated to the borrower.

Implications of the Judgment

This ruling has significant consequences for the banking and financial sectors:

- Banks must modify their fraud classification process to ensure due process.

- Borrowers have gained additional legal protections against arbitrary classifications.

- The judgment reinforces the importance of procedural fairness in financial regulations.

- The ruling may prompt the RBI to amend its Master Directions to include a formal hearing process.

Conclusion

The Supreme Court’s decision in State Bank of India & Ors. v. Rajesh Agarwal & Ors. establishes a crucial precedent in banking law. By ensuring that borrowers are given a fair hearing before their accounts are marked as fraudulent, the Court has reinforced the constitutional principle of natural justice.

This ruling balances the need for effective fraud detection with the protection of borrower rights, ensuring that financial institutions operate with transparency and accountability.

Petitioner Name: State Bank of India & Ors..Respondent Name: Rajesh Agarwal & Ors..Judgment By: Justice Dhananjaya Y Chandrachud, Justice Hima Kohli.Place Of Incident: Telangana.Judgment Date: 26-03-2023.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: state-bank-of-india-vs-rajesh-agarwal-&-ors-supreme-court-of-india-judgment-dated-26-03-2023.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Fundamental Rights

See all petitions in Public Interest Litigation

See all petitions in Separation of Powers

See all petitions in Legislative Powers

See all petitions in Judgment by Dhananjaya Y Chandrachud

See all petitions in Judgment by Hima Kohli

See all petitions in allowed

See all petitions in supreme court of India judgments March 2023

See all petitions in 2023 judgments

See all posts in Constitutional Cases Category

See all allowed petitions in Constitutional Cases Category

See all Dismissed petitions in Constitutional Cases Category

See all partially allowed petitions in Constitutional Cases Category