GST Exemption Dispute: Analyzing the Conflict Over Tax Refunds in India’s New Tax Regime

The case at hand revolves around two industrial giants, Hero Motocorp Ltd. and Sun Pharma Laboratories Ltd., who contested the decision of the Union of India regarding the reduction of their tax exemptions after the introduction of the Goods and Services Tax (GST) system in India. The crux of the matter is whether the Union of India was bound to honor the promises made under the Office Memorandum (O.M.) of 2003, which granted 100% excise duty exemption to industrial units in the states of Uttarakhand and Himachal Pradesh. These promises were made to attract investments into the region, with a clear stipulation that the benefit would last for a decade from the commencement of production. However, after the GST regime was introduced in July 2017, this exemption was reduced to 58%. The appellants, relying on the earlier promises, sought the restoration of the full 100% exemption, which led to the appeals in the Supreme Court.

Let’s delve into the arguments presented by both the petitioners and the respondents, and the Supreme Court’s interpretation of the laws and policies involved in this landmark case.

Petitioner Arguments

Shri S. Ganesh, learned Senior Counsel appearing for Hero Motocorp Ltd., argued that the Union of India was bound by the unequivocal representation made in the Office Memorandum (O.M.) of 2003. He asserted that both the companies, Hero Motocorp and Sun Pharma, had set up their industries in reliance on the 100% excise duty exemption promised by the government. The appellant argued that the government could not now resile from its promise. He further contended that the reduction in the exemption to 58% under the new GST system was arbitrary, and the Union should have continued to honor its previous commitment.

Shri Ganesh highlighted that the earlier system had worked with a clear understanding between the Union and the States regarding the distribution of excise duties, and no reasonable justification had been provided for why the same should not continue under the new GST regime. He referred to judicial precedents where promises made by the government had to be respected, particularly in cases where the promise had been relied upon by the recipients.

He further argued that the policy reflected in the O.M. of 2003 stood on a higher pedestal than the statutory provisions and that the government was bound to uphold it. Additionally, he invoked Section 11 of the Central Goods and Services Tax (CGST) Act, suggesting that the government had the authority to grant the exemption and should have done so in the present case.

Shri Ganesh emphasized that the appeals deserved to be allowed and the Court should direct the Union to reimburse the 100% Central Goods and Services Tax (CGST) for the remainder of the period.

Respondent Arguments

On the other side, Shri N. Venkatraman, the learned Additional Solicitor General, represented the Union of India. His defense was rooted in the notion that promissory estoppel could not be applied against the government, especially in cases where there was a material change in circumstances that served the larger public interest. Venkatraman highlighted that the introduction of the GST system marked a monumental shift in India’s tax structure, and that both the Union and States were now equal partners in the levy and collection of taxes.

Shri Venkatraman argued that the new GST regime, being a destination-based tax, was a fundamental change compared to the earlier origin-based taxation. This shift made it impractical for the Union to continue granting tax exemptions under the old system. He cited the constitutional amendments and the subsequent enactment of the CGST Act, asserting that the legislative changes took precedence over the representations made in the O.M. of 2003.

The learned ASG also referred to Section 174 of the CGST Act, which specifically provided for the cessation of exemptions under earlier laws, including excise duty exemptions. He contended that the tax exemption could not continue as a privilege once rescinded by the new legislation.

In terms of the application of promissory estoppel, Shri Venkatraman pointed out that this doctrine could not be invoked against legislative or sovereign functions of the government, especially when it involved large-scale public interest issues like the introduction of GST.

Supreme Court’s Judgment

The Supreme Court, in its judgment delivered by B.R. Gavai, J., began by acknowledging the promise made in the O.M. of 2003, which granted 100% excise duty exemption to new and expanded industries in certain states, including Uttarakhand and Himachal Pradesh. However, the Court noted that a significant legal and policy change occurred with the introduction of the Goods and Services Tax system, which fundamentally altered the structure of indirect taxation in India.

The Court explored the concept of promissory estoppel and whether it could apply to a case where the law had changed. It held that while promissory estoppel could prevent the government from backing out of a promise that had led to a change in position by the parties involved, it could not apply in the face of a statutory change that was enacted in the public interest. The Court referred to several precedents where it had held that such estoppel could not operate against the legislative or sovereign functions of the state.

Importantly, the Court held that the introduction of GST and the subsequent rescinding of the earlier exemption notifications under the new tax system was a valid exercise of legislative power. The Court stated that the Union was not bound to continue with the 100% exemption promised in the O.M. of 2003, particularly in light of the changes brought about by the constitutional amendments and the enactment of the CGST Act.

While the Court acknowledged the legitimate expectations of the appellants, it found that the claims for 100% refund were without merit as they were based on the now-rescinded O.M. of 2003. However, the Court observed that the appellants did have a legitimate expectation and directed the respective State Governments and the GST Council to consider such representations in light of the facts of the case, including the fact that the appellants’ units were based in the Himalayan and North-Eastern States, where employment was at stake.

Conclusion

The judgment marked a significant moment in the intersection of law and policy, particularly concerning the issue of tax exemptions and public policy. While the appellants’ legal claims were rejected, the Court’s suggestion that the States and GST Council consider the legitimate expectation of the appellants reflects a balanced approach in dealing with the complexities arising from the introduction of the GST regime.

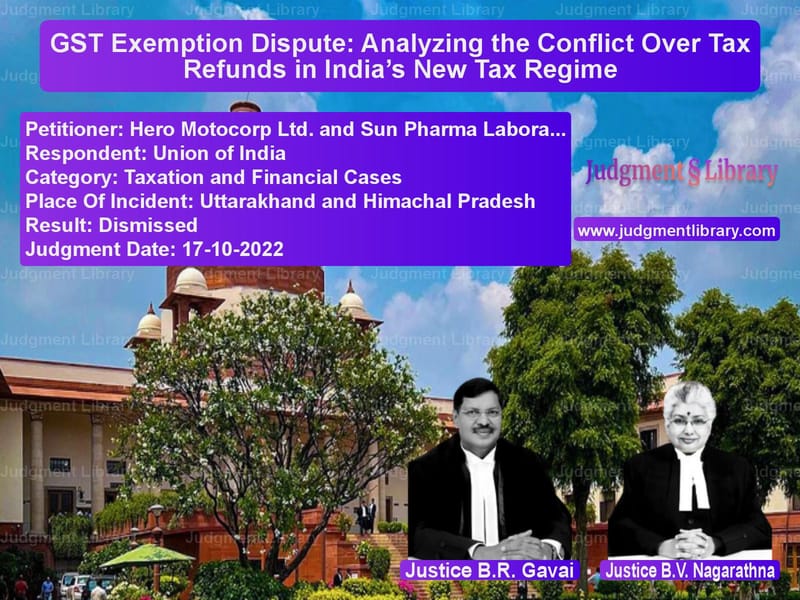

Petitioner Name: Hero Motocorp Ltd. and Sun Pharma Laboratories Ltd..Respondent Name: Union of India.Judgment By: Justice B.R. Gavai, Justice B.V. Nagarathna.Place Of Incident: Uttarakhand and Himachal Pradesh.Judgment Date: 17-10-2022.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: hero-motocorp-ltd.-a-vs-union-of-india-supreme-court-of-india-judgment-dated-17-10-2022.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Income Tax Disputes

See all petitions in GST Law

See all petitions in Tax Evasion Cases

See all petitions in Banking Regulations

See all petitions in Tax Refund Disputes

See all petitions in Judgment by B R Gavai

See all petitions in Judgment by B.V. Nagarathna

See all petitions in dismissed

See all petitions in supreme court of India judgments October 2022

See all petitions in 2022 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category