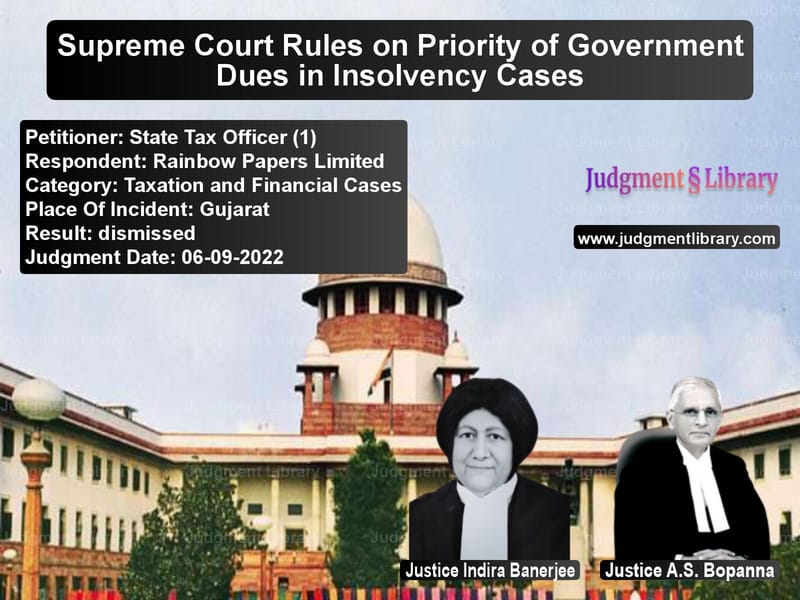

Supreme Court Rules on Priority of Government Dues in Insolvency Cases

The Supreme Court of India has delivered a landmark judgment in the case of State Tax Officer (1) vs. Rainbow Papers Limited, addressing the conflict between state tax dues and the Insolvency and Bankruptcy Code, 2016 (IBC). The Court ruled that government tax dues under the Gujarat Value Added Tax Act (GVAT Act) do not take precedence over the provisions of the IBC, specifically Section 53, which determines the order of distribution of assets in insolvency proceedings.

Background of the Case

The case arose from insolvency proceedings initiated against Rainbow Papers Limited, a company engaged in manufacturing craft paper and boards. The company had accumulated tax dues amounting to Rs. 53.71 crores under the GVAT Act, 2003. The appellant, the State Tax Officer (1), attempted to recover the outstanding dues through recovery proceedings.

However, during the Corporate Insolvency Resolution Process (CIRP), the tax department’s claim was filed late and was not considered by the Resolution Professional (RP). The Resolution Plan approved by the Committee of Creditors (CoC) did not include the government’s dues. The State Tax Department challenged this before the National Company Law Tribunal (NCLT), which ruled against it. The decision was upheld by the National Company Law Appellate Tribunal (NCLAT), leading to an appeal before the Supreme Court.

Legal Arguments

Arguments by the State Tax Officer

- The government argued that Section 48 of the GVAT Act provides that tax dues constitute a ‘first charge’ over the property of the dealer.

- Since Rainbow Papers owed Rs. 53.71 crores in tax dues, the state claimed priority over other creditors.

- The appellant contended that as per Section 3(30) and 3(31) of the IBC, the state should be considered a ‘secured creditor’ due to the charge created under the GVAT Act.

- It was argued that statutory dues should not be waived off under a resolution plan and that excluding them from the plan was against the law.

Arguments by Rainbow Papers Limited

- The respondent contended that the IBC provides a comprehensive mechanism for dealing with debts and overrides state laws that contradict its provisions.

- The priority of payments is governed by Section 53 of the IBC, which clearly ranks government dues lower than secured financial creditors and workmen’s dues.

- The respondent argued that the state’s claim was submitted after the deadline for filing claims, making it ineligible for consideration under the CIRP process.

Supreme Court’s Observations

The Supreme Court, led by Justice Indira Banerjee and Justice A.S. Bopanna, analyzed the arguments and provided the following key rulings:

1. IBC Overrides State Tax Laws

The Court reaffirmed that the IBC is a comprehensive code for insolvency resolution and takes precedence over conflicting state laws, including Section 48 of the GVAT Act.

2. Government Cannot Claim First Charge

The Court ruled that despite Section 48 of the GVAT Act granting priority to tax dues, it does not override Section 53 of the IBC, which outlines the waterfall mechanism for distributing liquidation proceeds.

3. Definition of Secured Creditor

The Court rejected the argument that the state is a secured creditor under the IBC. It held that a security interest must be created through a voluntary transaction, not merely by operation of law.

4. Late Filing of Claims

The Court observed that the tax department’s claim was filed belatedly and was rightly excluded from the resolution plan. It emphasized that adherence to timelines under the IBC is crucial for effective insolvency resolution.

Read also: https://judgmentlibrary.com/income-tax-deduction-on-bad-debts-supreme-court-ruling-explained/

Final Verdict

The Supreme Court dismissed the appeal and ruled as follows:

- The government’s tax claim does not take precedence over other creditors in insolvency proceedings.

- Section 53 of the IBC prevails over Section 48 of the GVAT Act.

- The state tax department cannot be treated as a secured creditor.

- Late submission of claims cannot be entertained under the CIRP framework.

Impact of the Judgment

This judgment has significant implications for insolvency cases and government tax claims:

- It reaffirms the supremacy of the IBC over state laws in insolvency matters.

- Government tax departments cannot claim priority over financial creditors and operational creditors.

- Statutory dues must be filed within the prescribed timelines to be considered in insolvency proceedings.

Conclusion

The Supreme Court’s ruling in State Tax Officer vs. Rainbow Papers Limited provides clarity on the treatment of government dues in insolvency cases. By upholding the primacy of the IBC, the judgment ensures a uniform and efficient insolvency resolution process, preventing undue interference by state authorities.

Petitioner Name: State Tax Officer (1).Respondent Name: Rainbow Papers Limited.Judgment By: Justice Indira Banerjee, Justice A.S. Bopanna.Place Of Incident: Gujarat.Judgment Date: 06-09-2022.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: state-tax-officer-(1-vs-rainbow-papers-limit-supreme-court-of-india-judgment-dated-06-09-2022.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Tax Refund Disputes

See all petitions in Customs and Excise

See all petitions in Banking Regulations

See all petitions in Judgment by Indira Banerjee

See all petitions in Judgment by A. S. Bopanna

See all petitions in dismissed

See all petitions in supreme court of India judgments September 2022

See all petitions in 2022 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category