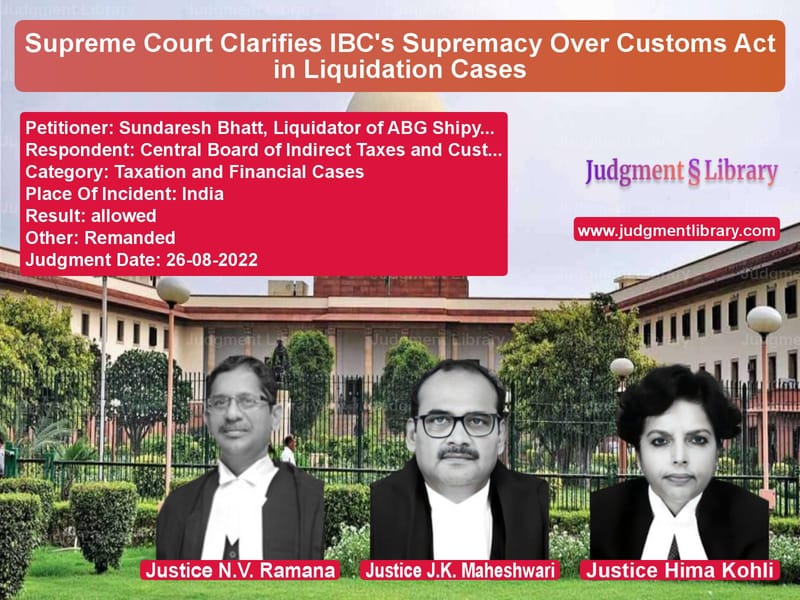

Supreme Court Clarifies IBC’s Supremacy Over Customs Act in Liquidation Cases

The Supreme Court has issued a landmark ruling in the case of Sundaresh Bhatt, Liquidator of ABG Shipyard vs. Central Board of Indirect Taxes and Customs, clarifying the interplay between the Insolvency and Bankruptcy Code, 2016 (IBC), and the Customs Act, 1962. The ruling settles crucial questions on the powers of the Liquidator and the priority of claims in insolvency proceedings.

Background of the Case

ABG Shipyard, a major shipbuilding company, was undergoing Corporate Insolvency Resolution Process (CIRP) under the IBC. During its operations, the company had imported goods and stored them in Customs Bonded Warehouses in Gujarat and Maharashtra. However, as the company entered insolvency, it faced multiple claims, including customs duties for these goods.

The Liquidator sought possession of the warehoused goods for sale as part of the liquidation process. However, the Customs authorities opposed this, demanding payment of outstanding duties before releasing the goods.

The dispute reached the National Company Law Tribunal (NCLT), which ruled in favor of the Liquidator, directing Customs to release the goods without payment of duties. The decision was later overturned by the National Company Law Appellate Tribunal (NCLAT), which held that customs authorities retained the right to seize and sell the goods for duty recovery.

Arguments of the Parties

Petitioner’s Arguments (Liquidator of ABG Shipyard)

- The Liquidator argued that once insolvency proceedings commence, all claims against the Corporate Debtor must be resolved through the IBC framework.

- He contended that the moratorium under Sections 14 and 33(5) of the IBC bars customs authorities from enforcing their claims independently.

- He asserted that warehoused goods remain part of the Corporate Debtor’s estate and should be available for liquidation.

- The Customs Department had already submitted claims under the IBC, demonstrating its acknowledgment that it was bound by the Code.

Respondent’s Arguments (Customs Department)

- The Customs Department claimed that warehoused goods are subject to customs duty, and the importer (Corporate Debtor) loses its rights over the goods if duties remain unpaid.

- It relied on Sections 48 and 72 of the Customs Act, arguing that the company had relinquished ownership by failing to clear duties.

- The Department asserted that the Customs Act grants it superior rights to recover dues from the sale of goods.

- It argued that liquidation under the IBC does not override statutory obligations under the Customs Act.

Supreme Court’s Observations and Ruling

After reviewing the legal provisions and precedents, the Supreme Court issued a decisive ruling in favor of the Liquidator.

Key Observations:

- IBC Overrides the Customs Act: The Court reaffirmed that the IBC, as a later and more comprehensive law, takes precedence over the Customs Act in insolvency cases.

- Moratorium Applies to Customs Proceedings: The Court clarified that once insolvency proceedings commence, all enforcement actions against the Corporate Debtor, including those by customs authorities, must cease.

- Limited Role of Customs Authorities: The Court held that customs authorities can assess duties and file claims but cannot seize or auction assets independently.

- Customs Dues Are Operational Debts: The ruling confirmed that customs dues must be treated as operational debts under the IBC and ranked accordingly in the distribution hierarchy.

Impact of the Judgment

The Supreme Court’s decision establishes a clear precedent on the role of government authorities in insolvency cases:

- Customs authorities can determine duties but must claim them through the IBC process.

- Government dues do not get priority over secured creditors and other stakeholders in liquidation.

- The ruling ensures a uniform application of insolvency laws and prevents parallel proceedings by regulatory bodies.

Conclusion

This judgment reinforces the supremacy of the IBC in insolvency proceedings, providing clarity on the treatment of government dues. It protects the rights of creditors and ensures that liquidation processes are not disrupted by independent enforcement actions.

Read also: https://judgmentlibrary.com/supreme-court-clarifies-high-court-jurisdiction-in-income-tax-appeals/

Petitioner Name: Sundaresh Bhatt, Liquidator of ABG Shipyard.Respondent Name: Central Board of Indirect Taxes and Customs.Judgment By: Justice N.V. Ramana, Justice J.K. Maheshwari, Justice Hima Kohli.Place Of Incident: India.Judgment Date: 26-08-2022.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: sundaresh-bhatt,-liq-vs-central-board-of-ind-supreme-court-of-india-judgment-dated-26-08-2022.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Tax Evasion Cases

See all petitions in Banking Regulations

See all petitions in Judgment by N.V. Ramana

See all petitions in Judgment by J.K. Maheshwari

See all petitions in Judgment by Hima Kohli

See all petitions in allowed

See all petitions in Remanded

See all petitions in supreme court of India judgments August 2022

See all petitions in 2022 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category