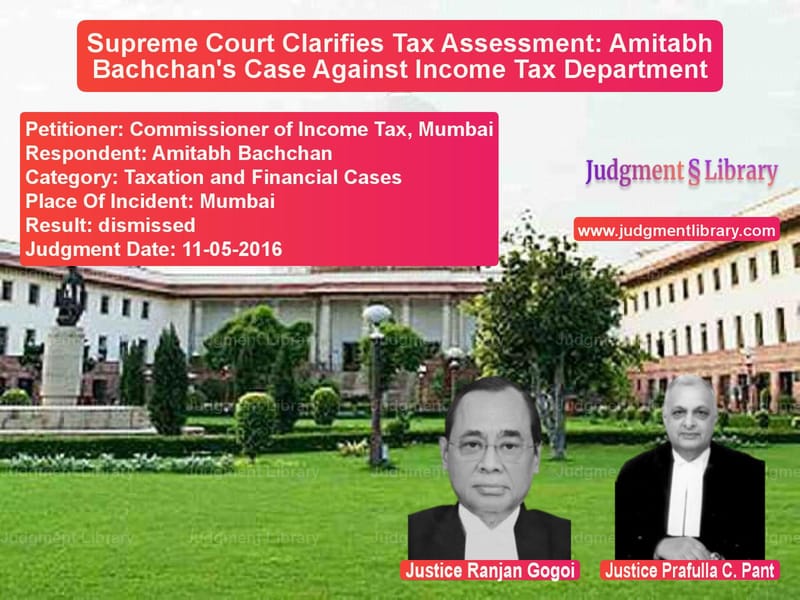

Supreme Court Clarifies Tax Assessment: Amitabh Bachchan’s Case Against Income Tax Department

The case of Commissioner of Income Tax, Mumbai vs. Amitabh Bachchan is a landmark ruling in Indian tax law. It deals with the interpretation of Section 263 of the Income Tax Act, 1961, and the revisional powers of the Commissioner of Income Tax (CIT). The Supreme Court of India upheld the principle that tax assessments must follow natural justice and procedural fairness.

Background of the Case

The dispute arose over the assessment of Amitabh Bachchan’s income for the financial year 2001-2002. The assessment order was finalized on March 30, 2004. Subsequently, the Commissioner of Income Tax (CIT) issued a show cause notice on November 7, 2005, citing eleven grounds on which the assessment order was proposed to be revised under Section 263 of the Income Tax Act.

The CIT, in its order dated March 20, 2006, set aside the assessment and directed a fresh review. Amitabh Bachchan appealed to the Income Tax Appellate Tribunal (ITAT), which ruled in his favor on August 28, 2007. The Revenue then challenged the ITAT order before the Bombay High Court, which dismissed the appeal on August 7, 2008. The matter was subsequently taken to the Supreme Court.

Key Legal Issues

- Whether the CIT had the jurisdiction to revise the assessment order under Section 263 of the Income Tax Act.

- Whether the CIT was justified in considering issues beyond those mentioned in the initial show cause notice.

- Whether procedural lapses in assessment could be a ground for invoking Section 263.

Arguments Presented

Appellant’s (Commissioner of Income Tax) Argument:

- The assessment order was erroneous and prejudicial to the interests of the Revenue.

- The Assessing Officer failed to conduct necessary inquiries into certain financial transactions.

- The CIT had the power under Section 263 to revise the assessment to prevent loss of revenue.

Respondent’s (Amitabh Bachchan) Argument:

- The CIT had gone beyond the scope of the show cause notice while passing the revisional order.

- The ITAT and the High Court had correctly ruled that the order was in violation of natural justice.

- The CIT’s findings were based on conjecture and lacked substantive evidence of wrongdoing.

Supreme Court’s Analysis

The Supreme Court examined the matter under the framework of Section 263 of the Income Tax Act, which allows the CIT to revise an assessment order if it is both erroneous and prejudicial to the interests of the Revenue. The Court ruled that:

- The CIT had exceeded its jurisdiction by considering issues not mentioned in the original show cause notice.

- The revisional power under Section 263 requires adherence to principles of natural justice, which were violated in this case.

- The ITAT and the High Court correctly set aside the CIT’s order as it lacked proper reasoning and procedural fairness.

The Court further emphasized that revisional powers should not be exercised arbitrarily and must be supported by a clear finding of error in the assessment.

Final Verdict

The Supreme Court ruled:

- The CIT’s order dated March 20, 2006, was set aside.

- The ITAT’s ruling in favor of Amitabh Bachchan was upheld.

- The Revenue’s appeal was dismissed.

Key Takeaways

- Scope of Revisional Powers: The CIT cannot go beyond the scope of the initial show cause notice while revising an assessment order.

- Adherence to Natural Justice: Tax authorities must follow due process and provide fair hearing before passing adverse orders.

- Limitations of Section 263: Revisional jurisdiction cannot be used as a tool to re-examine every assessment unless clear errors exist.

- Importance of Procedural Compliance: The ruling reinforces that arbitrary revisions without proper inquiry are not sustainable.

This judgment serves as a crucial precedent in tax law, ensuring that revisional powers are exercised within legal boundaries and procedural fairness is maintained.

Detailed Breakdown of Compensation Calculation

The Supreme Court’s decision ensures that taxpayers are protected from arbitrary tax reassessments. The key principles derived from this case are:

- Assessments should be based on substantive evidence and legal reasoning.

- Show cause notices must contain all issues that will be considered in the revisional order.

- Revisional orders must align with established judicial principles.

Implications for Future Taxation Cases

This ruling has broad implications for taxation law:

- It prevents tax authorities from arbitrarily revising assessments.

- It ensures taxpayers are granted procedural fairness.

- It establishes judicial scrutiny in tax reassessments.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Commissioner of Inco vs Amitabh Bachchan Supreme Court of India Judgment Dated 11-05-2016-1741860761995.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Income Tax Disputes

See all petitions in Tax Refund Disputes

See all petitions in Banking Regulations

See all petitions in Judgment by Ranjan Gogoi

See all petitions in Judgment by Prafulla C. Pant

See all petitions in dismissed

See all petitions in supreme court of India judgments May 2016

See all petitions in 2016 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category