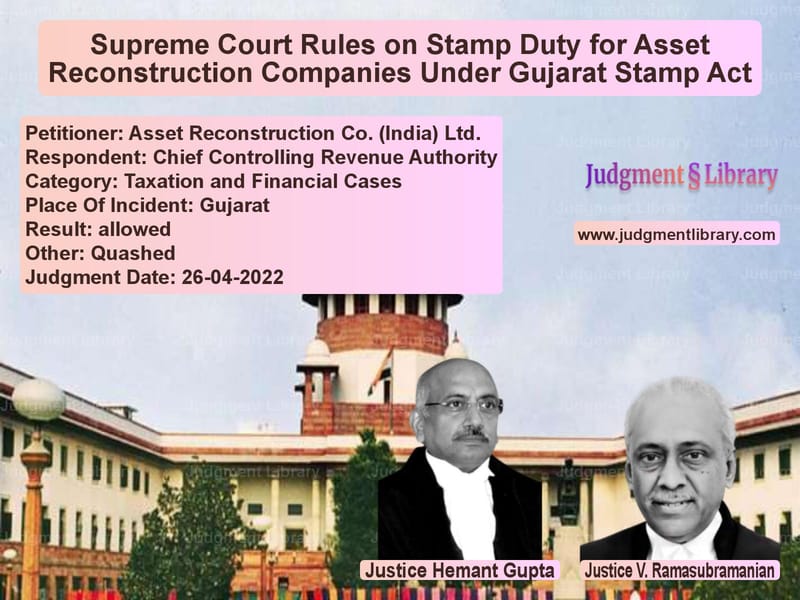

Supreme Court Rules on Stamp Duty for Asset Reconstruction Companies Under Gujarat Stamp Act

The Supreme Court of India recently delivered a significant judgment in the case of Asset Reconstruction Co. (India) Ltd. v. Chief Controlling Revenue Authority. The case revolved around the liability of Asset Reconstruction Companies (ARCs) under the Gujarat Stamp Act, 1958, and whether stamp duty should be payable on the assignment of debt, particularly when it includes an irrevocable Power of Attorney (PoA) allowing the assignee to sell secured assets.

Background of the Case

Asset Reconstruction Companies play a crucial role in financial recovery by acquiring and restructuring non-performing assets (NPAs). In this case, the Oriental Bank of Commerce (OBC) assigned a defaulted loan to Asset Reconstruction Co. (India) Ltd. (ARCIL) through an agreement executed on November 18, 2008. The agreement was registered with the Sub-Registrar, Bharuch, in Gujarat.

Following an audit, the Accountant General’s office objected to the registration, arguing that the assignment agreement included a Power of Attorney (PoA), which provided ARCIL with the authority to sell immovable properties securing the debt. The Revenue Authority imposed additional stamp duty, treating the PoA as a separate chargeable instrument under Article 45(f) of the Gujarat Stamp Act.

Read also: https://judgmentlibrary.com/gst-refund-delays-supreme-court-lowers-interest-rate-on-late-payments/

Legal Issues

The case raised several important legal questions:

- Should an assignment agreement and a PoA be treated as separate instruments for stamp duty purposes?

- Does the Gujarat Stamp Act allow the imposition of additional stamp duty on a PoA embedded in an assignment agreement?

- Are ARCs liable to pay stamp duty when acquiring assets under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI Act)?

Arguments by the Petitioner (ARCIL)

ARCIL challenged the additional stamp duty demand on several grounds:

- The assignment agreement was already charged under Article 20(a) of the Gujarat Stamp Act, making the additional levy improper.

- The PoA was an incidental clause in the agreement, not a separate conveyance requiring fresh stamp duty.

- Under the SARFAESI Act, ARCs derive their power to enforce security interests directly from the statute, not from any PoA.

- Imposing additional stamp duty would create a financial burden on ARCs and undermine the purpose of financial asset restructuring.

Arguments by the Respondent (Chief Controlling Revenue Authority)

The Revenue Authority countered with the following arguments:

- The PoA in the agreement granted ARCIL the right to sell secured properties, which is a distinct transaction under stamp duty laws.

- Article 45(f) of the Gujarat Stamp Act applies when a PoA is given for consideration and contains an authority to sell immovable property.

- The deficit stamp duty was identified during an audit and was a legitimate charge.

Supreme Court’s Observations

1. Treatment of Assignment Agreement and PoA

The Supreme Court examined whether the assignment agreement and the PoA were separate instruments. It ruled:

“A PoA granted in furtherance of a legally recognized transaction does not, in itself, become a separate taxable instrument. The document must be read as a whole.”

2. Applicability of Article 45(f)

The Court examined Article 45(f) of the Gujarat Stamp Act, which states that when a PoA is executed for consideration and contains an authority to sell property, it must be treated as a conveyance.

However, the Court clarified:

“The assignment agreement already attracts duty under Article 20(a). Since the PoA is not an independent transaction, no further stamp duty is required.”

3. SARFAESI Act and Stamp Duty

The Court recognized the SARFAESI Act’s objective to facilitate speedy recovery of distressed assets. It stated:

“The transfer of financial assets under SARFAESI is a statutory right. Levying additional duties would defeat the purpose of fast-tracking the asset resolution process.”

Judgment

- The Supreme Court set aside the Gujarat High Court’s ruling.

- The demand for additional stamp duty was quashed.

- ARCIL was relieved of any further liability under the Gujarat Stamp Act.

Implications of the Judgment

- Provides clarity on the treatment of PoAs in financial transactions.

- Reduces the cost burden on ARCs and financial institutions.

- Ensures uniformity in interpreting stamp duty laws for secured transactions.

- Boosts financial asset restructuring under the SARFAESI Act.

Conclusion

The Supreme Court’s ruling in Asset Reconstruction Co. (India) Ltd. v. Chief Controlling Revenue Authority is a landmark decision that prevents unnecessary financial burdens on ARCs. It ensures that secured transactions under the SARFAESI Act are not subjected to multiple levies, thereby facilitating financial restructuring and debt recovery.

Petitioner Name: Asset Reconstruction Co. (India) Ltd..Respondent Name: Chief Controlling Revenue Authority.Judgment By: Justice Hemant Gupta, Justice V. Ramasubramanian.Place Of Incident: Gujarat.Judgment Date: 26-04-2022.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: asset-reconstruction-vs-chief-controlling-re-supreme-court-of-india-judgment-dated-26-04-2022.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Income Tax Disputes

See all petitions in Banking Regulations

See all petitions in Tax Refund Disputes

See all petitions in Judgment by Hemant Gupta

See all petitions in Judgment by V. Ramasubramanian

See all petitions in allowed

See all petitions in Quashed

See all petitions in supreme court of India judgments April 2022

See all petitions in 2022 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category