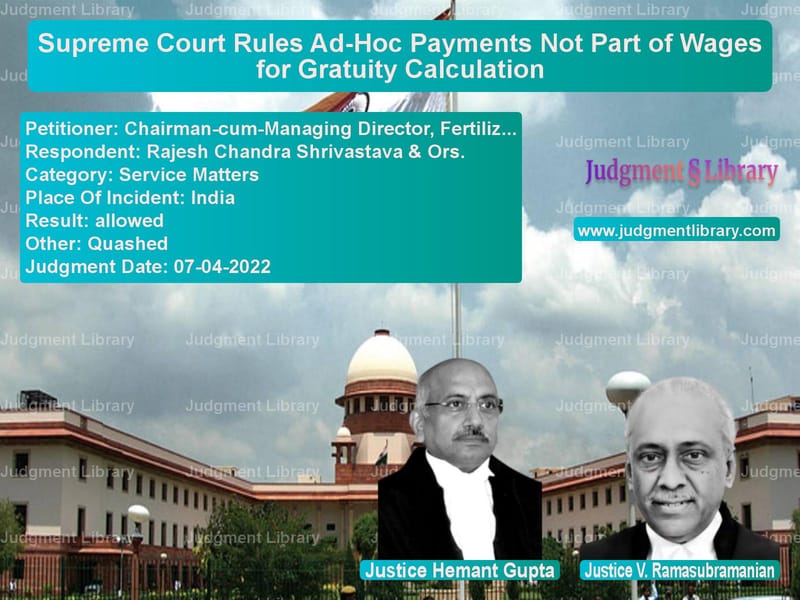

Supreme Court Rules Ad-Hoc Payments Not Part of Wages for Gratuity Calculation

The case of Chairman-cum-Managing Director, Fertilizer Corporation of India Ltd. & Anr. vs. Rajesh Chandra Shrivastava & Ors. addresses whether ad-hoc payments made to employees under an interim order of the Supreme Court should be considered as ‘wages’ under the Payment of Gratuity Act, 1972. The Supreme Court ruled that such payments do not form part of wages and should not be included in gratuity calculations.

Background of the Case

The case originated when employees of Fertilizer Corporation of India Ltd. and Hindustan Fertilizer Corporation Ltd. sought revised pay scales in 1996. Their demands were not met, leading to litigation.

Key facts:

- Employees of these corporations moved writ petitions before various High Courts in 1996 for wage revision.

- The Union of India had the petitions transferred to the Supreme Court.

- In 2000, the Supreme Court ordered ad-hoc payments as an interim measure:

- Class I employees: Rs. 1,500 per month

- Class II employees: Rs. 1,000 per month

- Class III employees: Rs. 750 per month

- Class IV employees: Rs. 500 per month

- The Government of India shut down the fertilizer units in 2002.

- A Voluntary Separation Scheme (VSS) was introduced, and most employees opted for it.

- Following the closure, the Supreme Court dismissed the pending cases in 2003.

- Later, employees filed applications before the Controlling Authority under the Payment of Gratuity Act, 1972, claiming that the ad-hoc payments should be included in wage calculations for gratuity.

- The Controlling Authority ruled in favor of employees, and appeals before the Appellate Authority were dismissed.

- The Fertilizer Corporation challenged this ruling before the Allahabad High Court, which dismissed their plea.

- The Corporation then approached the Supreme Court.

Arguments of the Petitioners (Fertilizer Corporation of India Ltd.)

- The ad-hoc payments were interim measures and not part of employees’ regular wages.

- These payments were explicitly made subject to the final outcome of the case.

- The Supreme Court’s final decision in 2003 dismissed the employees’ claim for wage revision.

- Since the ad-hoc payments had no permanent character, they could not be considered as wages under the Payment of Gratuity Act, 1972.

- The High Court erred in treating these payments as part of wages.

Arguments of the Respondents (Employees)

- The employees argued that since the ad-hoc payments were made continuously for three years, they formed part of their regular wages.

- These payments were made along with their regular salaries and should be counted in gratuity calculations.

- Since the Supreme Court never specifically ruled that ad-hoc payments should be excluded from wage calculations, they should be included.

Supreme Court’s Ruling

The Supreme Court, comprising Justices Hemant Gupta and V. Ramasubramanian, ruled in favor of the Fertilizer Corporation, holding that ad-hoc payments cannot be treated as wages.

1. Ad-Hoc Payments Were Conditional and Temporary

The Court emphasized that ad-hoc payments were made purely as an interim measure and were not part of the wage structure.

“The interim order was passed purely as an ad-hoc measure and was not to affect the final decision of the case.”

2. Wages Defined by Contractual Terms

The Court observed that wages, as per the Payment of Gratuity Act, must be part of an employee’s earnings under the terms of employment.

“Payments made as a temporary relief do not qualify as wages under Section 2(s) of the Act.”

3. Interim Benefits Cease When Main Petition Is Dismissed

The Supreme Court noted that since the employees’ main demand for wage revision was dismissed in 2003, any interim benefits automatically ceased.

4. Past Precedents on Wage Calculation

The Court cited The Straw Board Manufacturing Co. Ltd. vs. Its Workmen, where it ruled that only basic wages and dearness allowance are included in gratuity calculations.

5. No Recovery of Past Payments

Recognizing that some employees had already received enhanced gratuity payments based on the High Court’s ruling, the Court ordered that no recovery should be made from such employees.

Final Judgment

- The Supreme Court allowed the Fertilizer Corporation’s appeal.

- The orders of the High Court, Controlling Authority, and Appellate Authority were set aside.

- The ad-hoc payments were excluded from gratuity calculations.

- Employees who had already received excess payments were not required to return the amount.

Impact of the Judgment

- Clarifies that temporary relief payments do not count as wages for gratuity.

- Prevents employees from claiming additional benefits based on interim court orders.

- Provides a precedent for companies facing similar wage disputes.

- Ensures gratuity payments remain aligned with the original terms of employment.

Conclusion

The Supreme Court’s decision in Fertilizer Corporation of India Ltd. vs. Rajesh Chandra Shrivastava reinforces the principle that ad-hoc payments made under court orders cannot be included in wage calculations for gratuity. The ruling upholds employer rights while maintaining fairness by ensuring that employees do not have to return payments already received.

Petitioner Name: Chairman-cum-Managing Director, Fertilizer Corporation of India Ltd. & Anr..Respondent Name: Rajesh Chandra Shrivastava & Ors..Judgment By: Justice Hemant Gupta, Justice V. Ramasubramanian.Place Of Incident: India.Judgment Date: 07-04-2022.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: chairman-cum-managin-vs-rajesh-chandra-shriv-supreme-court-of-india-judgment-dated-07-04-2022.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Employment Disputes

See all petitions in Pension and Gratuity

See all petitions in Public Sector Employees

See all petitions in Judgment by Hemant Gupta

See all petitions in Judgment by V. Ramasubramanian

See all petitions in allowed

See all petitions in Quashed

See all petitions in supreme court of India judgments April 2022

See all petitions in 2022 judgments

See all posts in Service Matters Category

See all allowed petitions in Service Matters Category

See all Dismissed petitions in Service Matters Category

See all partially allowed petitions in Service Matters Category